One of the top concerns for any non-resident Indian is managing their assets across borders. And with the concerns rising around the succession of wealth and assets, especially given the complexities of cross-border tax and inheritance laws, estate planning for NRIs has become crucial than ever.

Right estate planning ensures that your assets are allocated in order and that trusted individuals are appointed to manage them and address future circumstances related to them.

In a nutshell, estate planning ensures your assets are appropriately managed after your death.

In this blog, we will understand how NRIs can effectively do estate planning through creating a trust.

- NRI estate planning is an essential process for NRIs to ensure their assets are passed on smoothly to their heirs and beneficiaries.

- Common assets for funding the trust include real estate, tangible assets such as jewelry and antiques, and collectible securities. Additionally, retirement accounts, investment accounts, cash accounts, business interests, stocks, and bonds must be included.

- The entire purpose of creating a trust in estate planning is asset management, tax management, wealth protection, and financial care.

- Key parties in a trust include the settlor, who establishes the trust; the trustees, who manage the trust's assets; and the beneficiary, who benefits from the trust.

Why Early Estate Planning Is Important For NRIs

Early estate planning for NRIs is crucial if you want to protect your assets across borders, avoid legal disputes, and ensure that your wealth is transferred smoothly to your family.

Generally, an NRI's assets are spread across countries, such as property in India, bank accounts abroad, retirement funds, and more. This is why NRIs often face compliance issues and complex tax rules.

Hence, early planning gives you ample time to plan everything that complies with both Indian and foreign tax laws. Additionally, if you start planning early, there is a higher chance that litigation risk will be reduced and that assets will be distributed fairly after thorough consideration.

In a nutshell, early estate tax planning provides NRIs with peace of mind, smart asset allocation, and ensures that the assets are passed on smoothly and legally to the loved ones.

Benefits Of Creating A Trust

For NRIs, creating a trust brings in an array of benefits. Such as

Avoid being a part of probate

Probate is the process of transferring a deceased person's assets to their rightful beneficiaries. The court supervises this entire process. Hence, the process becomes lengthy and expensive, which is why NRIs choose to set up a trust beforehand to avoid the high costs and delays.

Now, when you create a trust, all the assets under your name are transferred to the trust, meaning nothing from your assets is subject to probate. This saves your beneficiaries time and money and ensures that your assets are distributed as per your wishes.

Provide the way you wish

As an NRI, forming a trust gives you the freedom to provide for your beneficiaries the way you wish and the way it suits your specific needs.

Now you can either set up the trust to distribute the assets over time or provide for specific needs, such as medical expenses or education. Additionally, you can also assign a trustee on your behalf who will manage the trust for your beneficiaries and will ensure everything goes exactly the way you wanted.

Protect Your Assets Against Legal Issues

This benefit of creating a trust is among the most underrated. Many NRIs don't know this, but when you transfer your assets to the trust, they become the property of the trust and are not considered your own personal assets. Meaning if you get sued or have any outstanding debts, nothing will come on your assets, and they will be protected in the trust.

Please note that: Irrevocable trusts generally provide creditor protection, while revocable trusts typically do not.

High On Privacy

Unlike a will, which later becomes a matter of public record upon probate, a trust is held high on privacy grounds and is not subject to public scrutiny.

Manage Estate Taxes

Certain types of trusts help you reduce or manage estate taxes. However, this depends on the law of your country of residence.

NRIs, your financial struggle has come to an end with Savetaxs. Book an expert-backed consultation today.

Taxation Of Trusts For NRIs In India

Here is a simple explanation of the tax implications for NRIs for different types of trusts.

1: Discretionary Trust

Under this trust, the trustee decides who gets and how much from the trust.

2: Non-discretionary Trust

Here, the beneficiaries' shares are fixed and clearly stated in the trust deed.

| Types of trusts | Revocable Trust | Irrevocable Trust |

|---|---|---|

| Dicretionary | Here, the income is taxed in the hands of the transferor. However, the income is taxed at the applicable slab rate. | Income is taxed in the trustee's hands as a representative assessee at the maximum marginal rate (MMR). |

| Non-discretionary | - | Here, the income is taxed in the trustee's hands at the same rate applicable to the beneficiaries for income other than business income. In the case of business income, MMR is applicable. Now, as per the clubbing provisions of the income tax law, if the beneficiary is a minor and the tax officer taxes the income of the beneficiary, then it shall be clubbed in the hands of the parent. |

Note: Indian trust taxation varies depending on the trust's structure and the nature of its income. This table is a simplified view of it. It is advisable to consult an NRI tax advisor and a legal advisor to understand in detail the type of trust and its tax treatment for NRIs.

Estate Planning Techniques For NRIs

The following are key aspects of estate planning for NRIs.

Draft A Trust

In estate planning, the first and most basic step is to create a legally valid trust. The trust allows NRIs to identify their legal heirs and specify how assets located across borders will be divided among the beneficiaries. With the help of a professional lawyer, a private discretionary trust can be created to hold the NRIs' assets.

