- Can NRIs Buy A Property In India? (FEMA Guidelines)

- Step-by-Step Process For NRI Purchasing A Property In India

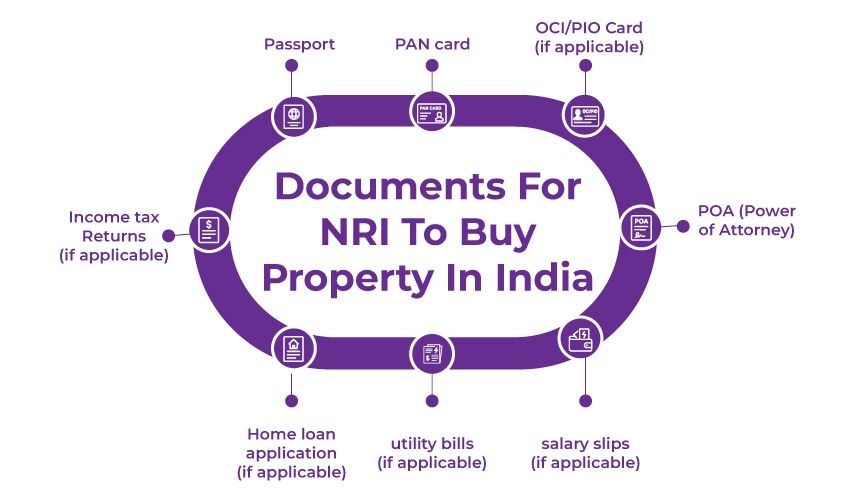

- Documents Required For NRI To Buy Property In India

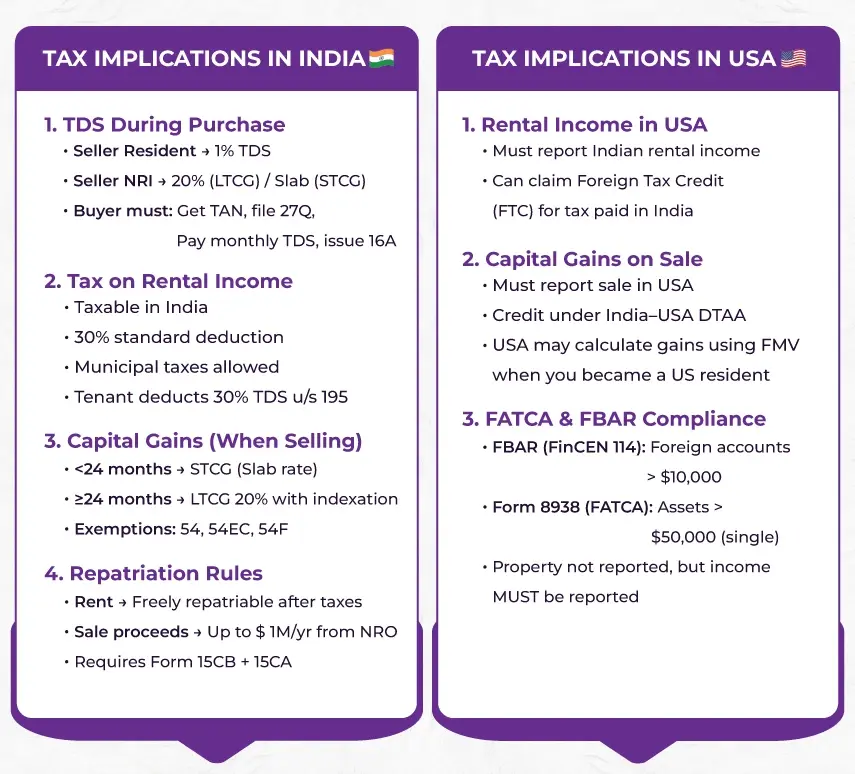

- Post Property Purchase Tax Implications For NRIs In India

- Tax Implications For NRIs In The USA

- Points To Consider As An NRI Buying Property In India

- The Bottom Line

India's growing economy is projected to become the third-largest in the world by 2030. This growth has significantly improved the real estate market in India, offering robust infrastructure and attractive investment returns.

Hence, there is no doubt that the real estate market in India is rising rapidly. As a result, NRIs are purchasing property in India, particularly those living in the USA. And now that the laws governing real estate market investments have been revised for the better, investing is even more easier for NRIs.

According to statistics released early this year, NRI investors have invested more than USD 13.3 billion in the Indian real estate market.

So, as an NRI, if you haven't invested yet or are planning to purchase property in India, you're in the right place.

This blog discusses all aspects of NRI purchasing property in India from the USA. Right from drafting a PoA in the USA, to selecting a property in India, verifying documentation, executing the entire process, and the tax implications in both India and the USA.

