Form 16 is a statement issued by the employer to its employees. It contains the details of the deductions and deposited TDS of the employee. Whereas Form 26AS is a document issued by the Income Tax Department of India. It contains details of the deducted TDS of the taxpayer at several sources, TCS collected by different collectors, and advance tax payments. Additionally, all the information stated in Form 16 is also mentioned in this form.

However, due to omission or small errors, there can be a mismatch between the two. This further creates issues when filing the ITR. To help you out, this blog will provide you with information about the differences that may arise in both the forms and the consequences of mismatches. Additionally, solutions to resolve them. So, read on and gather all the information.

- TDS statement and Form 26As are the two key documents that an individual requires when filing the ITR returns. Both forms complement each other and ensure the ITR is filed flawlessly; they must match in all aspects.

- A TDS statement is shown in Form 16 or Form 16A. It contains the details of the payment nature made to him/her and the tax deducted from his/her payments.

- Form 26AS can be stated as the annual statement under Income-tax Rule 31AB. It reflects the credited tax into your account, as mentioned with the IT department, against your PAN card.

- It is vital to rectify the mismatches between the TDS statement and Form 26AS, as if it is not updated, you cannot avail the data re-fill facility. Additionally, it delays the processing of your ITR returns and refunds. Also, you get the TDS mismatch income tax notice from the IT department.

- Further, the key reasons for mismatches between the TDS statement and Form 26AS are the incorrect PAN number stated in the TDS return, a mistake in the selected Assessment year, omission in the TDS return, and more.

What Is a TDS Statement?

The full form of TDS is tax deducted at source. It can be defined as the amount deducted when an individual is making a payment or crediting to their account. This further deducted amount is then deposited to the Income Tax Department on their behalf.

Considering this, every person who makes payments on which TDS is applicable should file TDS returns. It is a statement containing information about the people who get payments after tax deductions. They are known as deductee. It also consists of the payment nature made to him/her and the deducted tax from his/her payments. It is known as TDS statements.

Further, based on such file statements, the deductor provides Form 16 (TDS on salary) annually and Form 16A (TDS on other income) quarterly.

This was all about a TDS statement. Moving ahead, let's know about Form 26AS.

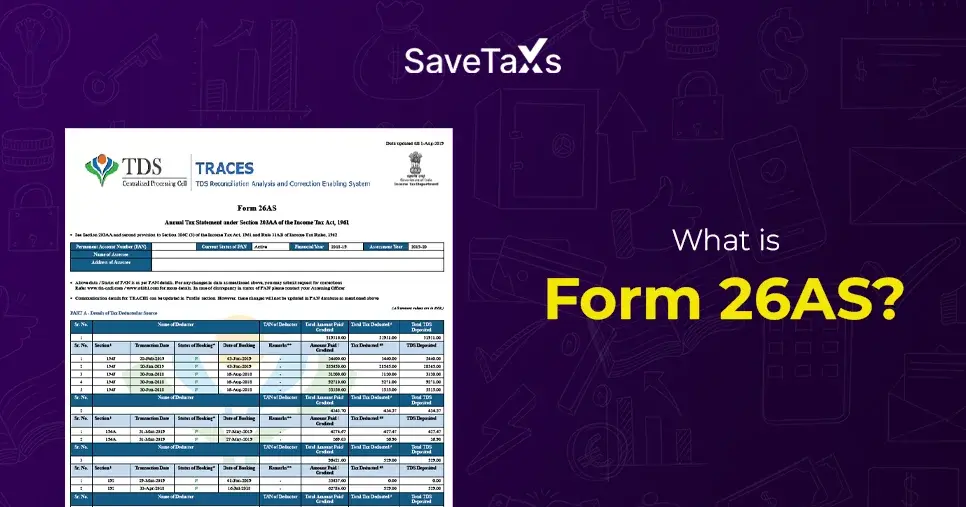

What Is Form 26AS?

Form 26AS is a statement that is issued by the Income Tax Department. It contains all the information about the deducted TDS and collected TCS. It also includes the details about income sources and the tax credit. Generally, every entity, whether an individual or a company that has deducted TDS, must deposit that amount to the government via a bank.

Additionally, banks should upload these TDS details on the Tax Information Network (TIN) central system. Considering this, the deductors would also file quarterly statements to TIN, mentioning quarterly TDS details. It helps in issuing the Form 26AS for the concerned PAN.

Further, the Form 26AS statement provides a detailed view of the:

- Total earned income

- TDS/ TCS deducted

- Self-assessment tax and advance tax paid by the taxpayer

This was all about Form 26AS. In simple words, this form is an annual statement under Income tax Rule 31AB. It showcases the tax credit in your account, as stated by the IT department, against your PAN card. Moving further, let's know why it is important to rectify mismatches in both forms.

Importance of Rectifying Mismatches

Here are the reasons why it is important to rectify the mismatched information in the TDS statement and Form 26AS:

- The Income Tax Department for ITR filing offers a pre-fill service, where all information is captured automatically by matching the PAN. However, if your TDS statement or Form 26AS is not updated, you cannot use the pre-fill ITR facility.

