At present, India is the fastest-growing economy in the world. Over the past two decades, the country has experienced significant growth. All this made the country a favorable investment option for residents and NRIs. Among all the investment options, child plans stand out the best.

NRIs should also consider investing in these plans as they provide competitive returns and tax benefits that are not available in other countries. Additionally, investing in child plans also helps you secure the future needs and requirements of children.

Still not convinced why NRIs should invest in child plans in India? Read on the blog, clear all your doubts, and know why these are the best investment options for the best returns in India.

- A child plan is a blend of investment and insurance products. The investment part helps you build a secure future for your child which is useful for supporting their financial needs such as health, education, marriage and more. Further, the insurance part privdes the death cover of the premium payer.

- Through investments in Indian markets, NRIs can diversify their portfolio across different geographies and capitalize the economic growth story of India.

- The child plans based on your risk appetite offer you the flexibility to choose the investment funds. Additionally, they also offer different premium payment options, i.e., periodic payments or a lump sum.

- Under section 80C of the Income Tax Act, 1961, NRIs are eligible to claim tax deductions on paid premiums.

- Further, a child plan with an accumulated value of cash can act as collateral when applying for a loan. It eliminates the need for other asset types for collateral security.

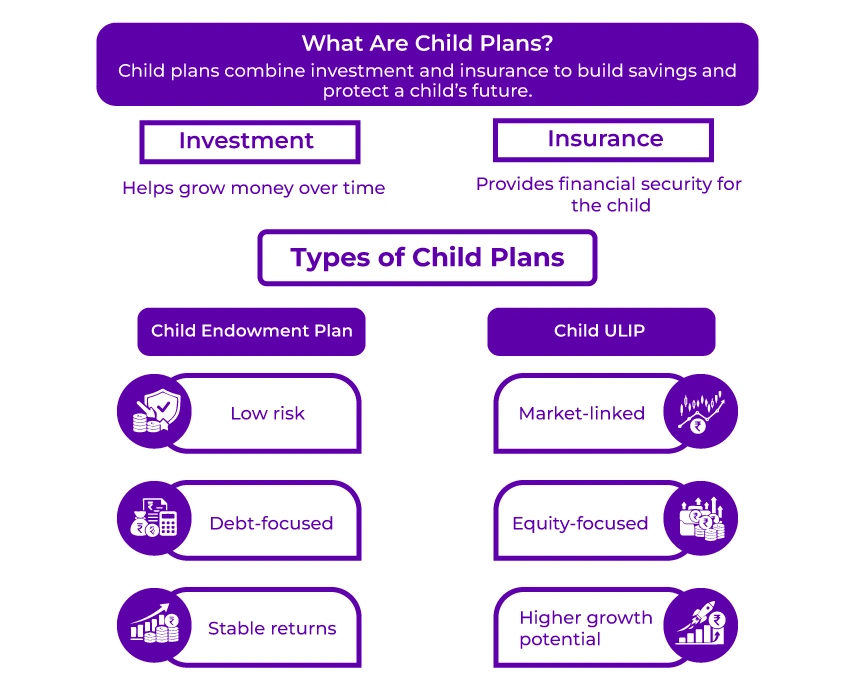

What Are Child Plans?

A child plan can be defined as the combination of investment and insurance under one roof. The investment part, through investment in several financial instruments, helps in the accumulation of funds. These include debt bonds, equities, and more.

On the other hand, through insurance, you protect your child from unforeseen events like sudden demise. It certifies that, as per the terms and conditions of your policy, from your insurer, your child receives a fixed annual payment.

Further, the child investment plans are of two types:

Child Endowment Plan

In this plan, the premium paid by the investor is invested in debt instruments chosen by the company. To pay the premium, you get the option to select the payment mode. Considering this, you can opt for a regular payment or a lump sum option. The child endowment plans consist of less risk. It means that the investments are a safe bet and are not subject to market changes.

Child ULIPs

In this plan, the amount you paid as a premium is mainly invested in equity instruments. In this, only a small portion of the premium is invested in debt funds. Additionally, in child ULIPs, you get the freedom to choose investment instruments. You can opt for lump sum or regular premium payment modes. Further, ULIPs are also popular as market-linked plans and assist you in attaining systematic savings, flexibility, accumulation, and liquidity at once.

