- What Businesses Should Apply For An Indian PAN Card?

- A PAN Card For A Company Name

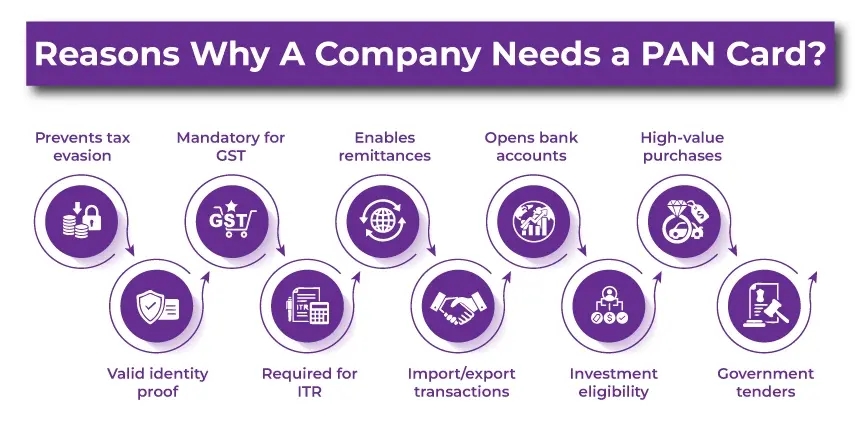

- Reasons Why A Company Needs a PAN Card?

- How To Apply for a Company PAN Card For Indian Citizens & NRIs?

- How To Apply For A Company PAN Card for a Foreign Citizen?

- Things To Consider Before Filing The PAN Card For a Company

- What Are The Documents Required For a PAN Card For a Company

- Fees For PAN Card For Company

- What Are The Benefits Of The PAN Card For a Company

- Challenges Occurred While Applying for the Company PAN Card.

- The Bottom Line

PAN card for a company or a business PAN card is an important identification tool for companies incorporated or operating in India. Mandated under Section 139A of the Income Tax Act, the business PAN card is allotted to companies, LLPs, partnerships, and other business entities. It helps with tax-related matters, streamlining financial transactions, and boosts business credibility.

In this blog, we will cover all the crucial aspects of a company's PAN card, including how to apply, the required documents, its benefits, and more.

- A company's PAN card is a mandatory document issued by the Income Tax Department of India to companies incorporated or operating in India. It is a unique 10-digit alphanumeric identification number.

- A company PAN card is also known as a business PAN card.

- A business PAN card is required for tax filing, opening a bank account, claiming tax deduction, and executing other financial transactions.

- All business entities, such as partnership firms, private limited companies, limited liability partnerships, one-person companies, etc., must have a PAN card issued in the name of their legal entity.

- As a business owner, you cannot have your GST registration in India without a PAN card.

What Businesses Should Apply For An Indian PAN Card?

Any corporate or artificial juridical person conducting business activities in India must apply for a business PAN card. Companies that are registered abroad but doing business in India are also required to have a PAN card.

All the following companies and entities must generate a PAN card in India.

- Company

- Limited Liability Partnership (LLP)

- Partnership firm

- Hindu Undivided Family (HUF)

- Association of persons

- Body of Individuals

- Trust

- Incorporations

- Limited companies

- Associations

- Private firms

- Hedge funds

- Foreign institutional investors

A PAN Card For A Company Name

Under the Indian income tax law, all companies must apply for a PAN card. The company's PAN card is different from the PAN cards of the company members. Now that a company is an artificial judicial person and can enter into financial transactions under its name, a PAN card is mandatory for companies.

The company PAN card has a 10-digit unique Permanent Account Number. It is mandatory that a company is required to get a PAN card as soon as it is registered, hence the Ministry of Corporate Affairs (MCA) has introduced a facility to apply for a PAN card along with the company's registration form.

Dated 1 February 2017, the Ministry of Corporate Affairs has launched a common application form for companies, named SPICe+, which allows a corporate applicant to apply for all three: company registration, PAN, and TAN.

