An assessing officer (AO) is an individual who has the authority to evaluate Income Tax Returns, and their jurisdiction is defined by section 120 of the Income Tax Act, 1961. Each taxpayer is assigned a specific jurisdictional AO based on the address linked to their Permanent Account Number (PAN) and their income level, enabling an organized and effective assessment process.

All communication between the income tax department and the taxpayer is required to go through the designated jurisdictional AO, who acts as the official income tax officer for each taxpayer. In this blog, we will learn more about who an assessing officer is and how to find your assessing officer.

- An AO is an official appointed by the Income Tax Department to assess a taxpayer's income tax returns.

- Every taxpayer is assigned a specific jurisdictional AO based on factors like their PAN details, address, and income profile.

- All official communication with the tax department happens through the assigned AO.

- AO has significant powers, including demanding books of accounts, carrying out searches, and seizing relevant materials etc.

Who is an Assessing Officer?

The AO plays an important role in reviewing tax returns, whether they have been processed by the Centralized Processing Center (CPC) or not. This is to verify the accuracy of the reported income and identify any intentional/unintentional errors. This careful examination of income tax returns is known as 'Assessment'.

An assessing officer (AO) is an official from the Income Tax Department who is responsible for carrying out these assessments. They have jurisdiction over the assessment of taxpayers (assessee) who are obligated to pay taxes according to the law.

Here is a list of ranks in the income tax department in India:

- Principal Chief Commissioner of Income Tax or Principal Director General of Income Tax.

- Chief Commissioner of Income Tax or Director General of Income Tax.

- Principal Commissioner of Income Tax or ADG/ Principal Director of Income Tax.

- Commissioner of Income Tax or Additional Director General/Director of Income Tax.

- Additional Commissioners of Income Tax or Additional Director of Income Tax.

- Joint Commissioner of Income Tax or Joint Director of Income Tax.

- Deputy Commissioner of Income Tax or Deputy Director of Income Tax.

- Assistant Commissioner of Income Tax or Assistant Director of Income Tax.

The AO responsible for handling the return filed by you may vary based on the volume of income/ nature of trade as assigned by the Central Board of Direct Taxes (CBDT or Board).

Get expert guidance for all NRI PAN card needs, whether you need to apply, correct, or update your PAN card.

What is the Significance of an Assessing Officer?

An AO is crucial for performing a detailed analysis of income tax returns to confirm their correctness, in accordance with tax regulations, various circulars, notifications, and directives from the Board, while making use of their judgment in interpretation.

During this process, the AO may recalculate a taxpayer's taxable income. Also, the AO has the authority to request books of accounts, supporting documents, or any other necessary information from the taxpayer through a notice for verification.

Upon completing the assessment, the AO issues a formal assessment order to the taxpayer, detailing any tax demand. Moreover, taxpayers can also contact the income tax department for various issues, including rectification of returns and refund requests.

What is the Purpose of Jurisdiction?

Jurisdiction is vital for all interactions between the taxpayer and the income tax department. The jurisdiction of an AO defines the geographical area where the AO has authority and responsibilities. Based on their income level, taxpayers are categorized into specific ranges or circles.

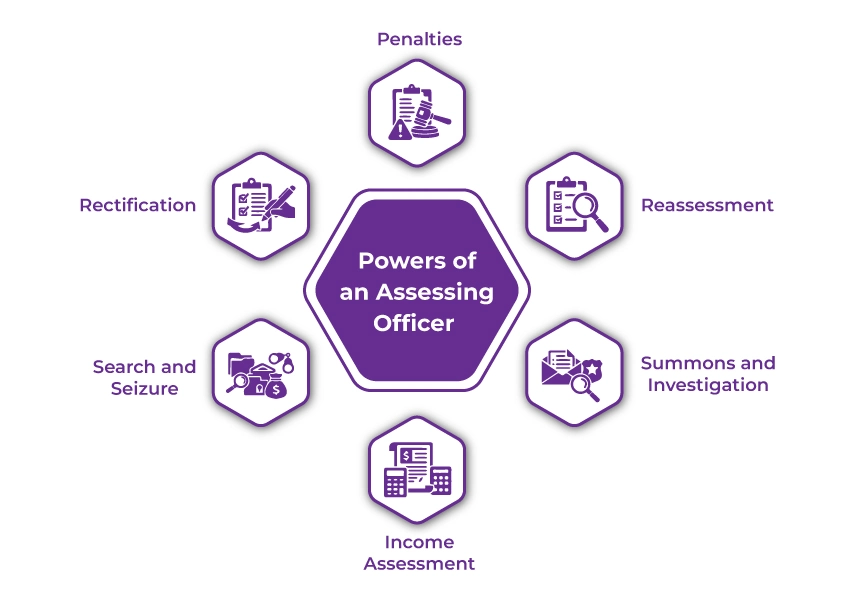

What are the Powers of an Assessing Officer?