This was all about child plans and different types of them. Moving ahead, let's know why NRIs should invest in child plans in India.

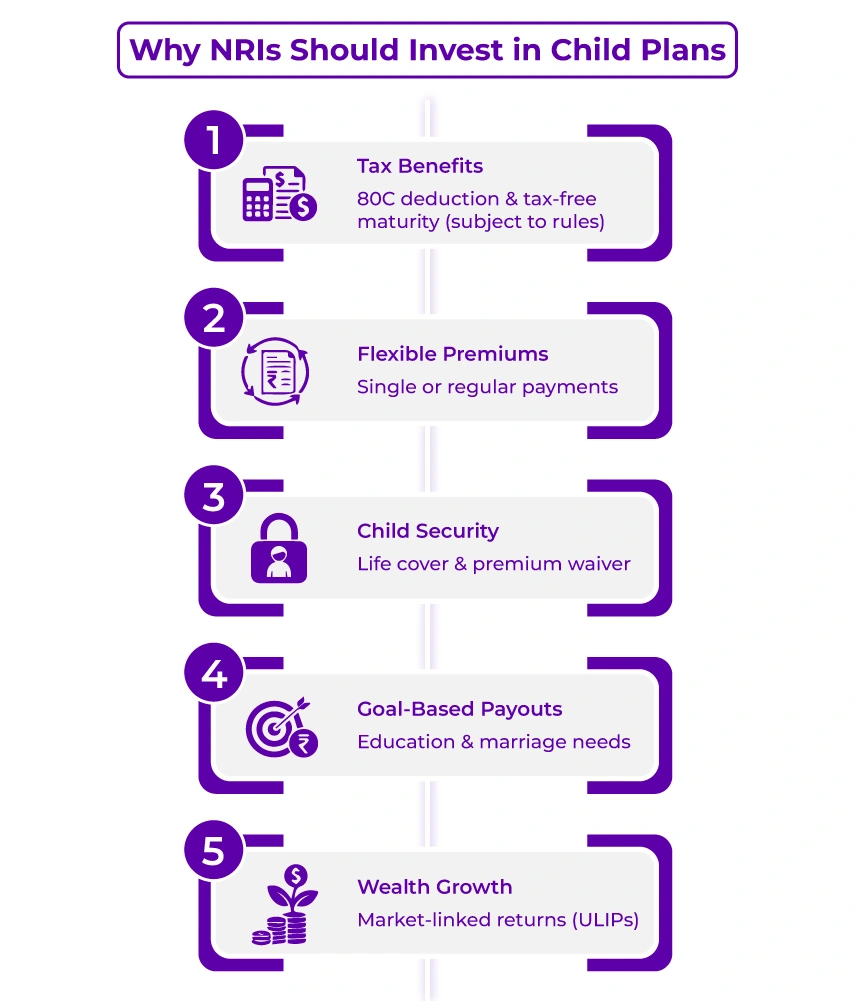

Why NRIs Should Invest in Child Plans in India?

Here are the following reasons why NRIs should invest in child plans in India:

- Tax Benefits: Under section 10(10D) of the Income Tax Act, 1961, generally, the maturity proceeds are tax exempt. Additionally, you can also use the paid premium for claiming a tax deduction of up to INR 1,50,000 under section 80C.

- Premium Payment Options: At your convenience, you get the option to choose the premium mode. You can select between limited-period payments or opt for a premium as a single payment.

- Availability of Riders: Riders are the additional benefits that you get over and above the basic advantages of the policy. However, to get the rider benefit, you need to pay a higher premium. Some of the available rider options are critical illness benefits, accidental benefits, and more.

- Financial Security: After your death, your child gets financial security from the child plan. In a lump sum, the life cover amount is paid to your child. Additionally, your child does not need to pay premiums in the future and receives income protection.

- Flexible Payout Options: Your invested funds are required by you at several stages. It includes higher education or the marriage of your child. The child plans as per your needs, offering you the ease and benefit of withdrawal at different stages.

Further, under the ULIP-based child plan, over the long run, to achieve the optimum benefits, you can choose the equity fund option. Under this case, the return can vary between 14 to 18%. Additionally, at the desired stage, to ensure the flow of the fund, you are allowed to make systematic withdrawals.

This was all about why NRIs should invest in child plans in India. Moving further, now let's know the benefits of investing in these plans.

