NRIs living in foreign countries like Singapore have access to several investment options, providing them opportunity to increase their wealth across global markets. However, with the substantial opportunity comes the requirement for comprehensive strategic planning. It helps in identifying the challenges of managing wealth across multiple jurisdictions.

To help you out, this blog provides you with a goal-oriented, practical approach to financial planning for NRIs in Singapore. From income management to tax optimization and retirement planning, here is your details overview of the financial success in the country. So read on and gather all the information.

- Effective financial planning is important for NRIs to handle several regulations in both Singapore and India. Additionally, use them to their benefit.

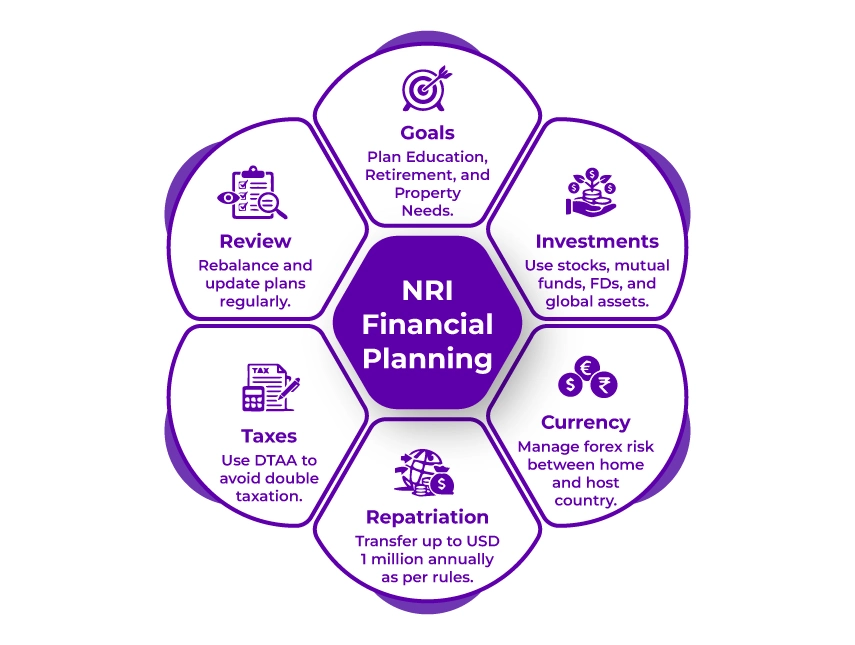

- For effective financial planning, it is vital to set clear financial goals, choose the right investment option, manage currency fluctuations, repatriation, and taxation.

- Depending on the residential status and sources of income tax is imposed in India on NRIs on capital gains from mutual funds in Singapore.

- DTAA eases cross-border taxation and helps in avoiding paying double taxes on the same income.

- Further, to get growth and compounding benefits, invest in long-term financial plans.

How NRIs Can Do Financial Planning in Singapore?

Singapore is one of the developed countries in the world. It has low tax rates; however, the cost of living in the country is very high. Whether you are working in the banking and financial services industry or the thriving technology sector, or running your own business, effective financial planning is important. Moving further, here are some points that you need to consider when doing financial planning in Singapore.

Setting Clear Financial Goals

The first step towards successful financial planning is having clear priorities and objectives. Considering this, common financial goals for Singapore-based NRIs include funding the education of children at world-class institutions, generating substantial wealth for a comfortable retirement, buying property either in India or for investment, and more.

The critical successful financial factors lie precisely in fulfilling these goals with appropriate risk profiles and timeframes. In this, short-term objectives are generally completed within three years. It includes emergency funds or planned major purchases that need capital preservation and high liquidity. It makes them ideal options for conservative instruments like short-term FDs, savings accounts, or liquid funds.

Further, long-term financial goals like property acquisition, retirement planning, and higher education for children allow for growth-oriented, higher-risk investments. For instance, direct stock investments, equity mutual funds, or real estate that, over extended periods, deliver superior returns.

Once you set clear financial goals and a timeline, you can move to the implementation phase, identifying the most appropriate strategies for how and where to invest your money in the country.

Selecting Investment Options Available for Singapore-Based NRIs

As a Singapore-based NRI, you can enjoy the unique benefits of accessing sophisticated, diverse investment options available across both countries. Each of them provides different opportunities and benefits. However, a key question arises: where should you invest your money? The clear answer to this question is to choose an investment as per your financial goals, risk tolerance, and the unique benefits each market provides.

Considering this, in Singapore, the investment options include the following:

- The Central Provident Fund (CPF) system is available for permanent residents. It comes with the Supplementary Retirement Scheme (SRS) contributions that provide tax perks or other retirement-linked savings programs offering long-term wealth accumulation.

- Additionally, you can also opt for Exchange Traded Funds (ETFs) and stocks listed on the Singapore Exchange (SGX), which provide exposure to both local and international markets.

- Also, Singapore REITs are a popular investment option among investors for their professional management and income generation. Further, modern global investment platforms like StashAway, Endowus, and others with professional management provide access to international portfolios.