Thus, all domestic companies must apply for a PAN card, along with the company register form, only on the official MCA portal, except for the following companies:

- Domestic companies that are registered before February 1, 2017, but haven't applied for the PAN card.

- Domestic companies registered after February 1, and where PAN has not been applied through the common application form ( SPICe+) of MCA.

The above-mentioned companies that were established before 1 February 2017 and do not have a PAN card, or a domestic company established after 1 February 2017 and has not applied for a PAN card via form SPICE+, can apply for a PAN card on the NSDL website.

However, please ensure that such companies can apply for a PAN card only by selecting the "digitally through e-KYC & e-Sign (paperless)" method for submitting the documents. Additionally, you are required to submit the PAN application using a DSC (Digital Signature Certificate), as applications submitted through any other options by these companies will not be accepted.

Please note that foreign companies can submit their PAN application via the NSDL website.

Reasons Why A Company Needs a PAN Card?

To run a business in India, a PAN card is a non-negotiable requirement. Moreover, the following are the reasons why a company must have a business PAN card:

- The PAN card ensures that all transactions the company engages in are legitimate and accountable, and prevents legal complications and tax evasion.

- The business PAN card serves as a valid identity proof, ensuring the company's credibility and authenticity.

- A business PAN card is a legal and mandatory requirement under the Income Tax Act for GST registration or any financial transactions.

- For a business to file an income tax return, pay taxes, and act in compliance with tax regulations, you need a PAN card. Henceforth, it is also required to pay invoices or receive remittances if any.

- A company must provide its tax registration number to any party paying it for any purpose.

- Companies engaged in import and export business need a PAN card to engage in foreign exchange transactions.

- To open a business bank account in a bank, the company must have a PAN Card.

- To invest in the company and in mutual funds, stocks, or other investment projects, you need a PAN card.

- To conduct high-value business transactions, such as purchasing assets, property, or vehicles, you need a business PAN card.

- For a company to participate in any government tenders, contracts, or any other government project, you need to have a PAN card.

How To Apply for a Company PAN Card For Indian Citizens & NRIs?

For companies and LLPs, PAN applications are generally required to be submitted digitally using DSC. Individuals including NRIs may apply either online or offline. The following is the process:

Online Mode

Step 1: Visit the NSDL website.

Step 2: Select the "Application Type" option as "New PAN - Indian Citizen ( Form 49A)" from the drop-down box, and the "Category" option must be chosen as "Company"

Step 3: Now fill in the form with all requested details, such as the company name, email ID, phone number, date of incorporation, and the captcha code, then click the "Submit" button.

Step 4: Select the "Submit digitally through e-KYC and e-Sign" option, and choose whether you want a physical PAN card.

Step 5: Fill in the remaining required details in the application, including your company and contact details, AO code, and then upload all required documents.

Step 6: Choose the payment mode and complete the payment. Once the payment is successfully completed, an acknowledgment will be generated; take a printout of the acknowledgment slip. With this acknowledgment number, you can track the application status.

After the acknowledgment is generated, the PAN card will be sent to the company's registered office.

Offline Mode

Step 1: Indian citizens can visit the nearest PAN center to obtain the PAN application form (Form 49A). However, you can also download the PAN application form from the Protean PAN website.

Step 2: You must then fill in the application form using a black ballpoint pen. Ensure the company's director signs the form.

Step 3: Submit the application to the PAN center with all the required documents and pay the fees at the center.

Step 4: They will then issue an acknowledgment as proof of the documents submitted.

After verifying all documents, the authorities will dispatch the e-PAN card to the company's registered office or send it to the company's email within 12-20 days.

Simplify your NRI PAN card application process from anywhere in the world with expert support from Savetaxs.

How To Apply For A Company PAN Card for a Foreign Citizen?

Foreign citizens can apply for a PAN card through online mode by following the given process.

Online Mode

Step 1: Visit the NSDL website

Step 2: Select the "application Type" option as "New PAN - Foreign Citizen (Form 49AA)" from the drop-down list, and the "Company" option as the category.

Step 3: Fill in the PAN card application form with all required details, such as the company name, email ID, phone number, date of incorporation, and captcha code, then click the submit button.

