ELSS (Equity-Linked Savings Scheme) funds are a variation of a mutual fund that invests a major portion of its corpus into equity or equity-related instruments. It helps investors and NRIs generate wealth, receive returns, and also save taxes.

These funds are also known as tax saving schemes as they offer a tax exemption of up to Rs. 1,50,000 from your annual taxable income under Section 80C of the Income Tax Act. It is an equity-oriented scheme that has a mandatory lock-in period of three years. The returns after this three-year lock-in period are treated as LTCG (Long-Term Capital Gains).

Keep reading this blog to know more about ELSS tax-saving funds for NRIs. We will cover what exactly ELSS is, the top 10 best ELSS mutual funds to invest in, how to choose the best ELSS mutual funds, and so on.

- ELSS funds are primarily invested in equities, and they have a mandatory lock-in period of three years.

- These funds offer a tax exemption of up to Rs. 1.5 lakh under Section 80C of the Income Tax Act, hence it is also known as tax tax-saving scheme.

- The profits acquired after the three-year lock-in period are treated as long-term capital gains.

- Gains exceeding the Rs. 1,50,000 limit are taxed at 12.5%.

- An NRE investor can easily access ELSS mutual funds through their NRE or NRO accounts, and constant monitoring is not required, as these funds are managed by professional fund managers.

What is ELSS for NRIs?

ELSS (Equity Linked Savings Scheme) is a type of mutual fund that primarily invests in equities and equity-related instruments, with at least 80% of its *corpus allocated to equity securities across various market caps and sectors. This diversified strategy helps mitigate concentration risk while targeting significant returns.

You can invest in ELSS mutual funds either through a lump sum (a single large investment) or through a Systematic Investment Plan (SIP) (regular small fixed amounts). With SIPs, each installment has a separate 3-year lock-in period. For instance, if you start monthly SIPs in January 2025, the first installment will be redeemable in January 2028, the second in February 2028, and so on.

Get maximum refund on your NRI tax filing with the help of Savetaxs.

Once the lock-in period ends, profits are considered long-term capital gains. Currently, LTCG up to Rs. 1.25 lakh every year is tax-free, while gains exceeding this limit are taxed at 12.5%.

The required holding period can be beneficial, allowing fund managers to make long-term strategic investment decisions without the pressure of immediate redemptions, which could lead to better returns over time.

*Corpus: Corpus is the total amount of money collected from investors and managed by the fund. It is also known as the assets under management (AUM).

What are the Top 10 ELSS Tax-Saving Funds for NRIs?

Here is a table showing the top-performing ELSS mutual funds based on the past five-year returns:

| Fund | NAV (Net Asset Value) | 5 Yr CAGR (Compound Annual Growth Rate) | Risk | Exit Load | Minimum Investment |

|---|---|---|---|---|---|

| DSP ELSS Tax-Saver Fund - Direct Plan-Growth | 134.338 | 18.29% | Very High Risk | 0% | Rs. 500 |

| Motilal Oswal Long Term Equity Fund - Direct Plan Growth. | 46.9177 | 18.66% | Very High Risk | 0% | Rs. 500 |

| ITI ELSS Tax Saver Fund - Direct Plan Growth | 22.5239 | 17.44% | Very High Risk | 0% | Rs. 500 |

| JM Tax Gain Fund - Direct Plan Growth | 47.8852 | 19.49% | Very High Risk | 0% | Rs. 500 |

| NIPPON India ELSS Tax Saver Fund -Direct Plan Growth | 118.884 | 17.95% | Very High Risk | 0% | Rs. 500 |

| Bandhan Tax Advantage (ELSS) Fund - Growth- Direct Plan | 152.542 | 21.87% | Very High Risk | 0% | Rs. 500 |

| Total ELSS Tax Saver Fund - Direct Plan- Growth Options | 43.6437 | 17.39% | Very High Risk | 0% | Rs. 500 |

| SBI Long Term Equity Fund - Direct Plan Growth | 415.901 | 23.86% | Very High Risk | 0% | Rs. 500 |

| Parang Parikh ELSS Tax Saver Fund - Direct Plan | 30.4551 | 23.69% | Very High Risk | 0% | Rs. 500 |

| HDFC ELSS Tax Saver - Direct Plan - Growth | 1321.82 | 22.04% | Very High Risk | 0% | Rs. 500 |

Why NRIs Prefer ELSS Tax Saving Funds?

ELSS (Equity-Linked Savings Scheme) is one of the most preferred tax-saving options amongst NRIs, as it offers the shortest mandatory lock-in period of three years under Section 80C. It is the shortest among all options under Section 80C, like PPF (15 years) or NSC (5 years).

Since ELSS funds are equity-based, they also offer the potential for higher long-term returns. It is ideal for NRIs who are seeking tax benefits along with wealth growth.

