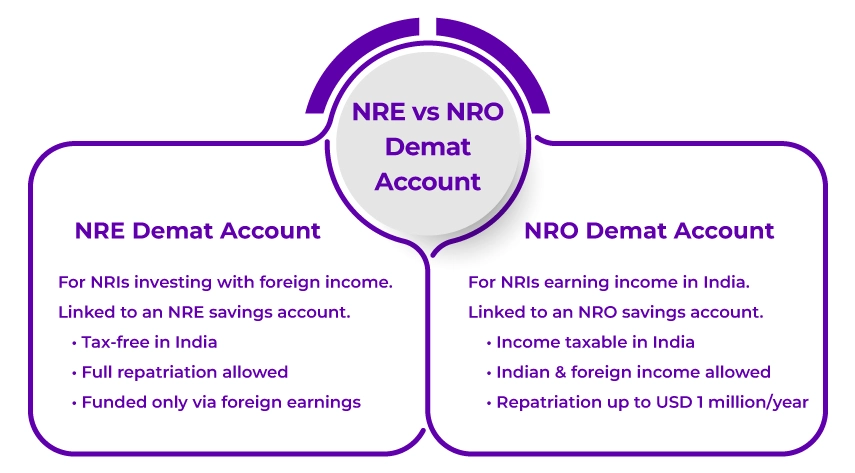

Many NRIs, when investing in the Indian stock market, often get confused between an NRE demat account and an NRO demat account. Despite their similarities in being used by NRIs, these accounts are often confused and misunderstood with each other. Although both accounts are for NRIs, but have unique features and serve different purposes.

Further, to help you out, this blog aims to provide you understanding of the key differences between these account types. It helps you in making the correct decision that matches your financial goals. So read on and clear all your doubts about these accounts.

- Select an NRE account if you have foreign-sourced income, as it provides tax-free interest and full repatriation.

- Choose an NRO account if you have income from an Indian source, such as dividends or rent. In this demat account, repatriation is capped, and interest is taxable.

- Assess your funding sources, tax situation, repatriation needs, and joint account preferences before choosing any demat account.

- Money in an NRE account can be transferred/ taken outside of India. Additionally, money in this account can also be converted into a foreign currency account.

- An NRO account is generally used for local payments or for making remittances from abroad and India.

What Is an NRE Demat Account?

A non-resident external (NRE) demat account is crafted for NRIs who want to invest in the stock market of India. Through an NRE account, you can hold and trade securities in India while having your primary income earned overseas. This demat account is linked to your NRE savings account. It further facilitates easy repatriation and transfers.

Now, let' know the key features of an NRE demat account.

Key Features of an NRE Demat Account

The key features of an NRE demat account are as follows:

- Tax Benefits: The income earned (interest and dividends) from the NRE demat account is free from all taxes in India.

- Repatriation Rules: You can repatriate your complete funds from an NRE demat account to your overseas bank account without any restrictions. It includes both principal and the earned interest.

- Fund Sources: The funds for investment should come from your NRE account, which only accepts foreign earnings.

This was all about the NRE demat account and its features. Moving ahead, let's know about the NRO demat account and its features.

What Is an NRO Demat Account?

A Non-resident Ordinary (NRO) demat account is for those NRIs who have Indian income sources. For instance, rental income, pensions, or dividends. An NRO demat account helps you to manage and invest your Indian earnings in Indian securities. Additionally, this demat account is also linked to your NRO savings account, helping you manage your local funds.

Further, let's know the key features of an NRO demat account.

Key Features of an NRO Demat Account

Here is the list of key features of an NRO demat account:

- Tax Implications: Unlike NRE demat accounts, for the income you earn in an NRO demat account, you need to pay tax in India. It includes dividend and interest income.

- Fund Sources: Into your NRO account, you can deposit both your Indian as well as your foreign earnings. It further provides flexibility for managing different income streams.

- Repatriation Limits: From an NRO demat account, repatriation of funds is restricted. Considering this, per financial year, you can invest up to USD 1 million, including all the investments. Additionally, it is subject to providing the required documentation and fulfilling all the necessary conditions.

