- Key Takeaways

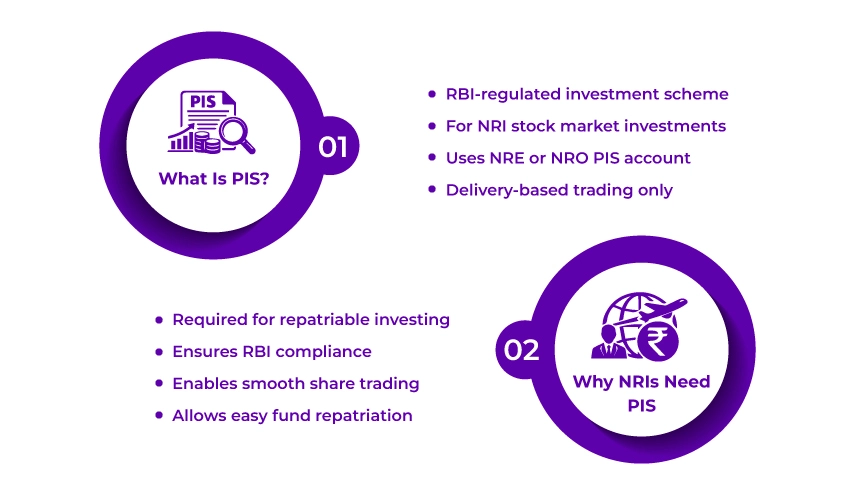

- What Is PIS and Why Do NRIs Need It?

- Types of PIS Accounts for NRIs

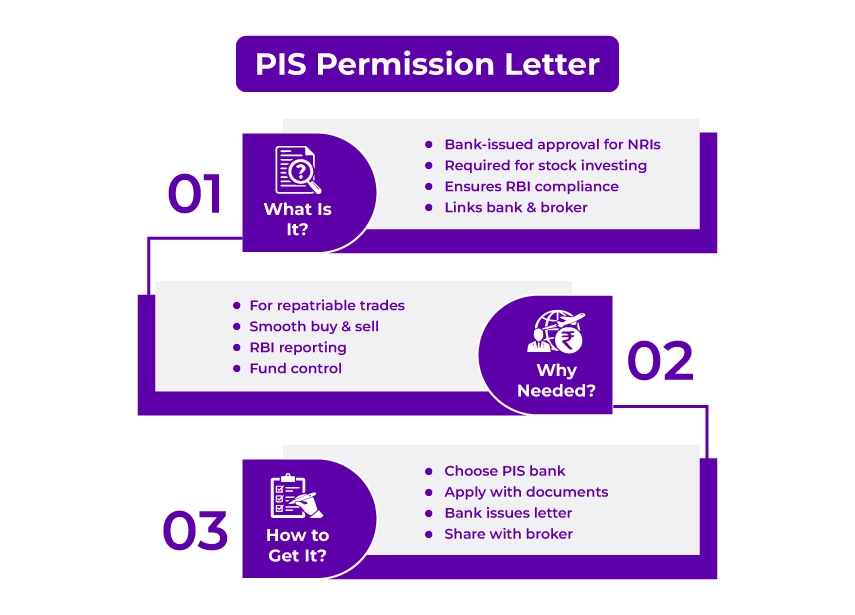

- What Is a PIS Permission Letter?

- Eligibility for PIS Permission

- Documents Required for a PIS Permission Letter

- How to Get a PIS Permission Letter for NRIs?

- PIS vs Non-PIS Route for NRIs

- Tax Angle: Why PIS Structure Matters for NRIs?

- Final Thoughts

A Portfolio Investment Scheme (PIS) allows NRIs on a repatriation basis to purchase and sell shares of listed Indian companies. Additionally, through an RBI-authorized bank where you have an NRE account, you can obtain a PIS permission letter. To do so, you need to open a PIS account for an NRI and start investing in the secondary market.

Further, to help you out, here is a comprehensive blog to understand PIS, including its types, permission letter, eligibility to get, and more. So read on and gather all the information related to it.

Key Takeaways

- A PIS is a framework of RBI for NRIs to invest in Indian bonds/ stocks through authorized stock exchanges.

- It regulates access to the capital markets of India, certifying compliance with foreign investment limits.

- Your designated bank account provides you with the PIS permission letter. For trading, it authorizes your PIS account.

- A specific NRE or NRO bank account is dedicated to PIS transactions only, linked to your broker.

- All share sales/ purchases should go through your designated PIS bank account.

What Is PIS and Why Do NRIs Need It?

A Portfolio Investment Scheme (PIS) allows NRIs to purchase and sell shares and convertible debentures of Indian companies listed on recognized stock exchanges. As stated under Schedule 3 of the Foreign Exchange Management Act (FEMA) 2000, through a designated bank branch, PIS investment is routed.