NRIs using their NRO or NRE accounts to invest can access ELSS funds easily without completing any additional paperwork. Furthermore, there is no need to monitor these funds constantly, as these are managed by professional fund managers.

Options like PPF and NSC are less flexible for NRIs in companies. An NRI is not permitted to open new PPF accounts, and both PPF and NSC have a long lock-in period and fixed returns.

Hence, ELSS offers flexibility and better liquidity for NRIs. Section 80C tax savings offer up to Rs. 1.5 lakh tax savings, and the opportunity to get higher returns, which makes it one of the most efficient tax-saving choices.

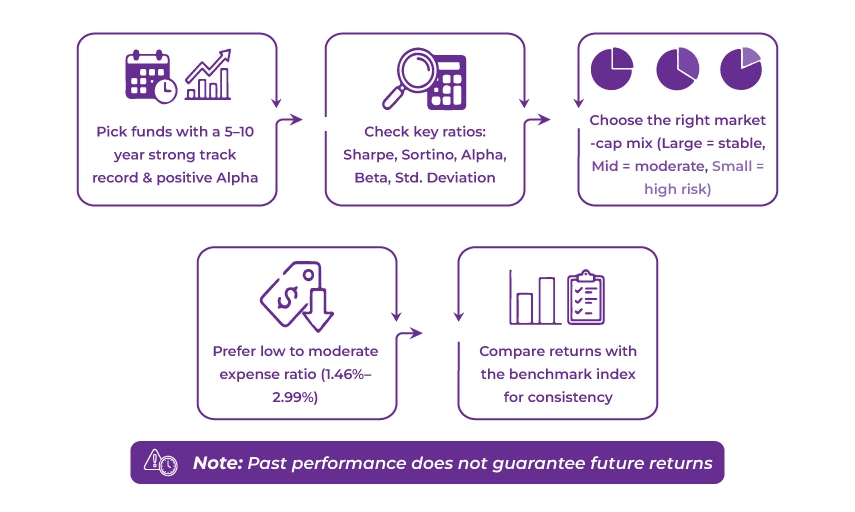

How NRIs Can Choose the Best ELSS Fund Option?

An ELSS is a type of mutual fund that provides dual tax-saving benefits and investment options in equity mutual funds. An NRI must consider the following parameters before selecting an ELSS fund:

Fund History

Opt for fund houses that consistently generate additional Alpha, such as 5 to 10 years. Check the quality of stocks in its portfolio and the investment style, as these factors show the fund's performance.

Financial Ratio

Consider factors such as the Sharpe ratio, standard deviation, Sortino ratio, beta, and Alpha to evaluate a fund's performance. A fund with a higher standard deviation and beta carries more risk than a fund with a lower deviation and beta. Funds with a higher Sharpe ratio will offer higher returns for the additional risk you accept. A fund manager plays a vital role in managing the investments.

Market Cap

The SEBI divides companies into three cap categories, which are large-cap, medium-cap, and small-cap. Large-cap companies are ideal for long-term investments as these are the most stable ones. The medium-cap is for people seeking flexible investments, and the small-cap is suited for those who are ready to take significant risks.

Expense Ratio

Expense ratio stands for the amount that the fund house charges for managing the capital invested by the investors. You must consider the expense ratio of any mutual fund, which ranges from 1.46% to 2.99%. It is advised to choose an expense ratio that is low to moderate.

Enjoy personalized guidance, transparent filing, accurate calculations, and 100% compliance.

Fund Returns

Compare the fund's performance with the underlying index, helping you ensure that the fund has been consistent over the past years. You can invest in the advised funds depending on these parameters.

Nevertheless, remember that the past performance doesn't indicate future returns, as it is dependent on market movements and the decisions of fund managers.

To Conclude

ELSS is ideal for investors who are willing to take a higher risk, as it mainly invests its assets in equity and equity-related securities. ELSS has the shortest lock-in period among Section 80C investments, and investing in these funds can help you grow wealth while saving taxes. These funds can be a useful tax-saving tool for NRIs if their situation matches their benefits.

Furthermore, to ensure extra accuracy and 100% compliance, it's better to consult the experts at Savetaxs. We have a professional team of experts who help NRIs make these decisions with utmost confidence. Our services and tools and designed to simplify NRI taxation and financial planning. Don't wait any further, connect with us right away.

**Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA, or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

- Mistakes NRIs Make While Investing in India

- NRI Purchasing Property In India From The USA - A Complete Guide

- Understanding Alternative Investment Funds (AIFs) in India for NRIs

- Things NRIs Should Consider While Investing in India

- Advance Investment Options for NRIs: AIFs, REITs & Bonds

- Impact of FEMA Rules on NRI Mutual Fund Investments

- Top 8 NRI Investment Myths Got Busted

- Difference Between Repatriable Vs. Non-Repatriable Investments for NRIs

- RBI Rules For NRI Investment : A Guide For NRIs

- Tax-Free Investment Options For NRIs In India

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1767780160.webp)