Seeking a regular income source from your investment in India while living overseas? As an NRI, dividend stocks are the best option to fulfill your financial needs. These investments can decrease portfolio volatility and, when markets decline, limit losses.

Want to know more about dividend stocks in India for NRIs? This blog will provide you with everything about it, from tax implications to strategies to increase your returns while following the FEMA regulations. So read on and gather all the information.

- Dividend stocks are a regular source of income for NRIs in India.

- Dividend stocks, in simple terms, are profits that are distributed by the companies to their shareholders.

- Compared to non-dividend-paying stocks, these are less volatile.

- NRIs are liable to pay TDS of 20% plus applicable surcharge and cess.

- Through the Double Taxation Avoidance Agreement (DTAA), signed between India and the current resident country, NRIs can reduce the TDS rate.

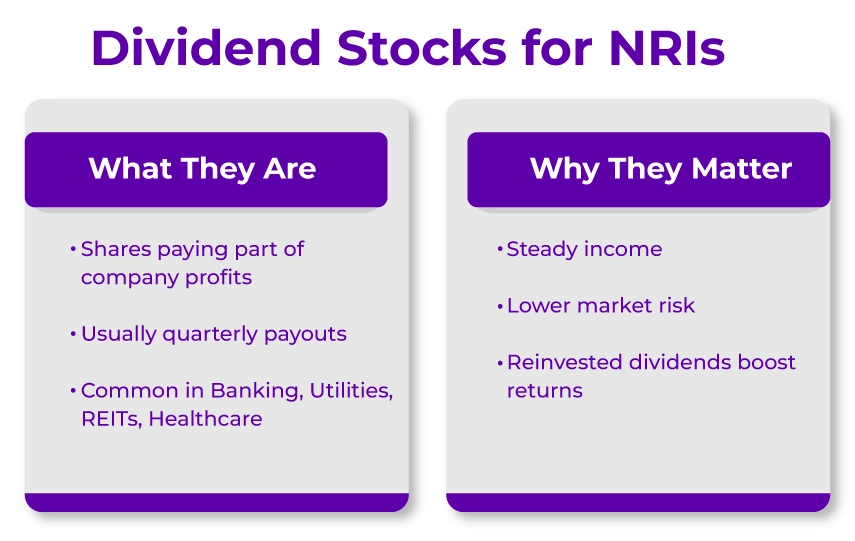

What Are Dividend Stocks?

Dividend stocks are shares of a company or organization that distribute a portion of their profits to their shareholders. These companies are different from businesses that focus on growth and reinvest all their income into expanding the business. Corporations that pay dividends to investors reward them with cash payments for their ownership stake. Generally, most of the companies pay dividends to investors quarterly, whereas some pay them monthly, semiannually, or annually.

Dividends denote the share that you earn from the profit of the company. Typically, dividend stocks focus on established sectors like:

- Banking and financial services

- Oil and gas

- Utilities and consumer staples

- Real Estate Investment Trusts (REITs)

- Healthcare and pharmaceuticals

So, now you know what dividend stocks are. Moving ahead, let's know the benefits NRIs get from investing in dividend stocks. +

Why Dividend Stocks Matter for NRIs?

Dividend stocks matter for NRIs because they provide them with lots of benefits. These are as follows:

- Without being impacted by market movements, generate regular income.

- Compared to non-dividend-paying options, dividends have lower volatility.

- Reinvestments in dividends, over time, enhance the sustainability of the total returns.

- For an investment portfolio, you can use dividends as a stable investment foundation.

- Although dividends do not provide growth potential, but generate income and offer reliability.

All the above-mentioned benefits make them perfect for people looking for passive income from investments in India. So, this is why dividend stocks matter for NRIs. Now, moving further, let's know how they can invest in these in India.

