Contra funds are a type of mutual fund that invests in underperforming stocks with an aim for long-term gains. Given the high risk, these funds can offer strong potential returns.

Contra funds provide a range of benefits, including the ability to outperform benchmarks in bull markets, long-term wealth creation, and the potential for high returns by investing in out-of-favour stocks. With so many relevant benefits, NRIs invest in contra funds to leverage the potential high returns and achieve portfolio diversification.

However, these funds run a long-term race and have a high-risk profile, with no guarantee that undervalued stocks will outperform in the future.

In this blog, we will discuss all aspects of contra funds, including why they attract NRIs, the best contra funds to invest in for NRIs, risks, and more.

- NRI investor who understands the market's correct mechanism, and the stock fundamentals related to the undervalued stocks can invest their money in the contra funds after analyzing their risk appetite.

- Since contra funds in India are categorized as equity-oriented mutual funds, they mainly invest in companies' equity.

- These funds are known as contra funds because they hold a market view that is contradictory. In simpler terms, contra funds invest capital in ways that run counter to prevailing market trends; hence, they are referred to as contrarian funds.

- Features of contra funds include identifying undervalued stocks and overlooked equity investment opportunities. The features furthermore include good returns at a lower investment cost, but does come with long streches of underperformance.

- NRIs can invest in contra funds using their NRO bank account and NRE bank account.

What Are Contra Funds

Contra funds are classified as equity mutual funds and aim primarily to invest in equities by taking a contrarian view of the market. According to the guidelines rolled out by SEBI, contra funds are required to invest a minimum of 65% of total assest in equity and equity-linked securities.

Simply put, the contra fund managers bet against the current market cycle trend.

These fund managers invest in stocks that are either undervalued or out of favour but have strong fundamentals. Additionally, they invest in those that are not preferred under the current market cycle.

These stocks are available at lower prices; contra fund managers invest in them, aiming to benefit when market sentiment shifts and their prices rise sharply.

Contra funds are often expected to rise during bullish market runs, but their performance is not tied to bull markets but rather to value-recovery phases.

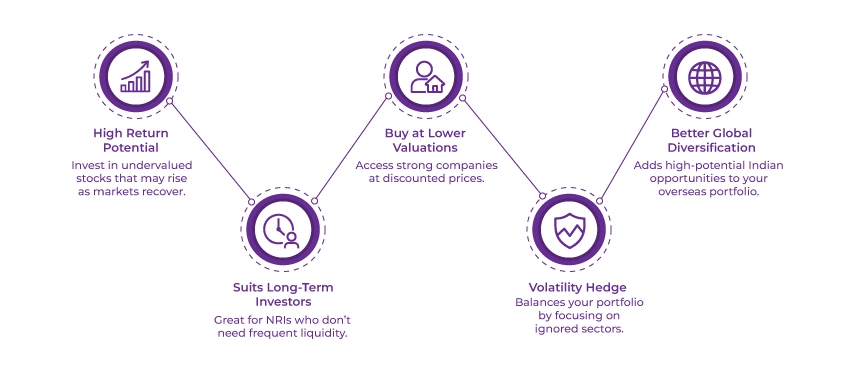

Why Contra Funds Attract NRIs

Contra funds are attracting NRIs for the following reasons:

Potentially High Returns

Contra funds, meaning investing in undervalued stocks that are anticipated to rise in value when market sentiment shifts.

Long-term Wealth Creation

Since NRIs are often seen as investing in long-term holdings as they do not frequently require immediate liquidity, contra funds seem to align precisely with that choice. The conotarian structure here needs patience. Hence, contra fund investing is a good pick for NRIs.

Enter The Market At Lower Valuation

Through contra funds, you get exposure to fundamentally strong companies' stock at discount prices. When market sentiment normalizes, investments like these often deliver strong upside returns.

File NRI ITR from anywhere, anytime with Savetaxs.

Hedge Against Market Volatility

Contra funds in India let you hedge against volatility, as while everyone is rushing to invest in trending sectors, contra funds balance the portfolio by entirely going on the pessimistic or ignore side of the market.

Best For Global Portfolio Diversification.

As an NRI living in a foreign land, contra funds are a good way to diversify your portfolio by investing in an undervalued segment of the indian market that has high future growth potential.

Read About More NRI Investment Opportunities here.

Best Contra Funds For NRIs

The following are the contra funds for NRIs.