What Are the Benefits of Investing in a Child Plan?

A child plan provides the following advantages to its investors:

- If you want to take a loan for the education of your child, a child policy can serve as collateral security. Hence, eliminates the need to contain any other collateral.

- Several plans are there to secure the future of your child, along with offering coverage for medical needs. This becomes important if your family has a history of diseases or anticipated health risks.

- In case of your unfortunate demise, a child plan helps your child in fulfilling his/her needs. After your death, it helps your child in maintaining the regular expenditure and supporting future aspirations and dreams.

- The cost of normal education is around INR 2,00,000. Eventually, with growing inflation, this expenditure is bound to increase. In this, a child plan assists you in providing the amount you require to set aside for the higher education of your child.

These were the benefits of investing in a child plan. Moving ahead, let's know the factors NRIs should consider while investing in child plans in India.

Savetaxs provides end-to-end expert assistance with filing tax returns in India and assists you in maximizing your refunds.

Factors NRIs Should Consider While Investing in Child Plans in India

NRIs, while investing in child plans in India, should consider the following benefits:

- Plan your investment portfolio. Note down the needs of your child, analyze your financial capability, and the time available for investment. Determine the premium amount you want to pay and the maturity benefit you aim to get based on your financial needs.

- The insurance part of the plan helps you protect your child from unforeseen events. It certifies that your children do not face debt in case of income loss due to any cause.

- Your child has several needs, from higher studies to marriage or setting up a business. Considering this, on a definitive basis, pretermine the amount you need for these expenses. Calculate the expected currency and inflation depreciation over time to make an investment plan that shall not fall short.

- Deciding the claim settlement ratio is an important thing that you should consider while investing in child plans. The ratio showcases all the applied claims and settled or granted actually by the insurer. Further, the higher the settlement ratio, the better the insurance provider.

- The most important decision is to achieve the maximum returns where to invest the savings. There are several child plans available to choose from, as per your requirements. You must opt for the one that fulfills your financial needs and goals.

- Go through the several premium amounts payable across different child policies and compare them. After that, choose the one that fits in your budget.

- Different insurance providers have different terms and conditions that, before proceeding, should be read and understood with the child plan. It is best to opt out of the policies that have complex conditions connected with them.

- Apart from the basic features of the child plan, the insurer offers several additional benefits. Settle down with the ones that your policy offers and take advantage of the same.

- The coverage amount is subject to several factors, such as the insured's age, earned income, and more. Determine everything and then select a plan that promises to fulfill your maximum requirements.

- It is vital to secure the future of a child, as long as feasible. At the same time, the longest policy can offer you low rates of premium. Hence, the policy term is a vital factor that you should consider.

These were some of the factors that NRIs should consider while investing in child plans in India.

Final Thoughts

Lastly, whether you are a resident Indian or an NRI, investing in child plans is a smart way to save for the future education or marriage of your child. These plans not only help you in saving money but also assist you in giving your child the gift of education without any financial worries. In short, it is a way to make sure the dreams of your child have the support that they require to come true.

Furthermore, being an NRI, if you are facing issues in choosing the right investment plan for your child, connect with Savetaxs. We have a team of financial experts who, as per your financial needs, can assist you in choosing the right investment plan.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Manish is a financial professional with over 10 years of experience in strategic financial planning, performance analysis, and compliance across different sectors, including Agriculture, Pharma, Manufacturing, & Oil and Gas. Mr Prajapati has a knack for managing financial accounts, driving business growth by optimizing cost efficiency and regulatory compliance. Additionally, he has expertise in developing financial models, preparing detailed cash flow statements, and closing the balance sheets.

- How can NRIs Invest in Alternative Investment Funds in India?

- Monthly Income Investments for NRIs in India

- Financial Planning for NRIs in Singapore: What to Consider?

- Financial Planning For NRIs In The USA - Manage Your Money Wisely

- Why Is Licence Agreemnt Better Than Rent Agreement For NRIs

- How NRIs Can Retire Early Using the FIRE Strategy?

- Step-by-Step Guide to NRI Investment in Mutual Funds

- How Can NRIs Open A Joint Demat Account

- Pravasi Pension Scheme for NRIs: Eligibility and Application Procedure

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1767789828.png)

_1767077669.webp)

_1767003468.png)

-in-the-USA_1762862398.webp)