- NRI purchasing a property in India from the USA needs to have all necessary documents, such as a PAN Card, use an NRE/NRO account for payments, and strictly adhere to FEMA rules.

- For NRIs to purchase a property in India from the US remotely, appoint a reliable person with a notarized Power of Attorney to act on your behalf.

- Please ensure to check all the legal documents and the identity of the holder before investing in any property.

- For purchasing property in India, you must understand the cross-border tax implementation for both India and the USA, along with registration charges, stamp duty, and more.

- As an NRI, you can acquire a residential and a commercial property in India without needing any prior approval from the RBI.

Can NRIs Buy A Property In India? (FEMA Guidelines)

Yes, NRIs and the PIOs can purchase an immovable property in India. But what's restricted to them is to buy a plantation property, agricultural land, or a farmhouse.

Types Of Property an NRI Can Buy From The USA.

NRIs purchasing property in India can buy either residential or commercial property.

Additionally, as per the FEMA regulation, NRIs can purchase a commercial or residential property from another Indian resident, NRI, or an OCI only.

Inheritance Of Property For NRIs

This is where FEMA hasn't imposed any restrictions on NRIs, as they can inherit any type of immovable property from an Indian resident or any other person who has legally acquired it.

Receiving Property As Gifts

As a gift, NRIs can receive either a commercial or a residential receipt from their relatives. Ensure that the relative gifting a prepry must either be a resident of India, an NRI, or an OCI. The restriction on agricultural land, farming, and planting also applies to gifting.

Lastly, please note that citizens of Pakistan, Sri Lanka, Afghanistan, China, Bangladesh, Iran, Nepal, or Bhutan must obtain permission from the Reserve Bank of India (RBI) to purchase or transfer any property in India. This is not mandatory for a lease agreement of up to 5 years.

Step-by-Step Process For NRI Purchasing A Property In India

NRI buying property in India is going to be a tedious task as it involves strategic planning and understanding cross-border tax implications in India and the USA. But with proper guidance and awareness, you can get through the process seamlessly.

Following is the property purchase process for NRI

Step 1: Draft a valid Power of Attorney

As an NRI living in the USA who cannot be physically present in India at the time of purchase, you can appoint a Power of Attorney holder in India.

A PoA (power of attorney) gives the chosen individual or an entity, also known as agents or PoA holder ( the person to whom the power is granted), the authority to make confident decisions or handle affairs on your behalf.

Granting your rights legally to someone else to purchase a property in India is a sensitive matter; hence, please ensure that your PoA holder is someone you trust, or hire a professional Power Of Attorney Consultant to ensure your matter is in the hands of an expert.

Process:

- Draft a power of attorney deed that clearly defines the identities of the principal and the agent, including the duration of the grant, and more such related information.

- Get the PoA for NRI property purchase notarized by the US Notary Public, and then have the required document apostilled.

- Send the PoA deed to India.

- Upon receiving the PoA for NRI property purchase in India, it is then registered or adjudicated at the local sub-registrar's office.

However, please note that the general PoA is often rejected, hence use a specific PoA type only.

Step 2: Select Property & Verify Legal Documents

This is one of the necessary steps in the property purchase process for NRIs.

Selecting the party and then verifying all its legal documents are essential steps. This needs to be done mindfully and with the help of a reputable real estate agent.

- Ensure to verify these property-related documents.

- Title deed.

- Previous sale deeds of the seller (if any).

- Encumbrance certificate (ideally of 15-30 years).

- RERA registration (this is mandatory if you are considering buying an under-construction property).

- The building plan approval.

- The occupancy certificate of a ready property.

- Identity of the seller.

Lastly, if you are purchasing a property from another NRI, please ensure to get a No Objection Certificate (NOC) from the income tax department. This certificate will confirm that the relevant seller has fulfilled all tax obligations for the property.

Please verify every document mentioned here. This will confirm that the seller has clear marketable ownership of the property and that its history is undisputed.

Step 3: Finalise The Deal

Once the property is selected and all verification checks are complete, you can proceed to pay the booking or the token amount for the property.

Sign the Agreement of Sale and ensure that all the payable terms, timelines, special case clauses, and penalties are documented clearly in the agreement.

In the case of an NRI, the PoA holder can secure the agreement of sale by signing the sale deed.

Step 4: Hire A Chartered Accountant

As an NRI buying property in India, it is non-negotiable for you to hire a CA.

A CA's expertise can provide you with the Correct TDS calculation, which in this case will be.

- If the seller is a resident Indian, TDS will be deducted at a rate of 1%.

- Whereas, if the seller is an NRI, TDS will be deducted at a rate of 20% + surcharge and cess if the property you purchase is a long-term held property. Whereas, in the case of short-term held property, the TDS will be deducted at the rate of 30% + surcharge and cess.