PoA Managing Assets Remotely

A Power of Attorney lets an individual authorize someone to manage the assets of a trust when they are not officially present to do it. This is an integral part of estate planning strategies.

Double Taxation Prevention

Double taxation of the same income source arises when the income of a deceased NRI is taxed in the country of residence and in India. However, the tax treaty between the two countries will provide relief from Double Taxation by giving tax credits to NRIs.

Henceforth, NRIs must regulate their affairs in accordance with the applicable tax treaty between India and their country of residence.

Common Mistakes NRIs Make In Estate Planning

The following are common mistakes NRIs make during estate planning. Understanding them can help you be practically prepared for them.

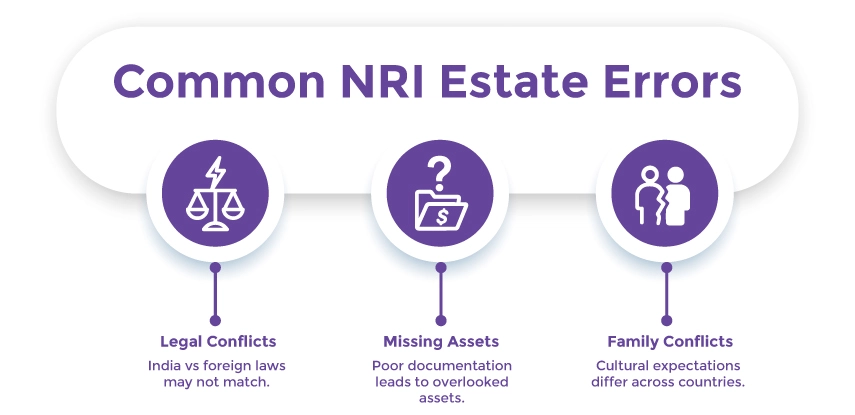

Cross-Border Legal System Conflict

What is valid under Indian law might be considered invalid under US law, creating legal complications for your beneficiaries. Each country's inheritance framework is different, and hence coordinating among them and building trust across both jurisdictions is complicated.

Complication In Asset Tracking

As an NRI, managing investments across borders becomes increasingly complex as your portfolio grows. Without proper documentation, certain small assets may be overlooked during estate planning.

Hence, it is important to document each asset you own to avoid last-minute hurdles. The best option is to consult an estate planning attorney who is familiar with the legal systems of both India and your country of residence. They can help you create a structured plan and ensure your global assets are protected.

Cultural Gap And Family Expectation

The approach to asset distribution in Western countries differs and might clash with the traditional expectations of your home country. Such a difference can create family conflicts if not addressed priorly in the estate planning phase.

Do not let complex tax situations stress you out. Connect with us today.

Best Practices For NRIs To Secure Their Global Assets

Here are three best practices an NRI must follow to create a compliant estate plan.

Proper Financial Structuring Helps in Minimizing Tax Liabilities.

Ensure that you create your estate and financial plan with the help of a trusted expert. They will help you develop a structured, tax-efficient portfolio.

Appoint a Trusted Executor

Once your estate plan is in place, please ensure you appoint a reliable and trusted executor or trustee. He/she will ensure a smooth asset handover and distribution in your absence.

Legally Compliant Across Multiple Countries

One key practice in forming your estate plan is to comply with inheritance laws and reporting requirements in the countries where you hold your assets.

The best option is to seek professional help to ensure the estate plans comply with Indian regulations and foreign law.

The Bottom Line

There is no lie that estate planning as an NRI is quite complex, especially when you hold assets across multiple countries. But taking action before time protects both you and your loved ones from complications later.

Hence, a detailed estate plan that is tailored to your needs will provide you with peace of mind and future security. To get a plan that is compliant and structured as per your needs, connect with Savetaxs.

Our experts bring 30 years of combined experience. They will first analyze your assets and wealth, along with your running debts. In the next step, we will create a trust in accordance with your requirements and review the beneficiaries and nominations.

Reach out to Savetaxs and get personalized guidance in curating your estate plan.

*Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA, or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Navneet brings in more than 12 years of experience as a US Tax and ITIN Expert. Additionally, he has expertise in accounting, finance, taxation, financial analysis, budgeting, and risk management.

- When Do NRIs Need to Disclose Their Foreign Assets in India?

- A Complete Guide On RNOR - Taxability Of Income & Key Rules

- How NRIs Can File Form 10F Without a PAN Card (Claiming DTAA Benefits)

- What Is UK Certificate Of Residence & How To Claim Tax Relief With It In India

- Rules for Tax on Gifting in India for NRI: Everything You Need to Know

- Taxation of Foreign Source of Income in India for NRIs

- NRI Income Tax Refund Delayed Because Of PAN Name Mismatch? Know What To Do

- Understanding Health Savings Account (HSA) For Returning NRIs

- Tax Rules for Selling Property in India as an NRI & US Tax Resident

- Tax Implications of Investing in US Stocks for NRIs and Indian Residents

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1766559165.png)

_1766561286.webp)