- What is an NRI Power Of Attorney (PoA)?

- Types of NRI Power Of Attorney Useful For Banking

- Banking Activities Managed Through A PoA For NRIs

- NRO Account Operations Managed By A PoA

- NRE Account Operation Managed By A PoA

- How to create and register PoA From Abroad For NRIs

- Legal Framework That Governs PoA in India

- NRI Power Of Attorney Revocation

- The Bottom Line

As an NRI living abroad, you cannot always travel back to India to carry out every banking or legal transaction. Hence, in such cases, you can grant a PoA to a trusted individual to fulfill your banking responsibilities.

This person will act as your legal representative in India and manage your financial and banking responsibilities when you are not present in India.

Such responsibilities include conducting daily banking transactions, signing legal documents, managing property, and handling other loan formalities.

In a nutshell, PoA is a legal and streamlined instrument for NRIs involved in financial and property-related affairs in India.

In this blog, we will discuss everything about Power of Attorney, including the types of PoA useful for banking, the banking activities that can be managed through a PoA, how to register a PoA from abroad, its legal validity, and much more.

- Power of attorney for NRIs is one of the most important legal instruments that allows a non-resident indian to appoint a representative in India to handle banking and other related matters.

- There are initially two types of power of attorney: General Power of Attorney (GPoA) and Special or Specific Power of Attorney (SPoA).

- For NRIs to execute the PoA from abroad, they must draft the PoA, have it notarized, and then have it attested by the Indian Embassy or Consulate in their country of residence.

- The principal party can revoke a PoA at any time by issuing a written revocation notice.

What is an NRI Power Of Attorney (PoA)?

An NRI PoA is a legal instrument or a document that grants the authorization to a trusted individual to act on your behalf in matters related to property, financial transactions, legal affairs, and more. This trusted individual is known as the attorney or the agent.

As an NRI who might not always be physically present in India, it is great to have a trusted legal representative to manage your legal affairs in your home country.

Through a PoA, the NRI grants the appointed attorney decision-making authority. The delegation of authority lets the PoA execute any legal task on the NRI's behalf. However, it's the PoA's responsibility to ensure that NRI's interests are safeguarded even in their absence.

Types of NRI Power Of Attorney Useful For Banking

Based on the purpose, the NRI can choose from different types of Power of Attorney, such as:

General Power Of Attorney by NRI

A general PoA provides the grantee (a person who is granted) with decision-making authorisation to act on your behalf. A general PoA grantee can engage in a wide range of banking, business, legal, or financial activities.

For example, as an NRI, you can use a general PoA Grantee to manage all your property transactions and documentation in India, as well as other formalities, such as disbursement of home loans. Along with this, the grantee can even represent you in legal matters.

Please note that, while drafting the PoA, you can mention any restrictions on the Grantee's power that they cannot exercise.

Optimize capital gains, avoid notices, and stay fully compliant.

Special Power Of Attorney By NRI

- As the name suggests, a special power of Attorney can be used to grant a specific power for a particular purpose, including banking and financial matters, the sale or purchase of a specific property, or any other legal matter in India.

- Upon completing the purpose for which the Grantee was given the PoA, the special PoA will no longer exist.

- Please note that, while drafting the PoA, you must specify the purpose and timeline for the tasks to be carried out by the Grantee under the special power of attorney.

- In general, the two participants in a power of Attorney are the principal (the one who grants the control) and the attorney/agent (a person authorized to act for the principal, also known as the Grantee).

Banking Activities Managed Through A PoA For NRIs

NRIs, here are some of the everyday banking transactions that can be executed using a power of attorney in India.

| Banking and financial operations | Managing real estate | Commercial and other related matters |

|---|---|---|

| 1: Handling the disbursement of home loan documentation and other formalities. 2: Managing the premium, claims, settlement of the insurance, and other related investments. 3: Remittance of currency earned in India. 4: Making payments locally in INR wherever necessary. |

1: Selling and buying of commercial or residential property. 2: Renting out the property. 3: Insuring the property and paying the eligible taxes. 4: Managing the mortgage and other charges created over the property with respect to the security for loans. |

