- Offline TDS Challan Correction for NRIs

- Process to Approach the Bank for Challan Correction

- Process to Contact the Assessing Officer for Challan Correction

- Application Format for TDS Challan Correction

- Online TDS Challan Correction via TRACES for NRIs

- Important Head Codes NRIs Should Know

- Final Thoughts

Tax Deducted at Source (TDS) Challan is the form used to deposit the TDS or Tax Collected at Source (TCS) to the Government. The aim behind its introduction is to manage human errors and online transactions of tax collection, deposit, and refund.

Suppose you have deposited the TDS into the Central Government's account, but you find that you made an unintentional error while paying it, like providing the wrong amount, PAN, TAN, or selecting the wrong major head code, etc. Also, your challan is already generated, then in such situations, the errors attract the situation of no tax credit for the deductee. Additionally, for NRIs, only the deductor (buyer, tenant, or employer holding the TAN) can initiate the TDS challan correction. The NRI must coordinate with the deductor or take professional assistance.

The tax department understands that such minor mistakes can't be avoided. Hence, they provided a mechanism to rectify such errors, which is called Challan correction. It can be done either online or offline. Keep reading further to know more about the process to correct mistakes in the TDS challan.

- The TDS challan form was introduced to handle human errors and online transactions of tax collection, deposit, and refund (if any).

- Errors in the TDS challan can be rectified using the challan correction process, either online or offline.

- The TRACES portal must be used to do the TDS challan correction online, for which a digital signature is required.

- The challan correction request can be checked via TRACES, which can be initiated, available, failed, in progress, submitted to an admin user, processed, or rejected.

Offline TDS Challan Correction for NRIs

For payments carried out on or after the 1st of September, 2011, a new challan correction method was laid down for the corrections of physical challans. The table below lists the challan corrections that can be made, along with the name of the authority that is responsible for making such corrections:

| Fields in which corrections must be carried out | Authority Responsible for Correcting | Time limit for the correction carried out by the bank |

|---|---|---|

| Payment Nature | In case of online challans, the concerned assessing officer is authorised. Conversely, in the case of a physical challan, the collecting bank*/assesing officer is authorised. | Within 3 months of the date of deposit of the challan |

| Minor Head Code | Within 3 months of the date of deposit of the challan | |

| Major Head Code | Within 3 months of the date of deposit of the challan | |

| Total Amount | Within 7 days from the date of deposit of the challan | |

| PAN/TAN | Within 7 days from the date of deposit of the challan | |

| Assessment Year | Within 7 days from the date of deposit of the challan | |

| Name | In both online and physical challan cases, the concerned assessing officer is authorised for rectification. | N/A |

Challan Correction Carried out by the Bank is Subject to the Following Conditions:

- Banks cannot change names

- PAN/TAN correction allowed only if name in the challan is not different from the name as mentioned in the new PAN/TAN.

- Amount correction allowed only if it matches the actual amount credited to the government account.

- Only one correction per field is permitted

- Partial corrections are not allowed. It means either all the requested changes will be permitted, if they pass the validation, or none of the changes will be allowed, if even any one of the changes fails during validation.

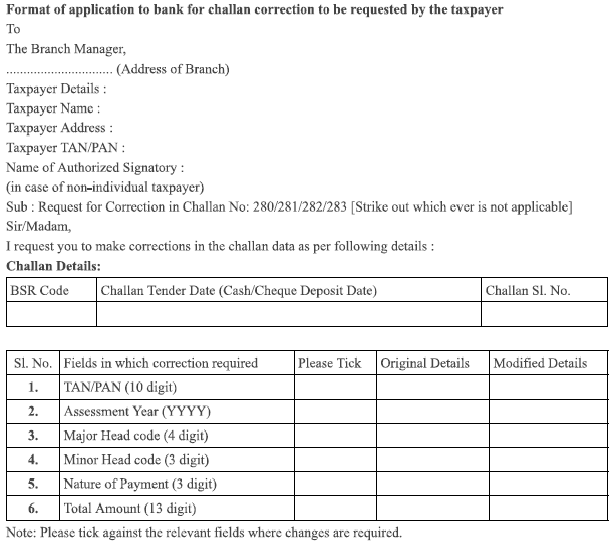

Process to Approach the Bank for Challan Correction

Follow the steps below to connect with the bank for challan correction:

- The taxpayer must submit the request form for correction (duplicate) to the concerned bank branch.

- They also need to attach a copy of the original challan counterfail.

- You need to attach a copy of the PAN card if you want to make corrections for challans in Form 280, 282, and 283.

- Attach the original authorization with the taxpayer's seal to the request form for non-individual taxpayers.

- You must submit a separate request form for each challan.