Step 4: Select the "Submit digitally through e-KYC and e-Sign" option.

Step 5: Fill in all the details in the application form, including the company and contact details, the AO code, and then upload the required documents.

Step 6: Choose the payment method and make the payment. After the payment, an acknowledgment will be generated. Print that acknowledgment number, and use it to track the application status.

Things To Consider Before Filing The PAN Card For a Company

The following are some tips to consider before filing the company's PAN card application.

- You must read the instructions on the form carefully and ensure that all supporting documents are in order and included when you submit the application.

- The form should be filled out only in block letters, and a black pen should be used for offline form filing.

- The full company name must be entered in the very first block, "Last Name / Surname". If the name is longer than the space provided for the "Last Name" block, it can be continued in the "First Name" and "Middle Name" blocks.

- The incorporated date of the company must be written in the Date of Birth/Date of Incorporation" block.

- Based on the nature of the business, enter the business code.

- The gender field, Aadhaar number field, parents' details, and residential office field must be left empty.

- The company's director must sign the form.

- Ensure that the payment method differs depending on whether the company is Indian or foreign.

What Are The Documents Required For a PAN Card For a Company

Below is the list of all documents required to be submitted or uploaded with the PAN card application for both Indian and foreign companies.

Documents Required For an Indian Company

- Copy of the registration certificate issued by the registrar of companies.

- A declaration or affidavit signed by the authorized signatories stating the reason for not obtaining or applying for the PAN card to date. This is required only for domestic companies established before Feb 1, 2017.

Documents Required For A Foreign Company

- Copy of registration certificate that is issued in the country where the applicant is located and duly attested by the "Apostille" for the countries that are signatories under the Hague Convention, 1961, or by the High Commission, consulate, or the Indian embassy in the country where the applicant is located.

- Copy of the register's certificate that is issued in India or the approval granted to set up an office in India by the Indian Authorities.

- Payment can be made online via international debit/credit card, wire transfer, or bank draft (where applicable)

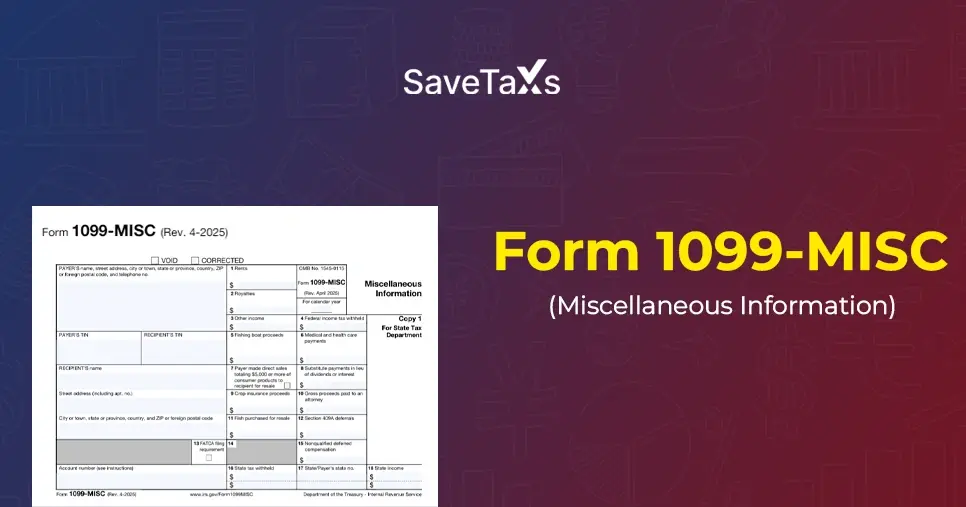

Fees For PAN Card For Company

The following table shows the PAN card fees, including GST, by application submission and dispatch mode.

| Mode Of Application Submission | Mode Of Dispatch PAN Card | Fees (including GST) |

|---|---|---|

| PAN application submitted offline or online using physical mode. | Dispatch of the physical PAN card in India. | Rs 107 |

| Dispatch of the physical PAN card outside India. | Rs. 1,017 | |

| PAN application submitted online through a paperless mode. | Dispatch of the physical PAN card in India. | Rs 101 |

| Dispatch of the Physical PAN card outside India. | Rs 1,011 | |

| PAN card application submitted offline or online using the physical mode. | Dispatch of the e-PAN card to the email ID. | Rs 72 |

| PAN card application submitted through paperless mode. | Dispatch of the e-PAN card to the email ID | Rs 66 |

What Are The Benefits Of The PAN Card For a Company

Having a PAN card brings a range of benefits for the company, which we discuss here.

