PAN card KYC (Know Your Customer) is the process of verifying a person's or entity's identity and address using the PAN card. It is a process through which businesses, specifically banks, get to know their customers better.

Considering this, KYC is mandatory in India for conducting financial transactions. It certifies transparency and prevents fraud in investments, banking, and other financial services.

Further, let's better understand the KYC concept by reading this blog and learn how to check your PAN card KYC status, verify your PAN card KYC, and more.

- KYC is a vital process for banks, financial institutions, and payment companies to verify customers' identities before providing financial services. It is regulated by the RBI.

- KYC is required to open a bank account, invest in the Indian stock market, apply for a bank locker, and more.

- In the KYC process, a PAN card acts as income proof of an individual or entity, as it contains information about all the financial transactions.

- The main purpose of PAN card KYC is to monitor the flow of money and prevent fraud and money laundering.

- Further, KYC plays two key roles, i.e., verifying your identity and establishing your location.

What Is KYC?

KYC stands for "Know Your Customer," which is a compliance regulation introduced by the Reserve Bank of India (RBI). It states that in India, all financial institutions should check the identities and addresses of all their customers. The key aim behind launching the KYC regulations was to prevent identity theft, terrorist financing, money laundering, tax evasion, and several types of online fraud.

Additionally, KYC helps in monitoring and tracking the destination and sources of different transaction types. Banks ask for KYC when you open a new bank account. Also, when investing in India stock market, Asset Management Companies (AMCs) must have your basic KYC details. It includes your name, address, gender, age, and more. It also includes checking documents such as your address proof, identity proof, and photographs.

This was all about KYC. Moving ahead, let's know where it is required.

Where Is KYC Required

You need KYC in several circumstances, such as:

- During the mutual fund investing time.

- Setting up a bank account.

- Opening a bank locker.

- In any beneficiary-associated modifications.

- During a loan application, a credit card application, or a debit card application.

These were some of the circumstances where KYC is mandatory. Moving further, let's know the role of the PAN card in KYC.

Role of PAN Card in KYC

In the KYC process, a PAN card is one of the mandatory documents that you need to submit. A PAN card acts as your income proof, as it has records of all your financial transactions. Additionally, lets you verify your identity.

Further, being an Indian citizen, whether a resident of India or an NRI, you need a PAN card in several circumstances to complete the KYC process. It includes availing a loan, opening a bank account, or investing in a mutual fund or other Indian stock market.

So, this was all about the role of a PAN card in KYC. Moving ahead, let's know how to check PAN card KYC status.

How to Check PAN Card KYC Status?

Once you have done your KYC status, by following the steps below, you can simply track your PAN card and KYC status:

- Step 1: Visit the official website of Central Depository Services Limited (CSDL).

- Step 2: Click on the "KYC Inquiry" option.

- Step 3: Mention your PAN card number or your name, date of birth/ incorporation (for companies), and exempt category as applicable.

- Step 4: To proceed further, click on the "submit" button.

- Step 5: Your KYC status will be shown on your screen. If your KYC is verified, the status will be reflected as "MF- Verified by CVLMF." Otherwise, if your KYC verification is pending, it will be stated as "Pending."

This is how you can check your PAN card KYC status by visiting the CSDL website. Moving further, let's know how to verify your PAN card KYC offline.

At Savetaxs, we provide you with expert NRI tax filing services that help you maximize your refunds and brighten your financial future.

How to Verify PAN Card KYC Offline?

Follow the steps below to verify your PAN card KYC offline:

- Step 1: Go to the official site of "CSDL Ventures" and on your device download the KYC. Take the printout of the same.

- Step 2: Fill out the downloaded KYC form carefully, ensuring all the mentioned details are correct.

- Step 3: Sign the KYC form in the given space to confirm that your stated details are genuine and correct.

- Step 4: Attach a photocopy of your PAN card, an address proof (self-attested), and a passport-size colored photograph. If required, you can also get your address attested by a third party.

- Step 5: Once you fill out the form, visit the nearest branch of your bank and submit your application along with the required documents.

- Step 6: Now, your application and submitted documents will be verified by the bank executive to determine whether the provided information is correct or not. Additionally, he/she will also update your KYC details.

So, this is how you can verify your PAN card KYC offline. Now, let's know the process to verify it online.

How to Verify PAN Card KYC Online?

The steps listed below will help you to process your PAN card KYC update, along with the verification, from the comfort of your home:

- Step 1: Visit the official website of SEBI and enter your login credentials. If you are using the website first time, then you need to register yourself by creating an account on it.

- Step 2: Navigate to the "Know Your Customer Registration Agency" section from the home page and click on it.