Step 5: Make The Payment

As an NRI, please ensure payment is made only through authorized channels. Such as:

- NRE Account

- NRO Account

- FCNR Account

- Inward foreign remittance (bank to bank)

Please note that cash payments are not permitted for NRIs.

Step 6: NRI Property Registration Process

Once you've paid the remaining amount, it's time to register your property.

The NRI property registration process involves you.

- Paying for the stamp duty (5 to 7% of the property value).

- Paying registration fees (generally around 1%).

- Visit the Sub Registrar's office.

File Your NRI ITR Today with an expert-backed approach at Savetaxs.

Mandatory documents you must keep in order at the time of registration

- PAN Card

- Passport Copy

- Address Proof

- The PoA Deed

Documents you must keep in order after registration

- Registered sale deed

- Encumbrance certificate

- The stamp duty and registration fee payment receipts.

- Property tax receipts &

- Mutation records

Documents Required For NRI To Buy Property In India

Having all the documents in order beforehand will save you from any last-minute legal complications.

Following the documents, the NRI needs to purchase a property in India.

- A Valid Passport: This is mandatory to verify your citizenship and identity.

- PAN card: No real estate transaction in India can happen without a PAN card; having one is essential.

- OCI/PIO Card (if applicable)

- PoA: As an NRI, if you are unable to be physically present in India, having a Power of Attorney deed granted to a trusted individual in India is essential.

- Other essential documents that might help include Income tax Returns, salary slips, utility bills, and a home loan application (if applicable).

Post Property Purchase Tax Implications For NRIs In India

To assess NRI property tax in India, it is essential to determine whether the seller is a resident of India or a non-resident. For accurate property tax filing for NRI please know:

TDS Deduction

As an NRI purchasing property in India, you are required to deduct TDS (tax deducted at source). Now, the TDS rate depends entirely on the seller's residential status and the type of capital gain from the property sale.

As an NRI, if you have acquired an immovable property from someone who is an Indian resident, then in this case, the TDS will be deducted at the rate of 1% only of the sale proceeds exceeding the total of 50 lakhs.

Whereas, if the seller's residential status is NRI and the property being sold has been held by the seller for more than 24 months from the date of acquisition, the gains from the sale of that property will be treated as long-term capital gains.

As an NRI buyer, you will deduct the TDS at the TDS deduction rate on long-term capital gains, which is 20%.

In case of a property that is held for less than or exactly 24 months, then the gains earned from that property will be classified as short-term capital gains for the seller, and you, as an NRI buyer, will deduct the TDS at the rate of 30%.

After deducting the TDS, please submit it to the department within 30 days of the deduction. Failure to do so will result in a fine of 1% per month on the outstanding TDS amount.

Taxation On Rental Income

As an NRI, if you plan to put up your purchased property in India for rent, then the rental income you earn from it will be taxable.

Following the tax treatment of the NRI Rental Income:

The rental income earned by an NRI from a property in India is declared under the head 'Income from House Property' while filing the ITR. It is taxed as per your applicable income tax slab rate.

Additionally, unlike resident Indians, NRIs' TDS deduction on their rental income is mandatory under Section 195 of the Income Tax Act, regardless of the rent value.

The tenant is obligated to deduct TDS at the rate of 31.2% (30% basic tax + 4% health and education tax) on the entire rent value. Meaning that, as an NRI, even if you earn rent of Rs 1, TDS will still be deducted.

Note: If the TRC is not provided, the TDS on rental income will be deducted at a higher rate, meaning the DTAA can reduce TDS through lower tax rate claims.

Tax Implications For NRIs In The USA

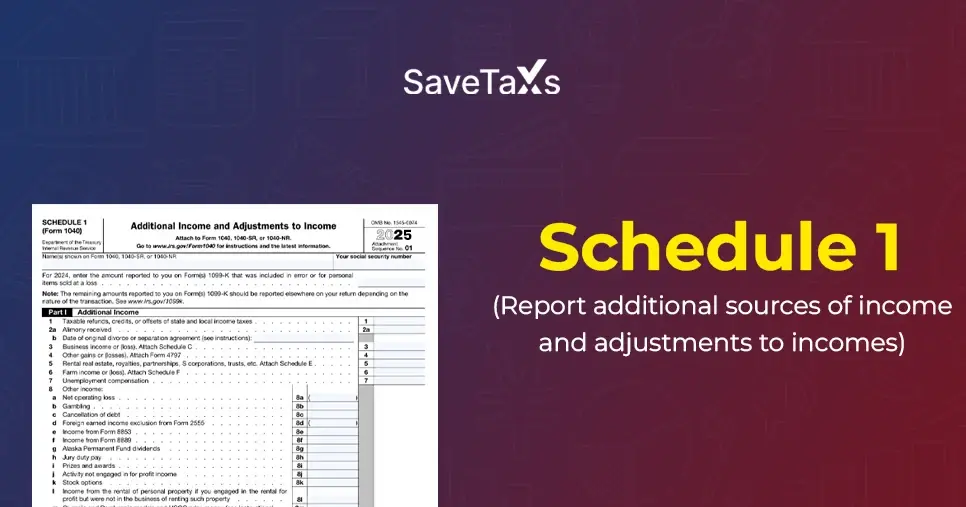

NRIs in the USA are generally taxed on their global income, including the Indian property.

