- What Are Gift City Funds For NRIs?

- How Gift City Funds Operate for NRIs?

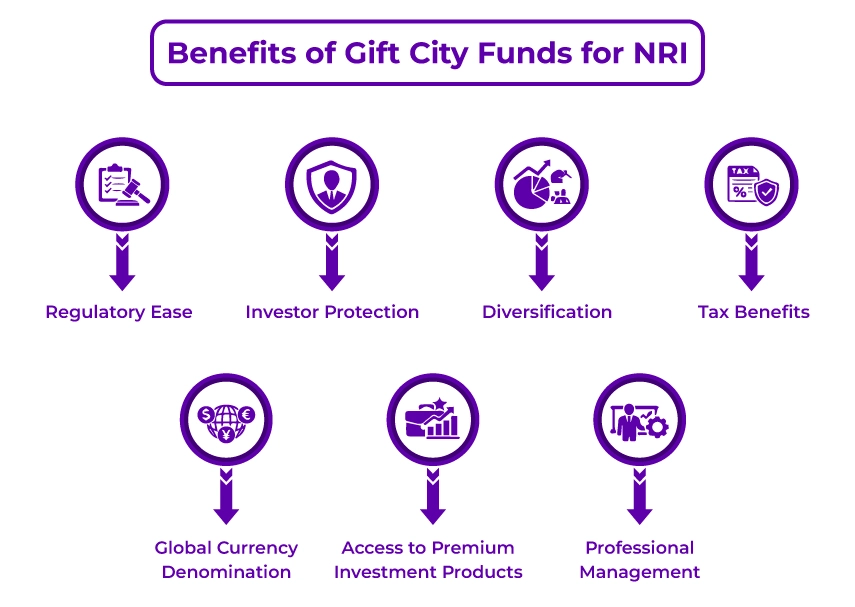

- Key Benefits of Gift City Funds for NRI Investors

- Investment Options Available in Gift City For NRIs

- Tax Benefits and Regulatory Advantages

- Risks and Key Considerations for NRIs

- How NRIs Can Invest in Gift City Funds?

- Final Thoughts

Gujarat International Finance Tec-City, also known as Gift City, is the first International Financial Services Centre (IFSC) in India. It is a home to several financial institutions, banks, and other global businesses. It provides them with a conducive atmosphere to set up their business and run their operations smoothly.

Also, in the Gift City, asset management companies (AMCs) have launched their own investment funds, known as Gift City funds. Additionally, it offers NRIs unique investment opportunities and addresses the issues faced by them with mutual fund investments in India.

Want to know more about Gift City funds for NRIs? This blogs provide you with complete information about it, from what it is to how it works, its features, and more. So read on and solve all your doubts about it.

- Gift City Funds are also known as the tax-free zone in India. It allows NRIs to invest in several financial products regulated globally.

- Operates under IFSCA, certifying operational transparency, global compliance, and investor protection.

- The tax-efficient framework, simplified compliance, and global currency flexibility make it an attractive alternative option to traditional investment routes.

- Gift City Funds provide benefits to investors from tax holidays, zero GST, and easy fund repatriation.

- NRIs can choose the premium methods and, based on their lifestyle and goals, add riders or extra benefits.

What Are Gift City Funds For NRIs?

Gift City funds are investments based in Gift City. These are governed by the International Financial Services Centres Authority (IFSCA). In simple words, these are mutual funds launched by AMCs in the Gift City.

These funds invest in global markets, providing exposure to international securities such as bonds and equities. Additionally, allows you to invest in several currencies, making investment hassle-free and simple. Also, they bring together global financial standards and the expertise of Indian fund management, allowing NRIs to invest easily with favorable tax rules and simplified regulations.

This was all about Gift City funds. Moving ahead, let's know how these funds operate for NRIs.

How Gift City Funds Operate for NRIs?

As mentioned above, Gift City Funds works under the regulatory framework of the IFSCA. It aligns the Indian financial regulations with global standards. It further helps the fund managers in Gift City to offer international investment schemes without the requirement to apply for separate Securities and Exchange Board of India (SEBI) approvals.

Considering this, NRIs, through their NRE account or overseas bank accounts, can directly invest in these funds using their foreign currency. It further eliminates the requirement of currency conversion. You can invest in a mix of global ETFs, Indian equities, bonds, and hybrid portfolios, providing you with diversification and opportunities for long-term capital growth.

So, this is how Gift City funds operate for NRIs. Moving further, now let's know the key benefits of these funds for NRI investors.

Key Benefits of Gift City Funds for NRI Investors

Here is why NRIs should consider investing in Gift City Funds:

- Regulatory Ease: With the SEBI regulations easing foreign investment norms, NRIs can now invest more freely in Gift City funds.

- Global Currency Denomination: Major global currencies denominate the Gift City Funds, allowing you to easily invest in them. Further, you can fully repatriate these funds without any restrictions and without facing the hassle of currency conversion.

- Diversification: Across multiple currencies, the Gift City fund invests in global securities. This further provides the investors with diversification of investments, hedging the risk in the investment portfolio.

- Access to Premium Investment Products: NRIs can invest in high-end products like Portfolio Management Services (PMS). It includes discretionary and non-discretionary PMS, focused PMS, and advisory PMS. Additionally, also includes alternative investment funds (AIFs) like real estate, global equity, hedge funds, and more.

- Tax Benefits: Unlike the local mutual funds, these funds do not impose tax deducted at source (TDS). Additionally, these works in tax-exempt jurisdictions provide lower tax rates on capital gains. Also, the Gift City funds also provide you benefit of different tax treaties signed between India and your current resident country, i.e., DTAA agreement.