- Step 3: After that, in the required fields, mention your PAN and Aadhaar card details.

- Step 4: Upload a photocopy of your Aadhaar card, fill out the KYC verification form online, and submit the same. Make sure, in the form, all the stated information is genuine and correct.

- Step 5: Upon submission, on your registered mobile number, you will receive an OTP. To validate your account, mention the received OTP.

Additionally, use the same mobile number that is registered with your PAN and Aadhaar card. If needed, by visiting in person, you can update your linked mobile number at any PAN or Aadhaar card centres.

This is how you can verify your PAN card KYC online. Moving ahead, let's know the documents required for the KYC process.

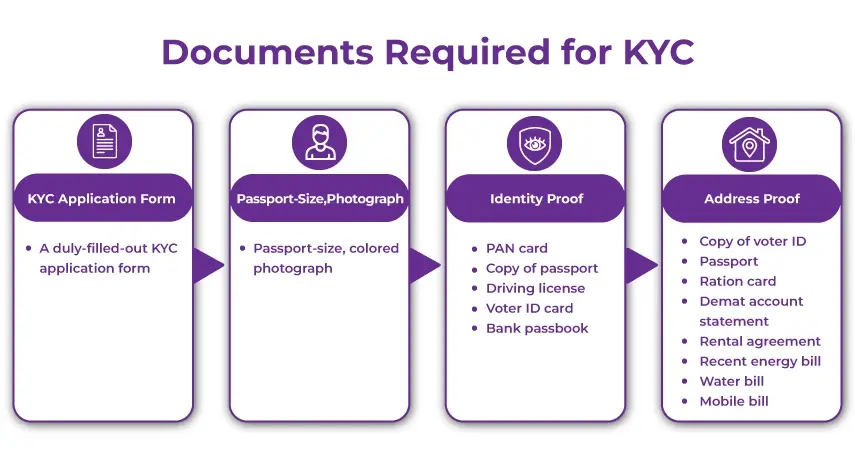

Documents Required for KYC

Here is the list of the following documents that you need for the PAN card KYC:

- A duly-filled-out KYC application form

- Passport-size, colored photograph

- Identity proof: PAN card, copy of passport, driving license, voter ID card, or bank passbook

- Address proof: Copy of voter ID, passport, ration card, demat account statement, rental agreement, recent energy bill, water bill, or mobile bill

These are some of the documents that you required for the PAN card KYC. Moving further, let's know the importance of the PAN card in the KYC process.

Importance of PAN Card in KYC

There are several reasons why a PAN card have immence importance in the KYC process, such as:

- It is an important document that helps in preventing money laundering and financial fraud activities.

- The main purpose of a PAN card is to verify the identity of persons and entities involved in financial activities.

- Bank and other financial institutions can cross-check the PAN card details with several other KYC information. It further helps in preventing potential discrepancies and fraudulent activities.

- A PAN card number helps in authenticating the identity of the cardholder. Hence, establishing transparency as well as accountability of financial transactions.

- A PAN is a mandatory document for conducting financial transactions, as every earning person or entity in India is required to hold this card.

- This card provides valuable information about different financial transactions. It includes buying high-value assets, tax payments, and salary deposits. This further helps banks and financial institutions in getting an idea of your financial profile. Additionally, closely monitor your transactional activity.

So, this is why a PAN card plays an important role in KYC.

With the expert guidance of Savetaxs, resolve your PAN card issues efficiently without any issues.

Final Thoughts

Lastly, for all citizens, whether resident or NRI, and entities in India, PAN card KYC is important. It provides transparency, authenticity and accountability to financial transactions. Additionally, helps in preventing fraud and illegal activities. Additionally, whenever you invest in financial instruments or open a new bank account, KYC status helps you in reducing the hassles included in that process.

Further, if you are still confused and looking for a reliable service to understand the PAN card KYC status, connect with Savetaxs. Our financial experts will solve all your doubts about the process and provide you with complete guidance with satisfactory results.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

- PAN vs TAN: Key Difference You Should Know

- How To Update The NRI Status On PAN Card

- Top 10 Benefits of Having a PAN Card for NRIs

- PAN Card 2.0: Features, Process, Benefits and More

- What is the Importance of Aadhaar and PAN Card for NRIs?

- PAN Card Correction/Update Online: How to Change Name, Address, DOB and Mobile Number in Pan Card?

- How to Apply for a Lost or Damaged PAN Card?

- How to Apply for an OCI Card Outside India?

- How to Apply for an OCI Card from the USA?

- Why NRI Need A PAN Card Even If They Don't Pay Tax In India?

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1766559165.png)

_1767164087.webp)