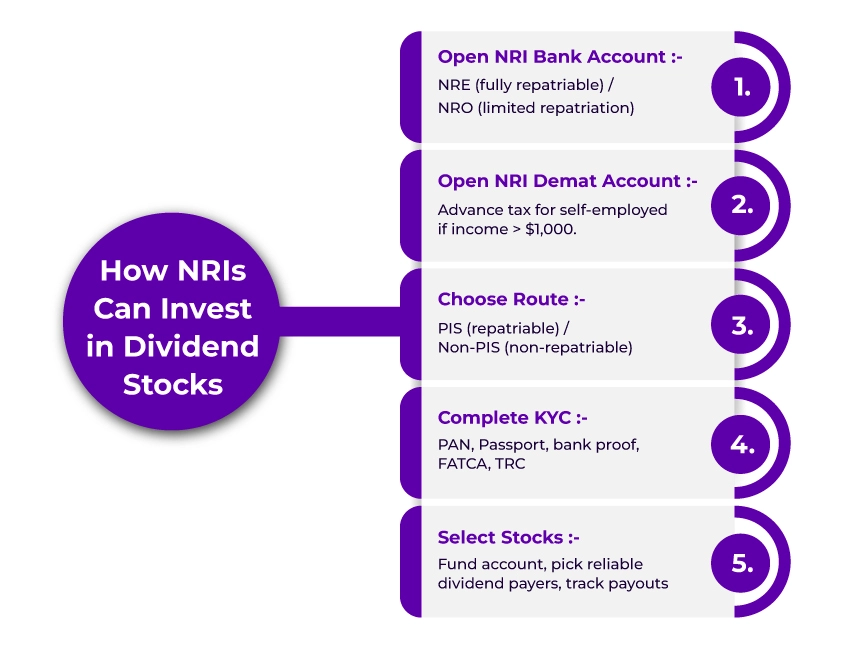

How NRIs Can Invest in Dividend Stocks in India?

Here is how NRIs can invest in dividend stocks in India:

Open an NRE or NRO Bank Account: To invest in dividend stock, NRIs first need to open a NRE or NRO bank account.

- NRE (Non-Resident External) Account: Dividends can be fully repatriable to your overseas account without any limitation.

- NRO (Non-Resident Ordinary) Account: Dividends received here have a repatriation limit, i.e., up to $1 million per year.

Apply for an NRI Demat & Trading Account: Once you open an NRE or NRO account, now with a SEBI-registered broker, open an NRI demat and trading account. Using these accounts, you can purchase and hold dividend stocks listed on the BSE and NSE.

Choose Between the PIS and Non-PIS Routes: To invest in dividend stocks, NRIs have two ways. These are as follows:

- PIS (Portfolio Investment Scheme)

-

- If investing on a repatriable basis (NRE account), PIS is mandatory.

- RBI tracks the transaction limits and compliance.

-

- Non-PIS Route

-

-

- It is used for non-repatriable investments.

- Less documentation and no reporting to RBI.

- Best for long-term dividend where repartition is not needed.

-

Submitted the Requested Documents for KYC: To activate your NRI trading and demat account, you need to submit the following documents for KYC updation:

- PAN Card

- Passport

- Indian address proof (optional)

- Overseas address proof

- Bank account proofs for NRE/ NRO account

- FATCA declaration

- Tax Residency Certificate (TRC) needed if you want to claim DTAA benefits

- Passport-sized photograph

Choose Your Dividend Stocks: Once your account is activated:

- Transfer funds to your NRI bank account (NRO/ NRE)

- Add funds to your trading account

- Opt for a reliable dividend-paying company like Infosys, ITC, and more.

- Monitor the dates of dividend payout and check the amount credited to your bank account.

So, this is how NRIs can invest in Indian dividends. Moving ahead, let's know the tax implications for NRIs on dividend income.

Tax Implications for NRIs on Dividend Income

If an NRI earns dividend income from investments made in mutual funds or shares of an Indian company, then that income becomes taxable in India. Since April 1, 2020, dividend payouts to NRIs are taxed in the hands of the investor after the removal of the Dividend Distribution Tax (DDT). Therefore, NRIs must report and pay dividend income tax in India based on the applicable tax rate. Considering this, when an Indian company pays a dividend to an NRI, it deducts 20% Tax Deducted at Source (TDS), plus applicable surcharge, and education and health cess. Further, this tax rate can also be slightly higher than 20%.

