- What is the CII Calculator

- Cost Inflation Index Table From FY 2001-02 to FY 2025-26

- How is Cost Inflation Index (CII) Used In Income Tax?

- What is the Concept of the Base Year in the Cost Inflation Index

- Why is CII Calculated?

- Who Notifies the Cost Inflation Index?

- How Does Indexation Benefit Applied to Long-Term Capital Assets?

- The Bottom Line

Cost inflation index (CII) is a number notified by the Income Tax Department of India to estimate inflation. In simpler terms, the CII measures the year-over-year price increases of assets and goods due to inflation. The cost inflation index for FY 2025-26 is estimated at 376.

In this blog, we will discuss everything related to the cost inflation index (CII), including a CII table from FY 20001=01 to 2025-26, how CII is used in income tax, and more.

- The cost inflation index (CII) is a number used to adjust the purchase or acquisition cost for inflation when calculating long-term capital gain tax in India.

- By increasing the purchase cost of capital assets in line with inflation, the CII ensures that taxpayers are not taxed on inflated gains. Henceforth, this results in a reduction in taxable profit.

- CII is applied to the original cost of long-term assets, such as property, stocks, and more, to compute the indexed cost of acquisition, which, in turn, reduces the capital gain tax.

- Every year, the Central Board of Direct Taxes notifies the CII for the particular financial year.

What is the CII Calculator

A Cost Inflation Index table is used to estimate the long-term capital gain from the sale or transfer of capital assets. Capital gain is the profit earned from transferring or selling any capital assets such as stock, property, land, patents, trademarks, or others.

In the accounting books, long-term assets are recorded at their cost. Hence, despite growing asset prices, these capital assets cannot be revalued.

When capital assets are sold, the gain generated is generally higher than the acquisition price. This enables the assessee to pay higher income tax on the profits from the sale of these assets.

The cost inflation index application for capital gains ends up adjusting the asset's purchase price based on the price at which it is sold. This results in lower earnings and a much lower tax burden.

Cost Inflation Index Table From FY 2001-02 to FY 2025-26

The following table shows the cost inflation index (CII) from 2001-02 to 2025-26.

| The Financial Year | Cost Inflation Index (CII) |

|---|---|

| 2001-02 ( Base year) | 100 |

| 2002-03 | 105 |

| 2003-04 | 109 |

| 2004-05 | 113 |

| 2005-06 | 117 |

| 2006-07 | 122 |

| 2007-08 | 129 |

| 2008-09 | 137 |

| 2009-10 | 148 |

| 2010-11 | 167 |

| 2011-12 | 184 |

| 2012-13 | 200 |

| 2013-14 | 220 |

| 2014-15 | 240 |

| 2015-16 | 254 |

| 2016-17 | 264 |

| 2017-18 | 272 |

| 2018-19 | 280 |

| 2019-20 | 289 |

| 2020-21 | 301 |

| 2021-22 | 317 |

| 2022-23 | 331 |

| 2023-24 | 348 |

| 2024-25 | 363 |

| 2025-26 | 376 |

How is Cost Inflation Index (CII) Used In Income Tax?

As afroementioed that the long-term capital assets are documented in the accounting books at cost price. Meaning, despite the rising inflation, they are existing at a cost price and cannot be revised. Now, when these capital assets are sold, the gain, or profit, is high because the sale prices are higher than the purchase prices. This results in the assessee paying higher income tax.

The CII is applied to long-term capital assets, thereby increasing their purchase cost, which results in lesser profits, ultimately lowering taxes and benefiting taxpayers.

What is the Concept of the Base Year in the Cost Inflation Index

The first year in the cost inflation index table is known as the base year and has a CII value of 100. The index for all other fiscal years is compared to the base year to estimate the increase in the inflation rate.

For any capital assets purchased before the base year of the CII, the taxpayer may use whichever is higher for the purchase price, the "fair market value," or the "actual cost," as of the first day of the base year. Ensure that the indexation benefit is applied to the purchase price, so that the calculated fair market value is based on the valuation report for a registered value.

Savetaxs offer end-to-end expert assistance with filing NRI income tax returns.

Why is CII Calculated?

The cost inflation index is calculated to compare the prices to the inflation rate. In a nutshell, a percentage increase in the inflation rate over the year will lead to prices rising.

Who Notifies the Cost Inflation Index?

The central government of India evaluates the cost inflation index by notifying it in the official gazette.

CII 71% of the average rise in the consumer price index * ( urban ) for the immediately preceding year.

Please note that the consumer price index compares the current prices of goods and services (which reflect the economy) with the cost of the same basket of goods and services in the last year to calculate the percentage change in prices.

How Does Indexation Benefit Applied to Long-Term Capital Assets?