So, this is what an NRO demat account is and its key features. Now that you have a basic idea of both the demat accounts, let's look at the key differences between them.

NRE vs. NRO Demat Account: Making the Right Choice

To properly take advantage of the unique features and use the service, it is important to understand the key difference between NRE vs NRO demat accounts. Considering this, to help you out, the table below shows the difference between the two accounts:

| Basis | NRE Account | NRO Account |

|---|---|---|

| Meaning | These accounts are designed for NRIs to manage and transfer their earnings from overseas to India. | On the other hand, NRO accounts are designed for NRIs who want to manage their investments and income sourced within India. |

| Taxability | In NRE accounts, earnings are not taxable in India, including interest income. | The earnings from these accounts are subject to Indian taxes, including earned income from interest. |

| Repatriability | It allows full fund repatriation, including the principal and interest amounts, to the resident country. | Earned interest is repatriable. However, the principal amount repatriation is restricted by specific amount limits. |

| Joint Account | An NRE account can be held jointly with another NRI. | An NRO account can be held with both an NRI and an Indian resident. |

| Deposits and Withdrawals | Deposits in an NRI account should be made in foreign currency, while withdrawals should be in Indian Rupees (INR). | Deposits in an NRO account can be made in both Indian and foreign currencies. However, withdrawals should only be made in INR. |

| Exchange Rate Risk | Exposed to fluctuations in exchange rates, which impact the deposit value. | Exchange rate fluctuation does not create any impact on it, as the account manages INR deposits and withdrawals. |

| Fund Transfer | You can transfer funds from one NRE account to another or from one NRE account to an NRO or resident account. | Funds can only be transferred to an NRO account or a resident account. In the NRO account, transfer of funds to NRE accounts is not permitted. |

| Currency Fluctuation | Currency fluctuations are sensitive due to the foreign currency component. | Currency fluctuation in this account is not sensitive, as the account primarily operates with INR. |

These were the key differences between NRE and NRO demat accounts. Further, you can open both the demat accounts for NRIs if you have diverse sources of income and investment goals.

Connect with Savetaxs, with expert guidance, file your taxes in India, and stay compliant with the tax laws of the country.

Final Thoughts

Lastly, knowing the difference between NRE vs. NRO demat accounts for NRI investments is vital in India. NRE accounts help you keep and convert your foreign currency into INR. Additionally, allows you to repartiate funds fully without any restrictions. In contrast, an NRO account allows you to deposit both Indian and foreign currency; however, interest is taxable. It totally depends on your investment goals and income sources, which demat account you choose.

Further, if you are new to the financial markets and facing issues in opening an NRI demat account, connect with Savetaxs. We have a team of financial experts who can help you open a bank account. Additionally, choosing the right investment options as per your financial goals.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Manish is a financial professional with over 10 years of experience in strategic financial planning, performance analysis, and compliance across different sectors, including Agriculture, Pharma, Manufacturing, & Oil and Gas. Mr Prajapati has a knack for managing financial accounts, driving business growth by optimizing cost efficiency and regulatory compliance. Additionally, he has expertise in developing financial models, preparing detailed cash flow statements, and closing the balance sheets.

- NRI Succession Certificate: A Guide to Inheriting Property

- Top 5 Problems NRI Face While Investing In India

- The Hidden Tax Burden of Investing in US Stocks for Indian Investors

- Foreign Investment Opportunities for NRIs: RBI FEMA Rules for Derivatives

- NRI Investment in SGrBs Through IFSC

- PIS vs. Non-PIS: The Best Stock Investment Options for NRIs in India

- Investing in REITs as an NRI in India- Complete Guide

- Registering a Will in India: Key Tips for NRIs

- A Complete Guide to Investing in Gold for NRI in India

- Sending Money to India from Abroad: A Complete Guide for NRIs

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1768307231.webp)

_1766730933.webp)

_1756816946.webp)