| Residential Status | Type of Shareholding | Other Conditions | Base Rate (%) | Surcharge (%) | HEC (%) | Effective TDS (%) |

|---|---|---|---|---|---|---|

| NRIs | Any | Dividend government bonds or other | 10 | N/A | 4 | 10.400 |

| FPIs/ FIIs | 20 | N/A | 4 | 20.800 | ||

| Company | Up to INR 1 Crore | 20 | N/A | 4 | 20.800 | |

| INR 1 Crore to INR 10 Crore | 20 | 2 | 4 | 21.216 | ||

| Beyond INR 10 Crore | 20 | 5 | 4 | 21.840 | ||

| Other than the above | Up to INR 50,00,000 | 20 | N/A | 4 | 20.800 | |

| INR 50,00,000 to INR 1 Crore | 20 | 10 | 4 | 22.880 | ||

| Beyond INR 1 Crore | 20 | 15 | 4 | 23.920 |

Further, if the country in which you are currently living has a Double Taxation Avoidance Agreement (DTAA) with India, you might avoid paying tax twice on the same income and reduce your TDS rate as low as 10-15%. For this, you need to submit Form 10F and a Tax Residency Certificate (TRC) to the dividend-paying company.

Additionally, repatriating dividends is simple. After tax deduction, as allowed by the RBI, you can transfer funds from your NRO account to your overseas account.

These were the tax implications that NRIs face in dividend stocks. Moving on, let's look at key investment strategies for NRIs to invest in dividend stocks.

Key Investment Strategies for NRIs in Dividend Stocks

With strategic dividend investing, NRIs can create a reliable income stream in India. As stated above, dividend stock provides both capital appreciation and regular income. This further helps NRIs while generating returns, maintaining a financial connection with their home country.

Financial Health Indicators to Consider

When choosing a dividend-paying stock, it is vital to consider key financial metrics. Companies with ratios exceeding 80% during economic downturns may face issues in maintaining dividends. Further, while buying dividend stocks, focus on these factors:

- Analysis of Payout Ratio: Search for companies that have sustainable payout ratios.

- Revenue and Earnings Consistency: Over time, these factors ensure the reliable payment of dividends.

- Debt Level Assessment: During difficult times, often high-leveraged companies reduce dividends.

Dividend Reinvestment Plans (DRIPs)

Through dividend reinvestment plans (DRIPs), you can boost your wealth. It automatically reinvests your dividends to buy more shares, further compounding. This strategy, over time, significantly increases the value of your portfolio without requiring any additional capital.

Connect with Savetaxs, unlock your financial potential, and increase your return in the Indian market.

Diversification Across Sectors

To reduce risk, across different sectors, including banking, FMCG, energy, and utilities, spread your investments. This approach offers stability to your portfolio, since dividend stocks generally show less volatility than non-dividend-paying options.

Practical Considerations

When investing in Indian markets for NRIs, the difference in time zones can create difficulties. To avoid this, set up an automated investment system. Additionally, work with brokers who have experience and knowledge of NRI-specific requirements. Further, in this process, important documents include:

- PAN Card

- Tax Residency Certificate

- Under PINS, NRE/ NRO Account

- Demat Account

Over the long term, compared to non-dividend stocks, dividend stocks often perform well. It is because reinvested dividend provides returns that lead to sustainable wealth accumulation. This makes the dividend stocks ideal options for NRIs seeking to create regular income streams from Indian investments.

Final Thoughts

Lastly, through dividend stocks, NRIs earn regular income from Indian investments while maintaining their financial connection to India. When selected from companies that are financially strong and have sustainable payout ratios, these stocks offer steady cash flow. It also helps in generating long-term wealth. Here, the above blog was your complete guide on dividend stocks in India for NRIs.

Further, if you still have confusion or want to know more about NRI investment options in India, connect with Savetaxs. We have a team of financial experts who help select the right investment option as per your financial needs. Additionally, we can also assist you in planning your taxes in India.

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

- Tax-Free Investment Options For NRIs In India

- Impact of FEMA Rules on NRI Mutual Fund Investments

- NRI Purchasing Property In India From The USA - A Complete Guide

- Advance Investment Options for NRIs: AIFs, REITs & Bonds

- What are the Top ELSS Tax Saving Funds for NRIs?

- Things NRIs Should Consider While Investing in India

- Mistakes NRIs Make While Investing in India

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1754392689.webp)

_1766129179.png)

_1752921287.webp)