- Easy financial transactions: Having a business PAN card is beneficial for smooth financial transactions. It also ensures that the business's financial operations comply with the Income Tax Department's regulations.

- Avoid paying higher tax rates: Without a PAN card, the company will be subject to higher tax rates and ineligible for many tax-related procedures. A PAN card helps businesses claim tax benefits, incentives, and rebates.

- Financial Transparency: For business financial transparency, a PAN card is needed. With a PAN card, businesses can consolidate financial transactions, file tax returns, open a business bank account, and establish themselves as a credible entity.

Challenges Occurred While Applying for the Company PAN Card.

The following are the challenges an applicant faces when applying for the company's PAN card.

- Incorrect Information: Ensure that the information you provide is accurate. If the details are inaccurate or differ from those already registered with government authorities, it could lead to delays and confusion. Hence, please recite all the business details, including the names, address, and all.

- Failure to Meet Legal Requirements: Before applying for a PAN card, ensure you understand and comply with the legal obligations and eligibility criteria for your business entity.

- Address Discrepancies: When your business documents have the company addresses that do not match official government records, it can cause last-minute delays and hassles. Hence, ensure that any address changes are updated in the official records within the time and before submitting the PAN card application.

Savetaxs is your trusted partner for reliable PAN card solutions for NRIs worldwide.

The Bottom Line

Every company incorporated or operating in India needs to have a PAN card. The company's PAN card helps in promoting financial clarity and compliance. From the Indian Income Tax department regulation compliance to banking transactions, GST registration, tax filing, and daily operation, the PAN ensures smooth financial and legal functioning of the firm.

Henceforth, if you are starting up a new business or need a PAN card for your existing business structure, Savetaxs is the name to trust. Our PAN card application process is 100% digital, hence NRIs can apply for a PAN card online from anywhere in the world. Additionally

We have a dedicated team of experts helping you with your PAN card application issues. Hence, connect with us, as we serve our clients 24/7 across all time zones.

PAN application procedures and documentation requirements may change as per CBDT and MCA notifications. Always verify the latest guidelines before applying.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Shaw brings 8 years of experience in auditing and taxation. He has a deep understanding of disciplinary regulations and delivers comprehensive auditing services to businesses and individuals. From financial auditing to tax planning, risk assessment, and financial reporting. Mr Shaw's expertise is impeccable.

- Top 10 Benefits of Having a PAN Card for NRIs

- Understanding PAN Card Password Format

- A Guide to Applying for NRI PAN Card Without Aadhaar Card

- PAN Card For Company - A Guide For Indian Citizens, NRIs, & Foreign National

- PAN Card Correction/Update Online: How to Change Name, Address, DOB and Mobile Number in Pan Card?

- PAN Card Photo and Signature Change - How to Change Photo and Signature in PAN Card?

- Aadhaar Card For NRIs In India

- How to Apply for a Lost or Damaged PAN Card?

- Why NRI Need A PAN Card Even If They Don't Pay Tax In India?

- How to Apply for an OCI Card Outside India?

- PAN Card Form 49A: How to Fill Pan Card Form 49A and 49AA?

- How to Apply for an OCI Card from the USA?

- PAN Card Surrender For NRIs and Indian Residents

- PAN Card Correction/Update Online: How to Change Name, Address, DOB and Mobile Number in Pan Card?

- What are the Top Reasons Why PAN Card Applications Gets Rejected?

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1768633699.png)

_1759750925.webp)

_1768221427.webp)

_1767170479.png)

_1766129179.png)