To invest in the Indian stock market, in any designated bank, NRIs need to set up a PIS-enabled NRE or NRO account. Additionally, the investment can be made on a repatriation or a non-repatriation basis.

Further, let's know why NRIs need a PIS account.

Importance of a PIS Account for NRIs

A PIS account helps NRIs earn good returns on investments in the Indian stock markets. It is the only way NRIs can buy and sell shares of Indian companies and convertible debentures. You can trade freely; however, transactions are restricted to intra-day. Considering this, with a PIS account, NRIs get the following benefits:

- Invest in the Indian stock market

- Seamless transactions

- Freely sell, buy, and repatriate

- User-friendly operations

This was all about the PIS account and why NRIs need a PIS account. Moving ahead, let's know the different types of PIS accounts for NRIs.

Types of PIS Accounts for NRIs

There are two types of PIS accounts for NRIs. These are as follows:

- Non-Resident External (NRE) PIS Account

- Funded with foreign currency, principal and capital gains are fully repatriable without any amount restriction.

- Used for repatriable investments.

- Non-Resident Ordinary (NRO) PIS Account

- Funded with Indian earned income, such as rent, dividends, and more.

- Repatriation is subject to limits generally of USD 1 million per financial year, including all investments.

- Used for non-repatriable investments.

So, with NRE PIS and NRO PIS accounts, NRIs can freely invest in the shares listed on Indian companies. Moving on, let's discuss a PIS permission letter.

With the expert guidance of Savetaxs, achieve a compliant and easy ITR filing as an NRI.

What Is a PIS Permission Letter?

A PIS letter is an official document issued by the RBI on behalf of a bank that authorizes NRIs to invest in the Indian stock market. In simple terms, it is a license that confirms compliance with RBI regulations before an NRI can start trading on the Indian stock market.

It is well known that the Indian stock markets are regulated by the RBI. One part of the regulation is providing a PIS letter to NRIs who want to participate in the Indian stock market. Here is why you need a PIS letter:

- A PIS letter is not only a paper; it makes sure that you follow all the trading rules. Additionally, it shows that Indians who live overseas can still participate in the Indian stock market.

- The letter certifies tax compliance and reporting by brokers, banks, and other investment platforms involved in stock market trade execution.

- Additionally, this letter facilitates smooth trade execution by allowing authorized brokers to link an NRE account for buying and selling shares.

- Apart from this, a PIS permission letter also ensures that investment and repatriation are done through a designated account.

This was all about a PIS permission letter and why NRIs need to obtain it. Moving ahead, let's know the eligibility to get this letter.

Eligibility for PIS Permission

Generally, an individual is eligible for a PIS letter if:

- He/she is an NRI, PIO, or OCI, holding a valid passport, and has an OCI/ PIO card (if applicable).

- With an authorized bank, maintain an NRE/ NRO savings account to operate PIS.

- Have a valid PAN card. Additionally, they have completed NRI KYC, including CRS/ FATCA declaration.

However, there are some restrictions also. These are as follows:

- Across all the banks, at a time, you can hold only one PIS approval. According to RBI guidelines, one NRE PIS account and one NRO PIS account.

- It is only available for secondary-market listed shares and convertible debentures. Considering this, it is not required for mutual funds, IPOs, bonds, F&O, and ESOPs.

So, this was the eligibility criteria an individual needs to follow to get a PIS permission letter. Moving further, let's know the documents NRIs require to get a PIS permission letter.

Documents Required for a PIS Permission Letter

Banks generally ask for the following self-attested documents, depending on where you reside, sometimes with embassy or notarisation attestation:

- Identity and Status

- Valid passport (with photo and address)

- Valid visa/ residence permit

- PIO/ OCI card (if applicable)

- Tax and KYC

- Copy of PAN card

- Current overseas or Indian address proof (bank statement, utility bill)

- FATCA/ CRS declaration for US/ other reportable jurisdictions

- Banking and Investment

- Details of NRE/ NRO account with the same bank

- Signed the PIS application form and investment declaration

- Details of existing demat and trading account, if any

Further, some banks may also ask you for a KYC form, a recent passport-size photograph, and in-person or video KYC before granting a PIS permission letter. Now, moving ahead, let's know how NRIs can obtain a PIS permission letter.

How to Get a PIS Permission Letter for NRIs?

If you already have an NRE/ NRO account, the process to get a PIS permission letter becomes straightforward. This is how NRIs can obtain it:

- Step 1: Choose a Designated PIS Bank/ Branch

- Select a bank that provides both NRE/ NRO accounts and has permission to run PIS. You can check this by visiting the selected bank website.

- The tie-up of your broker with those banks simplifies mapping.

- Step 2: Open or Confirm Your NRE/ NRO Account

- Certify your bank account is tagged correctly as NRE/ NRO, KYC as NRI is done, and PAN/ FATCA are updated.