Rental Income Taxed In The USA

If you have rented out your recently purchased property in India.

- Then you must report the rental income in the USA.

- You must claim the Foreign Tax Credit (FTC) for the taxes you have paid in India for the rent.

- Avoid double taxation by taking into account the terms and conditions of the India-US DTAA.

Capital Gains In the USA On The Sale Of Indian Property

NRIs ensure that even though you have paid the NRI property tax in India, you must still.

- Report gain in the USA.

- And claim all the eligible credits under the India-USA DTAA.

However, the USA may calculate your capital gains differently, using FMV at the time you are a US tax resident.

FATCA & FBAR Reporting

NRIs living in the USA, this one's mandatory for you.

FBAR (FinCEN Form 114)

This form is your Report of Foreign Bank and Financial Accounts (FBAR). The US government uses the form to collect information about your foreign financial accounts.

You are required to use this form if your foreign account balances exceed the set threshold of USD 10,000 at any point in the financial year in your NRE and NRO accounts.

Form 8938 (FATCA Reporting)

This form is the Statement of Specified Foreign Financial Assets. You will use it to report your financial interests in foreign assets to the IRS if the total value of the foreign assets exceeds USD 50,000 for individuals and USD 100,000 (joint).

However, the Indian property itself does not need FBAR, but the rental income here must be reported.

Points To Consider As An NRI Buying Property In India

Before buying a property in India, NRIs must conduct a careful evaluation, including associated factors, to ensure they are making a legitimate and secure investment.

The following are the rules for NRI buying property in India

Legally Verifying It All

Before investing in any property, no matter how flashy or attractive the price may look, please ensure the property title is clear of any ownership issues. Additionally, run a check on all necessary approvals, including land-use approvals, construction permissions, and no-objection certificates (NOCs).

The Location Analysis

Research the location of the property. Consider the property's infrastructure, the facilities available in the neighborhood, and the location's connectivity to other hospitals, convenience stores, the airport, and famous attractions.

Finance And Funding

When buying a property in India as an NRI from the USA, it is essential to consider all available financing options. Such via NRE/NRO account and home loan for NRIs. Consider additional expenses, such as stamp duty, legal fees, and other costs, to estimate the property's final price.

Tax Implications

For NRIs, the most tedious task in the property purchase process is correctly understanding the India-US tax implications. This includes understanding capital gains tax, TDS, income tax, and related matters.

Get your cross-border taxes handled by an expert here at Savetaxs.

The Bottom Line

For NRI purchasing property in India, this concept offers a mix of personal connection and an incredible financial opportunity. With the real estate market in India growing rapidly, NRIs can benefit in the long run with appreciated capital values and rising rental income.

All you need to do is ensure that everything is done in accordance with the law and that you understand the tax implications of both India and the USA.

However, if you're looking for an NRI real estate taxation consultant who can provide expert insights and assist you throughout the process, Savetaxs is the name to trust.

We have been helping NRIs across 90+ countries with their cross-border real estate needs and tax compliance. Our experts bring more than 3 years of experience to the table so that you can be assured of the best real estate investment strategies tailored to your specific goal.

Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA, or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Varun is a tax expert with over 13 years of experience in US taxation, accounting, bookkeeping, and payroll. Mr Gupta has not prepared and reviewed over 5000 individual and corporate tax returns for CPA firms and businesses.

- The Hidden Tax Burden of Investing in US Stocks for Indian Investors

- Top 5 Problems NRI Face While Investing In India

- Sending Money to India from Abroad: A Complete Guide for NRIs

- Investing in REITs as an NRI in India- Complete Guide

- A Complete Guide to Investing in Gold for NRI in India

- Registering a Will in India: Key Tips for NRIs

- NRI Investment in SGrBs Through IFSC

- Foreign Investment Opportunities for NRIs: RBI FEMA Rules for Derivatives

- NRI Succession Certificate: A Guide to Inheriting Property

- PIS vs. Non-PIS: The Best Stock Investment Options for NRIs in India

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1767170479.png)

(i)-Of-The-Income-Tax-Act_1756812791.webp)