- Investor Protection: Gift City funds operate under IFSCA, which certifies compliance with regulatory norms and global financial standards. This further makes these funds more safer and secure investment option.

- Professional Management: Gift City funds are managed by experienced fund managers. They have the expertise and knowledge to choose the right securities for the portfolio and produce higher returns.

These were the key benefits of investing in Gift City funds for NRIs. Moving ahead, let's know the available investment options in Gift City.

Investment Options Available in Gift City For NRIs

The Gift City provides several investment options for NRIs to select from. These are as follows:

- Offshore Banking and Deposits: Bank and financial institutions launched in the Gift City provide offshore banking deposits and foreign currency term deposits. NRIs can invest them in several currencies and get competitive interest rates.

- Alternative Investment Funds (AIFs): AIFs set up in the Gift City provide exposure to several asset classes. It includes private equity, real estate, debt securities, equities, and venture capital investments.

- Global Equities and Bonds: Through the Gift City IFSC exchange, NRIs can invest in global bonds and equities.

- Real Estate Investment Trust (REIT): The Gift City IFSC exchange has listed REITs. It provides easy access to NRIs to invest in the real estate market of India at a low cost.

This was all about the investment options available in the Gift for NRIs. Moving further, let's know about the tax benefits and regulatory advantages Gift City funds offer to NRIs.

File your taxes with expert assistance with guaranteed accuracy.

Tax Benefits and Regulatory Advantages

The Gift City funds offer the following tax benefits and regulatory advantages to NRIs:

- The concessional tax rates on dividend income are lower. The tax deducted on dividend income on the Gift City investment, compared to the tax deducted on investment outside the city, is lower. Considering this, the concessional rate of 10% tax is imposed on the dividend income.

- Interest income received from money lent out to IFSC units is completely exempt from all taxes.

- Capital gains on derivatives and shares listed within the IFSC are taxed at just 9%. These are far more favourable than the tax rates generally imposed under domestic Indian tax laws.

- No TDS is imposed on the income earned by NRIs on Gift City funds. It further helps in improving post-tax returns.

- Since all transactions are made in foreign currency, NRIs under the DTAA agreement can claim refunds or tax credits. This helps in reducing their tax obligations in their resident country on the same income.

- No GST is imposed on transactions made in the Gift City. This further reduces the overall investment cost.

- Further, on IFSC exchanges, transactions, no commodity transaction tax, no securities transaction tax, and no stamp duty is imposed.

These were some of the tax benefits Gift City funds offer to NRIs. Moving ahead, let's know the risks and key considerations associated with these funds that NRIs need to consider.

Risks and Key Considerations for NRIs

Here are some risks that NRIs need to consider before investing in Gift City funds:

- High Minimum Investment Requirement: Many Gift City investment options need a high entry threshold, i.e., $1,50,000 or more. This further creates a hurdle for small investors.

- Exposure to Global Market Volatility: Gift City Funds are often connected to global markets, which are directly impacted by global economic events and trends. As an outcome, these funds are more volatile.

- Currency Risk: Since investments and redemptions are done in foreign currencies. Hence, the exchange rate fluctuations can impact the returns.

- Liquidity: Compared to mutual funds, Gift City funds have lower liquidity. This further creates difficulty in selling your investments quickly.

So, these were the key risks that NRIs should consider before investing in Gift City funds. Now, moving further, let's know how to invest in these funds.

How NRIs Can Invest in Gift City Funds?

Using any of the following methods, NRIs can invest in Gift City funds:

- Directly with the Fund House: In this digital world, directly investing with the fund house has become simpler than ever. Considering this, to directly invest with them, you can visit the official website of AMC. However, you need to track and manage your investments on your own.

- Through a Bank: Many banks provide investment services in Gift City funds. To invest in these funds, you can select any bank. However, before investing, it is advisable to take the help of financial experts. It is because banks generally promote their own funds or offer those funds from which they get a higher commission.

- Through a Financial Advisor: Many financial experts and online platforms, without any hassle, assist you in investing in Gift City mutual funds. Further, they also provide value-added services like market research to make a portfolio that will align with your risk appetite and financial goals.

So, this is how NRIs can invest in Gift City funds.

With our financial experts choose the right investment options as per your financial goals.

Final Thoughts

Lastly, with several benefits like global currency flexibility, tax benefits, strong regulatory measures, and more, Gift City funds for NRIs are a good investment option. These funds provide access to global markets that are generally not available in traditional mutual funds. Additionally, these funds help NRIs diversify their portfolios and increase their returns.

Furthermore, if you are still confused and seeking reliable financial experts, consider connecting with Savetaxs. We have a team of financial experts who can assist you in choosing the right investment options as per your risk appetite and investment goals. Further, they can also help you with your tax planning in India.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Manish is a financial professional with over 10 years of experience in strategic financial planning, performance analysis, and compliance across different sectors, including Agriculture, Pharma, Manufacturing, & Oil and Gas. Mr Prajapati has a knack for managing financial accounts, driving business growth by optimizing cost efficiency and regulatory compliance. Additionally, he has expertise in developing financial models, preparing detailed cash flow statements, and closing the balance sheets.

- NRI Succession Certificate: A Guide to Inheriting Property

- How Can NRIs Invest In Indian Stock Market

- Registering a Will in India: Key Tips for NRIs

- Demat Account For NRIs - Application Process, Benefits & More

- All You Need to Know About NRI Life Insurance Plan

- Investing in REITs as an NRI in India- Complete Guide

- Top 5 Problems NRI Face While Investing In India

- NRI Investment in SGrBs Through IFSC

- Foreign Investment Opportunities for NRIs: RBI FEMA Rules for Derivatives

- Sending Money to India from Abroad: A Complete Guide for NRIs

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1767077669.webp)