On the other hand, in India, investment options available for NRIs are equally compelling. You can access your NRI mutual funds through your NRO or NRE accounts, providing diversification and professional management across different market capitalizations and various asset classes. Additionally, on NRE FDs, no tax is charged in India, making them ideal for investors looking for guaranteed returns.

Further, the key principle is certifying that every investment serves a specific, well-defined goal in your financial planning. For example, if you have a plan to retire in India, then having a substantial part of your wealth in INR assets makes sense to fulfill your currency needs in the future. On the other hand, if your children want to pursue higher studies in Singapore, consider having education funds in worldwide accepted currencies like SGD, EUR, or USD.

We provide tailored tax solutions that align with your individual tax regimes and regulations.

Managing Currency, Repatriation, and Remittances

One of the most common issues for Singapore-based NRIs includes managing the SGD-INR currency exchange relationship effectively. It further impacts the outcomes of your financial planning and overall returns. Compared to the Indian Rupee, the general strength of the Singapore Dollar offers substantial benefits when remitting funds to India for investment, family support, or buying property. However, if not managed properly through proper timing and planning, currency volatility can impact your returns.

Consider using the proper currency management strategies. It includes, rather, relying on traditional bank transfer, using remittance services that continuously provide low transfer fees and competitive exchange rates. Among the NRE or NRO accounts, choose the right NRI account to transfer your funds. Develop the discipline to strategically transfer your money, specifically when the value of INR is weaker against the SGD, increasing your remittance value.

Further, if you are planning a retirement in India, have income streams and currency-aligned investments with INR-denominated expenses. Additionally, avoid investing all your income in USD and SGD assets, as it will create currency risk that, over time, impacts your purchasing power.

Moreover, under the RBI guidelines, repatriation regulations, i.e., transferring money from India back to Singapore, are clearly stated. As per this, after tax compliance, per financial year, you can transfer up to $1 million from your NRO accounts. Additionally, planning your repatriation strategy well in advance ensures easier cash flow management and helps in avoiding any regulatory delays and complications.

Tax Planning and Compliance

Talking about taxation, Singapore has a favorable tax environment. Considering this, on most investments, no capital gains tax is charged. Additionally, in comparison to many developed countries, the personal income tax rates in Singapore are low. However, according to local tax laws, you are liable to pay tax in India for the income you generate from your Indian investments.

In this, using the India-Singapore Double Taxation Avoidance Agreement (DTAA) helps you avoid double taxation. Further, it also helps you in planning the tax-efficient withdrawal strategies that reduce your tax burden while fulfilling the compliance requirements of both countries.

Building a Long-Term Financial Plan

Financial planning is not a thing that you can only perform once. Based on your life and career changes, you need to regularly review and adjust your financial plans. It is because it significantly affects your cash flow, investment priorities, and tax exposures. In this, the best practices involve:

- Based on market conditions and risk appetite, rebalancing portfolios.

- To ensure alignment with your financial goals, periodically review your investments.

- Adjusting your financial plans for milestones like job change, marriage, children, or relocation.

- Aligning investments with return-to-India and retirement plans.

Additionally, it should also include choosing the right investment horizons, certifying liquidity, and planning for fund repatriation in the future in compliance with Indian regulations. Further, by following a long-term, disciplined approach and making timely adjustments, you can achieve steady wealth growth, financial stability, and peace of mind.

Moreover, this is how NRIs can do financial planning in Singapore.

Get personalized financial plans aligned with your long-term family and wealth goals.

Final Thoughts

Lastly, from the blog, it is clear why financial planning for NRIs in Singapore is important. It helps them build a flexible, secure financial foundation. Additionally, helps them maintain their lifestyle and goals across different countries, opportunities, and regulations. Whether your future lies in Singapore, India, or somewhere else in the world, financial planning helps you remain confident, prepared, and in complete control of your finances.

Further, if you are facing issues in planning your taxes or finances, connect with Savetaxs. We have a team of financial advisors who assist you in proper planning of your finances as per your goals and risk appetite. Additionally, they can also assist you in choosing the right investment option as per your preference.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Shaw brings 8 years of experience in auditing and taxation. He has a deep understanding of disciplinary regulations and delivers comprehensive auditing services to businesses and individuals. From financial auditing to tax planning, risk assessment, and financial reporting. Mr Shaw's expertise is impeccable.

- How Can NRIs Open A Joint Demat Account

- How can NRIs Invest in Alternative Investment Funds in India?

- Advantages and Disadvantages of Cryptocurrency for NRIs

- Step-by-Step Guide to NRI Investment in Mutual Funds

- What are the Crypto Tax Rates in Various Countries?

- Pravasi Pension Scheme for NRIs: Eligibility and Application Procedure

- Financial Planning For NRIs In The USA - Manage Your Money Wisely

- How NRIs Can Retire Early Using the FIRE Strategy?

- Why Is Licence Agreemnt Better Than Rent Agreement For NRIs

- Monthly Income Investments for NRIs in India

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1766561286.webp)