Ensure your ITR filing is smooth, accurate, and optimized for maximum savings with expert-backed assistance

Process to Contact the Assessing Officer for Challan Correction

The taxpayer can make a correction request to the concerned assessing officer when their limit to approach the bank for challan correction expires. They can request the officer who is authorized under the OLTAS (Online tax accounting system) application to carry out such a correction in challan data in bona fide cases. Additionally, it allows credit for the paid taxes to the concerned taxpayer. The other steps are the same as approaching a bank, as mentioned above

Application Format for TDS Challan Correction

Online TDS Challan Correction via TRACES for NRIs

TRACES (TDS Reconciliation Analysis and Correction Enabling System) must be used to carry out the online correction of the TDS challan for NRIs. To register on TRACES and request a challan correction online, you need a digital signature. Before proceeding with the Online Tax Accounting System or OTLAS correction process, ensure that to have the following prerequisites:

- A valid TAN (Tax Deduction and Collection Account Number). It is a 10-digit alphanumeric code issued by the Income Tax Department to identify deductions.

- Register yourself on the TRACES website, which is the official portal for TDS administration. You need to create an ID and set a password to register yourself on the TRACES. After that, provide your TAN, PAN, and other required details.

- A TDS file is a compressed file that includes your TDS information for a particular quarter. Use the TRACES portal to access this file using your login details.

Here is the Process to Apply for Online TDS Challan Correction for NRIs:

- Use your user ID, password, and TAN to log in to the TRACES website

- Select the 'Request for Correction' option under the defaults section

- Fill in the relevant financial year, quarter, form type, and latest accepted token number.

- Choose the correction category as 'Online' and click on 'Submit.' Once you do that, a request number will be generated

- Click on 'Go to Track Correction Request' under the defaults.

- Then, enter the request number or request period and click on 'View Request', or you can also click on 'View all Requests.'

- When the request status** becomes 'Available', click on Available/In progress status to proceed further with the correction.

- Enter information as per valid KYC

- From the drop-down, choose the type of correction category as 'Challan correction.'

- Make the required corrections in the selected file and click on 'Submit' to process your correction

- You will receive a 15-digit token number at your registered e-mail ID

The Status Correction Request Can be Any of the Following:

| Requested | When the user submits a request for correction |

|---|---|

| Initiated | The TDS CPC is processing your request |

| Available | The correction request is accepted, and the statement is made available for the correction. You can now make corrections to the statement. Clicking on the hyperlink will take the user to the validation screen. After you click on the request with 'Available' status, the request/statement status will change to 'In Progress.' |

| Failed | The request cannot be made available because of technical issues. The user can resubmit the request for the same details |

| In Progress | User is working on a statement. Clicking on the hyperlink will take you to the validation screen |

| Submitted to Admin User: | Sub-user/ Admin user has submitted a correction statement to the Admin user |

| Processed | The statement has been processed by TDS CPC (either for Form 26AS or for defaults) |

| Rejected | The TDS CPC has rejected the statement after processing. Check the 'Remarks' column to see the reasons behind rejection |

Important Head Codes NRIs Should Know

- Ensure to get a no-objection certificate (NOC) from the TAN holder in which the taxpayer has deposited the wrong tax.

- Minor Head: if a taxpayer is:

- A company = 0020

- A non-company = 0021

- Major Head:

- 200 = TDS/TCS Payable by taxpayer

- 400= TDS/TCS regular assessment

- The major head is related to the payment type; on the other hand, the minor head is related to the taxpayer.

Note:- Incorrect selection of these heads is a major reason for Form 26AS mismatch for NRIs.

Let Savetaxs experts handle your income tax filing from start to finish.

Final Thoughts

Finding errors in the TDS challan can be upsetting for NRIs, but there are solutions available. You can easily correct these issues and ensure the accuracy of your tax files by staying aware of the kind of corrections that are allowed. Additionally, remember that you need a digital signature to register and correct the TDS challan online.

Furthermore, if you have any more queries, seek advice from an expert at Savetaxs. We have a team of experts carrying years of experience and working 24*7 to guide and assist you with your financial matters and tax obligations. Contact us right away

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Shaw brings 8 years of experience in auditing and taxation. He has a deep understanding of disciplinary regulations and delivers comprehensive auditing services to businesses and individuals. From financial auditing to tax planning, risk assessment, and financial reporting. Mr Shaw's expertise is impeccable.

- Section 195 of Income Tax Act - TDS Applicability for NRI

- How to Claim TDS Refund for an NRI?

- Income Tax Form 13 For NRIs - Lower or Non Deduction

- Form 27Q Simplified For NRIs- TDS Return on Payments

- Your Complete Guide on TCS on Foreign Remittance

- What is Double Taxation Avoidance Agreement (DTAA)? How NRIs can Claim Benefits Under DTAA

- A Comprehensive Guide on the DTAA between India and the USA?

- Complete Guide On What is ITR, Documents Required, ITR Forms & Why To File

- TDS Deduction on Rental Property Owned by NRI

- NRI Selling Property in India

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

To correct a challan online via TRACES:

- Log in to the TRACES portal with TAN/DSC

- Under the default section, choose the request for OLTAS challan correction

- Enter CIN details (Challan Identification Number)

- Choose the fields in which you wish to make corrections

- Submit (processed in 1 day)

This is a common mistake. TDS deducted under the wrong section will lead to:

- Form 26AS mismatch

- Incorrect tax credit

- Potential tax notices

The buyer must revise the TDS return and correct the challan details through TRACES.

_1767780160.webp)