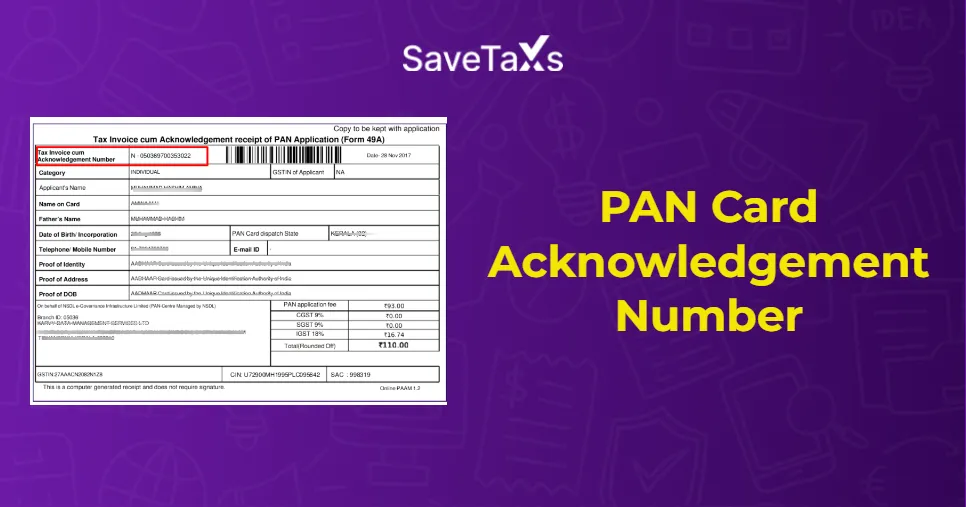

- What is a PAN Card Acknowledgement Number?

- How to Get an Acknowledgement Number for a PAN Card?

- Acknowledgement Number of PAN Card Download Process

- How Can I Track the Status of My NSDL PAN Card Using the PAN Acknowledgment Number?

- How to Download the PAN Card Acknowledgment Number Online?

- Can I Check the Status of My PAN Card Application Without the Acknowledgement Number?

- Difference Between PAN Number vs PAN Card Acknowledgment Number

- Bottom Line

A PAN (Permanent Account Number) card acknowledgment number is a 15-digit unique identification number issued to an applicant when they submit a PAN card application in India. This number confirms that your application has been received and processed by the relevant authorities.

The main use of this number is to track the status of your PAN card application, communicate with the Income Tax Department or PAN service providers, and also download e-PAN after your application is approved. Keep reading further to know more about the PAN acknowledgment number and how you can download it.

- The PAN card acknowledgement number is a 15-digit unique identification number generated and issued automatically after you submit your PAN application.

- This number is required to check PAN status and to communicate with the Income Tax Department or PAN service provider in case of discrepancies.

- You will receive the acknowledgement number via email (if applied online) or through a physical receipt (if applied offline).

- You can track the PAN application even without an acknowledgment number by using alternatives such as name, DOB, UTI coupon number, PAN number, or customer support.

What is a PAN Card Acknowledgement Number?

A PAN card acknowledgement number is a unique 15-digit identification number that plays an important role in the PAN card application process. It is used to track the progress of your PAN card application. After the successful submission of a PAN card application, the PAN card acknowledgment number gets automatically generated and issued to you.

This number confirms that your PAN application has been submitted and is being processed, regardless of whether you are applying for a PAN card online or offline. Hence, every applicant must keep this number safe for future reference. Additionally, it can also be used to contact the Income Tax Department or the PAN service provider in case of any inconsistencies.

NRIs can now digitally apply for a PAN card remotely at Savetaxs, regardless of where they are in the world.

How to Get an Acknowledgement Number for a PAN Card?

The process to get a PAN acknowledgement number is simple and straightforward. When you successfully submit your PAN card application online on the official website of UTIITSL or NSDL, the PAN card acknowledgment number gets automatically generated.

You will receive an acknowledgement receipt confirming the submission of your PAN application. This receipt will contain the PAN acknowledgement number. You will receive this receipt at your registered email ID if you apply using the online mode. Moreover, when applying for a PAN card offline, the PAN service centre will provide you with a physical acknowledgement receipt.

Acknowledgement Number of PAN Card Download Process

You can download your PAN card using the acknowledgment number if you apply online through the NSDL portal. Consider the steps below to download your PAN card using the acknowledgment number:

- Step 1: Navigate to the official website of NSDL.

- Step 2: Provide your 15-digit unique PAN acknowledgement number.

- Step 3: After that, enter your date of birth in the DD/MM/YYYY format.

- Step 4: Fill in the captcha code displayed on the screen and click on the "Submit" button.

- Step 5: Now, enter your registered mobile number and email ID. Then, click on the "Generate OTP" option.

- Step 6: Fill in the received OTP in the designated place and click on the "Validate" button.

- Step 7: Now, click on the "Download" option to download your PAN card in PDF format.

The PAN card PDF will be downloaded in a password-protected file. The password to open this file will be your date of birth in the 'DD/MM/YYYY' format.

How Can I Track the Status of My NSDL PAN Card Using the PAN Acknowledgment Number?

You can use the PAN acknowledgment number to stay updated about the status of your PAN card application. Follow the steps below to track the status of your PAN card application using the PAN acknowledgement number:

- Step 1: Visit the official NSDL website.

- Step 2: Find the "Know Status of PAN application" option and click on it. After that, you will be navigated to the next page.

- Step 3: Now, click on the drop-down bar against the "Application Type" option.

- Step 4: Click on the option called "PAN - New/Change Request".

- Step 5: Provide your 15-digit unique PAN acknowledgment number.

- Step 6: Fill in the captcha code displayed on the screen.