However, please note that fund growth potential is expected to change as market sentiment shifts, so it is better to always seek advice from NRI-specific portfolio or fund managers to make an informed decision.

| Serial Number | Fund | 1 Year Return | 3 Year Return | TER | AMC |

|---|---|---|---|---|---|

| 1 | Invesco India Contra Growth Direct Plan | 10.45% | 19.33% | 0.56% | Invesco Mutual Fund |

| 2 | SBI Contra Growth Direct Plan | 4.31% | 24.11% | 0.60% | SBI Mutual Fund |

| 3 | Kotal India EQ Contra Growth Direct Plan | 3.37% | 19.85% | 0.60% | Kotak Mahindra Mutual Fund |

Please note that NRIs can invest in contra funds using their NRO bank account and NRE bank account

Contra Funds Risks That NRIs Must Know

Contra funds in India are well known for their high risk, but with significant risks, they also offer great benefits.

NRIs can benefit from contra funds if they overcome the following risks:

The Opportunity Cost

These funds often experience zero profits for long periods. When a contra fund identifies a business that is currently facing trouble and invests in it for, let's say, 7 years, only to find later that the market is not improving within the intended timeframe, fund managers are left with nothing. They have no choice but to exit their investment and seek better opportunities.

When investors exit without a profit, this results in significant opportunity cost.

NRIs, we provide you with investment strategies that will only mark your portfolios green.

Maybe Losses

The natural nature of contrarian funds is to bet on an out-of-favour stock in the hope that it will rebound over a long period of time. If the stock rebounds as expected, it can offer the NRI investor high returns. On the other hand, if the stock does not perform as expected, the investor must be ready to mark the portfolio red.

Wise fund and portfolio managers suggest not to hold more than 10% of one's investment portfolio in contra funds.

Expertise of the fund manager

The fund manager's skill or expertise is the make-or-break factor in the mutual fund scheme's performance. This is because the choice of stock depends entirely on the research, assessment, and analysis conducted by the fund manager.

As an NRI investor, before you invest, please ensure you understand the fund manager's performance.

Should NRIs Invest In Contra Funds

Yes, as an NRI investor, if you're seeking long-term wealth creation, are a high-risk taker, and are willing to tolerate temporary volatility, you can invest in contra funds. Additionally, these funds offer a unique advantage: NRIs can invest in markets that are currently looming or pessimistic but fundamentally strong.

These funds are suitable for:

- NRIs with long-term wealth plans.

- NRIs who want to invest beyond India's usual trading sectors.

- NRI investors who believe in market cycles and the core value of investments.

- NRIs who are confident with the "buy low; wait long" investment tactic.

Indian contra mutual funds are not suitable for an NRI investor who prefers predictable returns, stable wealth, or short investment durations.

The Bottom Line

Contra funds are a choice for investors who have patience and do not rush to sell whenever there is bad news.

In a nutshell, if you are an investor who dares to sit tight, have control of your nerves, and can keep a cool head and wait until the market sentiment shifts and the stocks shine with their true value, then yes, contra funds are for you.

So, if you have all these skills but need a guiding light to help you make a better-informed decision, then Savetaxs is the name you can trust.

We have been helping NRI investors from 90+ countries diversify their portfolio in the Indian market. Our NRI contra fund investors and portfolio managers will provide you with a risk-proof contra fund strategy for NRIs and guide you through current and future market conditions so you can make an informed decision.

Connect with us today as we serve our clients 24/7 across all time zones.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Shaw brings 8 years of experience in auditing and taxation. He has a deep understanding of disciplinary regulations and delivers comprehensive auditing services to businesses and individuals. From financial auditing to tax planning, risk assessment, and financial reporting. Mr Shaw's expertise is impeccable.

- NRI Succession Certificate: A Guide to Inheriting Property

- PIS vs. Non-PIS: The Best Stock Investment Options for NRIs in India

- Registering a Will in India: Key Tips for NRIs

- Investing in REITs as an NRI in India- Complete Guide

- Top 5 Problems NRI Face While Investing In India

- Foreign Investment Opportunities for NRIs: RBI FEMA Rules for Derivatives

- A Complete Guide to Investing in Gold for NRI in India

- NRI Investment in SGrBs Through IFSC

- Sending Money to India from Abroad: A Complete Guide for NRIs

- The Hidden Tax Burden of Investing in US Stocks for Indian Investors

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1767789828.png)

_1766561266.webp)

_1768471286.webp)

_1767077669.webp)