1: Administration of offices or factories. |

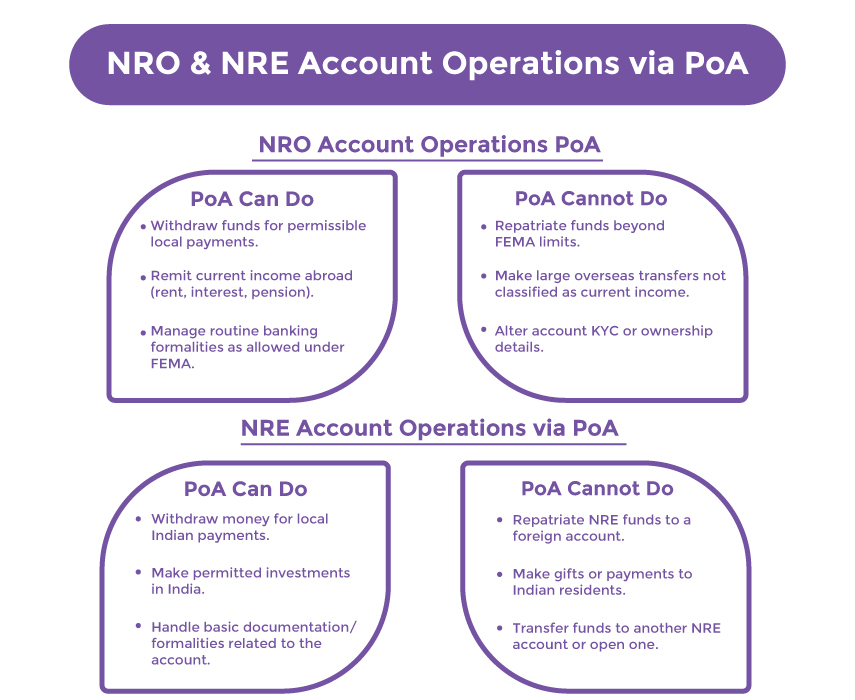

NRO Account Operations Managed By A PoA

Under the existing Foreign Exchange Management Act (FEMA), Indian banks are subject to specific compliance requirements, allowing the following banking activities to be executed by your Indian resident Grantee.

- Account operations for the Grantee are limited to withdrawal for permissible local payments.

- The grantee can remit the current income outside India, or the account holder, using normal banking channels.

- Please ensure that, while remitting the funds, the applicable repatriation limits and conditions will apply.

NRE Account Operation Managed By A PoA

As per the existing FEMA regulatory framework, Indian banks are subject to the applicable laws, and, hence, the following activities to be performed by your Indian Resident Grantee through a PoA:

- The grantee can withdraw the amount for local payments or remit funds held in the NRE account to you through the normal banking channel.

- Make investments in India.

The Indian Resident Grantee is not allowed to:

- Repatriate money from the NRE account to someone's foregin account.

- The grantee cannot make any payment to an Indian resident on your behalf as a gift.

- Transfer from your NRE account to another NRE account.

- Open an NRE account on your behalf.

Please note that all terms and conditions applicable to NRE accounts with respect to operations executed by a PoA also apply to FCNR (Foreign Currency Non-Resident Bank) Accounts.

How to create and register PoA From Abroad For NRIs

As an NRI, are you thinking that it is possible to register a PoA in India from abroad? Well, yes, it totally is. Follow the steps for a smooth PoA registration in your country.

Draft a PoA: NRIs to draft a PoA you can hire a legal practitioner to prepare a PoA tailored to your specific needs.

Get It Notarized: Meet a notary public from your country of residence and get the PoA notarised.

Embassy Attestation: Once the PoA is notarised, get it attested by the Indian consulate or Embassy in your country of residence.

Send and Register: Once the attestation is completed. Send the PoA to your appointed attorney in India, and they will register it at the Sub-Registrar's office.

Stay Compliant with Indian Tax Laws, Claim Deductions, and Avoid Penalties.

Legal Framework That Governs PoA in India

The Power of Attorney Act of 1882 and the Indian Contract Act of 1872 are the two legislations that govern the formation and operation of PoA in India.

The law under these acts ensures legitimacy, eligibility, and enforcement of PoAs in conjunction with the Indian Evidence Act of 1872.

NRI Power Of Attorney Revocation

As an NRI, revoking PoA in India can be a tricky affair. However, NRIs can follow the same procedure as residents to revoke a PoA by providing a written document stating the cancellation of the PoA.

It is essential to maintain proper communication and adhere to all legal requirements, including the legalization of documents executed outside India.

Under the following circumstances, the NRI PoA must be revoked:

- If the principal party dies.

- If there is valid proof of the attorney's misuse of power or violations of the agreement.

- If any of the parties wishes to revoke their power under the PoA.

- If the principal party becomes insolvent or insane.

The Bottom Line

NRI Power of Attorney (PoA) is one of the most essential documents for NRIs to handle their legal affairs in India efficiently. To draft an accurate PoA, it is always beneficial to seek the help of an adviser. Such a professional can help you successfully achieve the benefits of the PoA.

One such company is Savetaxs, a leading name in NRI taxation and compliance. Our experts will understand your needs and provide expert-backed consultation to draft a comprehensive, effective PoA.

Connect with us today as we serve our clients 24/7 across all time zones.

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

- When Does an NRIs NRE Account Lose Tax-Free Status in India?

- A Guide to NRO (Non-Resident Ordinary) Accounts

- Everything You Need to Know About UPI for NRI

- Everything You Need to Know About FCNR (B) Account

- How To Transfer Money From NRO Account to NRE Account

- NEFT, RTGS, IMPS and UPI to Transfer Funds From NRO to NRE Account

- Top 5 NRI Banks for NRE account in India for 2025

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1765974748.webp)

_1753429421.webp)