- Now, choose whether you want an NRE PIS account or an NRO PIS account, or both.

- Step 3: Submit PIS Application and Documents

- Fill the PIS application form and attach all the requested documents along with it, such as a passport, visa, and more.

- Additionally, submit scanned copies of the documents via email or internet banking, as some banks may ask for original couriers or branch submission.

- Step 4: Bank Processes and Issues PIS Letter

- The designated branch of the bank reviews your PIS application, sets up the PIS code on your account, and provides you with a PIS servicing branch.

- Further, via email, you get the PIS permission letter. Additionally, the physical copy of it is couriered to your mentioned address within 3-7 business days.

- Step 5: Share the PIS Permission Letter with Your Broker

- Upload the letter and bank details to the NRI onboarding portal of your broker. He/she will link your trading account. After that, all PIS-rout stock transactions flow via your bank and are reported to the RBI.

So, this is how an NRI can obtain a PIS permission letter. Moving further, now know the difference between the PIS vs the Non-PIS route for NRIs.

PIS vs Non-PIS Route for NRIs

The table below showcases the key differences between the PIS vs the Non-PIS route for NRIs.

| Features | PIS Route (NRE/ NRO PIS) | Non-PIS Route (NRO Only) |

|---|---|---|

| Use Bank Account | NRE PIS for fund repatriation/ NRO PIS for non-repatriation of funds. | NRO Savings (no PIS flag) |

| RBI Reporting | Mandatory- it is mandatory for all banks to report secondary-market stock trades | No PIS-specific RBI reporting, only normal NRO compliance |

| Products Allowed | Deliver-based equity and some debt on exchange. | Equity delivery, F&O, IPSs, bonds, mutual funds via NRO. |

| Repatriation | NRE PIS is fully repatriable, whereas NRO PIS is subject to NRO rules. | NRO: Repatriation of funds is allowed up to limits with tax clearance. |

| Costs | The cost is higher due to PIS reporting and transaction charges from the bank. | The cost is lower as there are no PIS reporting fees, and easy settlement. |

| Best for | This is best for NRE equity investors focused on repatriable holdings. | This is best for F&O, active traders, and broader investing from NRO funds. |

This was all about the PIS route and the non-PIS route for NRIs. Moving ahead, let's know the tax structure of PIS for NRIs.

Tax Angle: Why PIS Structure Matters for NRIs?

Across PIS and non-PIS routes, there are identical tax rates. However, for NRIs, PIS simplifies RBI reporting, TDS deduction, and audit trails. Further, here are the PIS tax benefits that NRIs get:

- On every sale, TDS is auto-calculated by the bank (20% STCG on equity, 12.5% LTCG on gains more than INR 1,25,000).

- RBI reporting helps in providing clean bank statements for ITR filing.

- You automatically received Form 16A, which further helps in easily claiming DTAA benefits.

- During assessments, a clear audit trail reduces scrutiny.

Further, to provide you with a clear idea, here is a simple comparison of PIS and non-PIS tax structures.

| Aspect | PIS Route | Non-PIS Route |

|---|---|---|

| TDS Handling | TDS is auto-deducted by the bank per trade | It is less consistent as the broker handles the TDS. |

| RBI Reporting | Mandatory and automatic | None |

| ITR Compliance | Form 16A + bank statements | Manual gain computation needed |

| Best for | Long-term equity investors | F&O/ itraday traders |

Therefore, the tax angle also highlights the importance of the PIS structure for NRIs.

Final Thoughts

Lastly, a PIS account for NRIs is a robust option for long-term, compliant equity investments in India. Under the RBI guidelines, it provides a clear path for structured reporting and repatriation. Additionally, a PIS permission letter is more than an official document. It permits NRIs to invest in the stock market of India.

Once you know about the PIS process and gather all the required documents, as an NRI, you can start your investing journey. Further, when in doubt, connect with Savetaxs. Our financial experts will provide you with the necessary investment guidance and assistance.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

- Why Is Licence Agreemnt Better Than Rent Agreement For NRIs

- Mutual Funds vs Real Estate: Best Investment Options for NRIs

- Why NRIs Must Invest in Child Plans in India for Best Returns?

- Financial Planning for NRIs in Singapore: What to Consider?

- What Are the Trading Restrictions for NRIs?

- Monthly Income Investments for NRIs in India

- Your Detailed Guide for Gift City Funds for NRIs

- Step-by-Step Guide to NRI Investment in Mutual Funds

- How NRIs Can Retire Early Using the FIRE Strategy?

- Should NRIs Link their DEMAT Account to an NRE or NRO Account?

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1768221427.webp)

_1767696432.webp)

_1763555884.webp)

_1766492717.png)

_1766559165.png)

_1754392689.webp)