- Step 7: At last, click on the "Submit" button to see the current status of your PAN card application.

How to Download the PAN Card Acknowledgment Number Online?

The PAN card acknowledgement number cannot be downloaded by itself since it is generated automatically upon the succesfull submission of your PAN application. However, you can download the PAN card acknowledgment receipt online in the PDF format that contains the acknowledgment number.

You will receive the acknowledgement number at your registered email ID when you submit your PAN card application successfully through the online mode.

Can I Check the Status of My PAN Card Application Without the Acknowledgement Number?

Yes, you can track the status of your PAN card application even without the acknowledgement number. Here is a list of some alternative methods to consider to track your PAN card status without the acknowledgement number:

Tracking PAN Card Status via the NSDL Website Using Name and Birth Date

Follow the steps below to check your PAN application status through the NSDL website without the acknowledgement number:

- Go to the PAN service portal of NSDL or the Income Tax Department.

- Fill in the required details accurately in the designated places, like your first name, middle name, and last name.

- Enter your birth date/ partnership or trust deed/ incorporation/ agreement/ association of purpose/ formation of a body of individuals.

- A captcha code will be displayed on the screen, enter it accurately.

- Click on the "Submit" button, and you can see the progress of the PAN card application on the screen.

Tracking PAN Card Status Through the UTIITSL Portal Using the Coupon Number

Follow the steps below to track the status of your PAN card application via the UTIITSL website:

- Navigate to the official UTIITSL website and go to the PAN card application status tracking page.

- Fill in your birth date/ partnership or trust deed/ incorporation/ agreement/ association of purpose/ formation of a body of individuals.

- After that, provide your coupon number in the specified column.

- Enter the captcha code displayed on the screen and click on the "Submit" button.

- The screen will now reflect the current status of your PAN card application.

Tracking the PAN Card Status Through the UTIITSL Portal Using PAN Number

Follow the steps below to monitor the status of your PAN card application using your PAN Number:

- Navigate to the official website of UTIITSL and go to the PAN card application status tracking page.

- Enter your birth date/ incorporation/ association of purpose/ partnership, or trust deed/ agreement/ formation of a body of individuals.

- Now, provide your GSTIN (if you have one) and click on the "Submit" button.

- The screen will reflect your registered contact number and email ID. You must verify them carefully, and then click on the "Generate OTP" button.

- Fill in the received OTP in the specified place and proceed further with the fee payment.

- Pay the required fee using a convenient payment mode.

- Upon successful payment, you can either download your e-PAN card or track the status of your PAN card application.

Tracking PAN Card Status Via SMS

On behalf of the Income Tax Department, Protean eGov Technologies Limited manages the PAN and TAN applications. Hence, Protean eGov Technologies Limited also provides an SMS service, using which you can check the progress of your PAN card application.

Generally, you can track the status by sending an SMS with the word "PAN" and your 15-digit acknowledgment number to 57575. However, in case you don't have the acknowledgment number, you can communicate with the customer support for help.

For assistance, you may either call Protean eGov Technologies Limited at 022-24994650 or the Aaykar Sampark Kendra at 0124-2438000.

Savetaxs' dedicated team of experts offers round-the-clock assistance with all your PAN card issues.

Difference Between PAN Number vs PAN Card Acknowledgment Number

People often get confused PAN number and the PAN acknowledgement number. So, the table below lists the difference between these two numbers:

| Basis | PAN Card Number | PAN Card Acknowledgement Number |

|---|---|---|

| Meaning | PAN number is a unique 10-character identification number issued by the Income Tax Department. (e.g., ABCDE1234F) | It is a 15-digit temporary reference number that is issued when you successfully submit your PAN application |

| Purpose and Validity | It is used for filing taxes, completing KYC, banking, investment, etc., and is valid for a lifetime for both NRIs and residents | It is used to track PAN application status and is valid only till your PAN is allotted |

| FEMA and Regulatory Use | It is vital to comply with FEMA regulations | It is not valid for FEMA or regulatory purposes |

| Change or Replacement | PAN number remains the same even if the card is lost or reissued | It becomes irrelevant once the PAN card is issued |

| Legal Acceptance | It is legally accepted as proof of tax identity | No legal standing as a tax identity |

Bottom Line

You will receive an acknowledgment number after successful submission of the PAN application, regardless of whether you apply online or offline. The number will be automatically generated and sent to your registered contact number or email address. There are various alternative methods to track your PAN card application status without the acknowledgment number. However, you must keep it safe to use it later in the future.

Additionally, to get expert assistance regarding PAN card services, Savetaxs is the name to trust. We have a team of experts to offer you full support, whether you need a new PAN card, a reprint, a PAN update and correction, PAN-Aadhar linking, or any other PAN-related issues. Contact us now, and get expert-backed guidance anytime.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Navneet brings in more than 12 years of experience as a US Tax and ITIN Expert. Additionally, he has expertise in accounting, finance, taxation, financial analysis, budgeting, and risk management.

- NRI Inoperative PAN Card: Reasons & Solutions

- PAN Card Photo and Signature Change - How to Change Photo and Signature in PAN Card?

- What Is An AO Code For PAN Card?

- What are the Top Reasons Why PAN Card Applications Gets Rejected?

- How NRIs Can Link Aadhaar with PAN?

- A Guide to Applying for NRI PAN Card Without Aadhaar Card

- How To Download e-PAN Card For NRIs and Indian Residents

- Tips For NRIs To Apply PAN Card In India Online

- Top Mistakes While Applying for an NRI PAN Card

- What are the PAN Card Fees for Indian and Non-Resident Indians?

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1767170479.png)

_1767429506.webp)

_1753429421.webp)

_1756467732.webp)