In India, the Assessing Officers (AOs) have significant powers under the Income Tax Act of 1961 to ensure adherence to tax laws and address evasion. Their main powers include the following:

- Rectification: AOs can correct obvious mistakes within a designated time duration.

- Penalties: AOs have the power to charge penalties for non-compliance, such as failing to file returns or concealing income.

- Reassessment: If there is an indication that income has been underreported. AOs have the power to reopen and reassess a taxpayer's income.

- Summons and Investigation: AOs can summon taxpayers and others to present evidence, documents, and additional information.

- Income Assessment: AOs determine the total income of individuals and entities and compute their corresponding tax obligations.

- Search and Seizure: If there are suspicions of tax evasion, AOs possess the authority to carry out searches and seize relevant materials, including documents and accounting records.

What is the Process to Find the Jurisdictional AO and AO Code?

To accurately manage your tax records in India, it's essential to find your jurisdictional AO code. Below are the steps to find your jurisdictional AO with and without logging into your profile.

Process to Find Jurisdictional AO by Logging into Your Profile

Follow the steps below to find your jurisdictional AO details:

- Step 1: Go to the income tax e-filing portal and log in using your PAN and password.

- Step 2: Under the profile settings, click on 'My Profile'.

- Step 3: Click on 'Jurisdiction details' under your profile.

- Step 4: The screen will display your jurisdictional AO details.

Process to Find Jurisdictional AO Without Logging in

Here is the process to consider to find your jurisdictional AO details without logging into your profile:

- Step 1: Go to the Income Tax Portal and find the 'Quick links' section and click on 'Know Your AO'.

- Step 2: Enter your registered PAN and mobile number on the 'Know Your Jurisdiction Assessing Officer' page. Click on 'Submit'.

- Step 3: You will be directed to a verification page where you will have to enter the OTP received on your registered mobile number.

- Step 4: The AO details will be displayed on the screen.

Savetaxs dedicated team is available around the clock to provide expert assistance with your PAN card issues.

Final Thoughts

An Assessing Officer (AO) is an official from the Indian Income Tax Department. They are liable for reviewing and processing a taxpayer's income tax returns to ensure accuracy and compliance with tax laws. Knowing your AO is important for effective communication with the Income Tax department, particularly if you need to respond to a notice, file a rectification request, or need to follow up on a refund.

Additionally, if you need expert-backed assistance with tax filing or financial planning, Savetaxs is the name to trust. We have a team of experts who bring over 30 years of experience. Our financial experts ensure accurate filing of your returns while maximizing your refunds. We work 24/7 across all time zones, so it doesn't matter where you reside; you can contact our team anytime, and we will offer the best quality service to you.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Shaw brings 8 years of experience in auditing and taxation. He has a deep understanding of disciplinary regulations and delivers comprehensive auditing services to businesses and individuals. From financial auditing to tax planning, risk assessment, and financial reporting. Mr Shaw's expertise is impeccable.

- Tax Guide for Working from India for a US Company After Expire of H-1B Visa

- Complete Guide for Income Tax Audit Under Section 44AB

- Section 80C of Income Tax Act - 80C Deduction List

- Can NRIs Change Their Tax Regime While Filing Their ITR In India?

- Section 80CCC: Deduction on Pension Fund Contributions

- Double Tax Avoidance Agreement (DTAA) Between India and UK

- Sections 90, 90A & 91 of the Income Tax Act for NRIs

- What is Double Taxation Avoidance Agreement (DTAA)? How NRIs can Claim Benefits Under DTAA

- How to Claim TDS Refund for an NRI?

- Section 195 of Income Tax Act - TDS Applicability for NRI

- TDS Deduction on Rental Property Owned by NRI

- What is a Tax Residency Certificate (TRC) and How to Get It?

- Everything You Need to Know About Form 15CA and 15CB of Income Tax

- What is the Double Tax Avoidance Agreement (DTAA) Between India and Singapore?

- A Comprehensive Guide on the DTAA between India and the USA?

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1768471286.webp)

_1763555884.webp)

_1754046271.webp)

_1764137986.webp)

_1754564786.webp)

_1767170479.png)