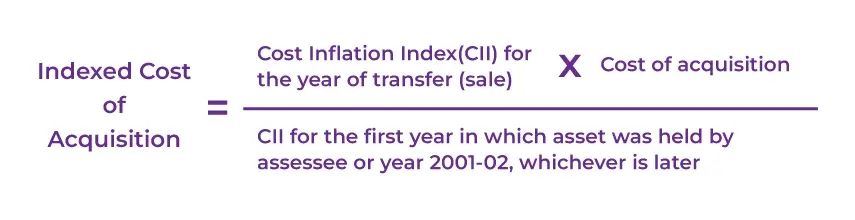

When the indexation benefits are applied to the purchase prices or the cost of acquisition of the capital assets, it becomes an "Indexed Cost Of Acquisition".

Indexed Cost Of Acquisition = Cost inflation index for the year of transaction (sale) * Cost of acquisition / CII for the year in which the assets were held by the assessee or year 2001-02, whichever is later.

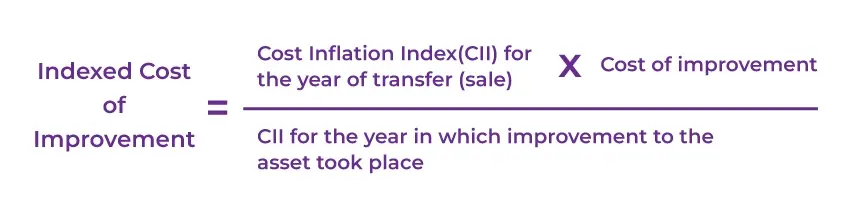

Indexed Cost of improvement = cost inflation index ( CII) for he year of transfer (sale) * Cost of improvement / CII for the year in which the improvement to the assets took place.

Points to Understand

- In the case where the property is being acquired in the will, the cost inflation index CII is to be taken from the year in which the property was acquired from the previous owner.

- Any improvement cost incurred before April 1, 2001, must be ignored.

- For bonds and debentures, index benefits are not allowed except for capital indexation bonds or sovereign gold bonds issued by the Reserve Bank of India.

- Indexation benefits for debt funds are no longer available, effective April 1, 2023.

- Indexation benefits are no longer available for any asset as of 23 July 2024. In the case of the transfer of land or a building acquired before July 23, 2024, the concerned taxpayer has the option to pay taxes at a rate of 12.5% without indexation or 20% with indexation.

Case 1: Mr. Rahul purchased a flat in FY 2001-02 for Rs 10,00,000. He sells the flat in FY 2017-18. What will be the calculated indexed cost of acquisition?

In this case, the CII for the years 2001-02 and 2017-18 is 100 and 272. Hence, the indexed acquisition will be 10,00,000 * 272/100 = Rs 27,20,000.

Case 2: Mrs. Apeksha has purchased the capital assets in FY 1995-1996 for Rs 2,00,000. The fair market value of the capital asset on April 1st, 2001, was Rs 3,20,000. Then, she sells the assets in the FY 2016-17. What will be the estimated cost of acquisitions?

In this case, the capital asset is purchased before the base year.

The cost of acquisition = the higher of the actual cost or FMV on 1st April 2001, i.e., cost of acquisition = Rs 3,20,000.

The CII for the years 2001-02 and 2016-17 is 100 and 264, respectively. Here, the indexed cost of acquisition is 3,20,000 * 264/100 = Rs 8,44,800.

Case 3: Miss Sharmila has purchased equity shares for Rs 1,00,000 on 1st March 2015 and then sells the shares on 1st April 2020. What will be the indexed cost of acquisition?

Here, the CII for the year of purchase, FY 2014-15, is 240, and for the year of sale, 2020-21, is 301.

Hence, the indexed cost of acquisition for the purchased equity shares will be Rs 1,00,000 * 301/240 = Rs 1,25,416.

Manage cross-border taxes easily with Savetaxs’ expert support.

The Bottom Line

The cost inflation index CII lets the taxpayer adjust the purchase price of the assets for inflation, resulting in a more accurate capital gains tax calculation. The CII helps change the acquisition prices of long-term assets to account for inflation and ensure taxation is fair.

Hence, you will be taxed on the real gain and not on the inflated amount. This is why understanding the use case for cost indexation is essential, as it can lower your taxable income from asset sales, especially when you have held the assets for many years.

As an NRI, if you need any professional assistance with cost indexation and capital assest management in India, Savetaxs is the name to trust. We have been helping NRIs for 90+ years, managing their capital assets in India and filing their taxes.

Connect with us as we serve our clients 24/7 across all time zones.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

- Double Tax Avoidance Agreement (DTAA) Between India and UK

- What is the Double Tax Avoidance Agreement (DTAA) Between India and Singapore?

- What is a Tax Residency Certificate (TRC) and How to Get It?

- Section 195 of Income Tax Act - TDS Applicability for NRI

- What is Double Taxation Avoidance Agreement (DTAA)? How NRIs can Claim Benefits Under DTAA

- TDS Deduction on Rental Property Owned by NRI

- How to Claim TDS Refund for an NRI?

- A Comprehensive Guide on the DTAA between India and the USA?

- Sections 90, 90A & 91 of the Income Tax Act for NRIs

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1767604193.webp)

_1756816946.webp)

_1764918370.webp)

_1765974748.webp)