- Additionally, if there is a mismatch in the information on both forms, your tax return will be rejected. Also, you need to respond online to the TDS mismatch income tax notice and explain the reason behind it.

- It further creates delays in processing your ITR returns and tax refunds. Hence, to file the ITR without any issues, it is vital to rectify the mismatched information.

- Also, in your Form 26AS, the deducted TDS is not shown, so your TDS refund will not proceed further.

So, this is why it is important to rectify mismatched information in the TDS statement and Form 26AS. Moving ahead, let's know the reasons for mismatches between the TDS statement and Form 26AS.

File your ITR with expert guidance on time without any issue with savetaxs.

Reasons for Mismatches Between TDS Statement and Form 26AS

There are several events where the information stated in the TDS statement, Form 16, or Form 16A differs from the details available in Form 26AS. To provide you with an idea, the most common TDS reasons for such mismatched information are stated below:

- When the TDS is not deposited by the deductor on time.

- The wrong amount was mentioned in the TDS return.

- Incorrect PAN number quoted in the TDS return.

- The PAN/ TAN of the deductor was wrongly entered.

- Mistake in the Challan Identification Number (CIN).

- Incomplete details of the assessee in the TDS return.

- Mistake in the selected Assessment year.

- Omissions in the TDS return.

- Mismatch in the quoted TDS and the actual deducted TDS.

These were the key reasons for mismatches between the TDS statement and Form 26AS. Moving further, let's know how you can rectify the TDS mismatches.

Rectifying TDS Mismatches

After comparing both forms, once you deduct the error, you should do the following to rectify the TDS mismatches:

- Inform the person accountable for TDS deduction from your income, i.e., the deductor of TDS or the employer.

- If the mismatch is due to a mistake by your employer, they can easily correct it. Hence, if you find any such mismatch, you should contact your employer.

- The employer should file a revised TDS return. Make sure that all information in the revised TDS returns is correct.

- Further, if the Income Tax Department has sent you a TDS mismatch intimation notice for a wrong tax credit. Through the income tax e-filing portal, you can respond online to it by stating the reason for such an error.

So, this is how you can rectify the TDS mismatches and file your ITR return on time. Moving ahead, let's know the consequences of TDS mismatch.

Consequences of TDS Mismatch

The mismatch in Form 26AS is identified through Form 16 and Form 16A. Form 16 is given by the employer, and Form 16A is received from the bank. Considering this, if TDS is deducted and you did not get an equivalent tax credit, make sure that it is shown in the tax credit.

In case you claim the credited amount in your ITR, and it is not reflected in Form 26AS, for tax underpayment, you will receive a demand notice. Additionally, if you have a tax refund, it will be reduced by that amount. Hence, in Form 26AS, the tax credit serves as the basis for processing your ITR.

Further, it may also happen that, due to some errors on the side of your deductor or employer, excess credit has been reflected on your Form 26AS. In such circumstances, to prevent the consequences for the excess amount, you should avoid claiming a tax credit. It is because, after identifying the mistake, the form might be corrected at any time by submitting a revised TDS return by the deductor. After that, if you claimed the credit and there is an excess amount, you are accountable for a demand notice.

This was all about the consequences of TDS mismatch.

With expert NRI tax consultation from Savetaxs, save now and fulfill your tax obligations without any hassle.

Final Thoughts

Lastly, computerized ITR processing of income tax returns has made it easy to identify matches between TDS statements and Form 26AS. Considering this, the income tax portal provides links to Form 26AS. It allows you to cross-check and verify the details. So, to avoid any adverse consequences, make sure that the Form 26AS and TDS statement consist of the same TDS details.

Further, being an NRI, if you find Indian taxes complicated, simply get in touch with Savetaxs. Our experts will help you accurately file your ITR and maximize your tax refunds.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Shaw brings 8 years of experience in auditing and taxation. He has a deep understanding of disciplinary regulations and delivers comprehensive auditing services to businesses and individuals. From financial auditing to tax planning, risk assessment, and financial reporting. Mr Shaw's expertise is impeccable.

- Section 194N- TDS on Cash Withdrawal

- Everything You Need to Know About Form 15CA and 15CB of Income Tax

- Estate Planning For NRIs Via Trusts: Protect Your Wealth For Future

- Your Complete Guide for Section 80D of the Income Tax Act

- Section 115BAC New Tax Regime 2025: Slabs, Benefits, Exemptions & Deductions

- What is Double Taxation Avoidance Agreement (DTAA)? How NRIs can Claim Benefits Under DTAA

- TDS on Sale of Property by NRIs in India

- NRI Selling Property in India

- What is the Double Tax Avoidance Agreement (DTAA) Between India and Singapore?

- Double Tax Avoidance Agreement (DTAA) Between India and UK

- TDS Deduction on Rental Property Owned by NRI

- What is a Tax Residency Certificate (TRC) and How to Get It?

- Section 89A - Tax Relief on Income from Foreign Retirement Funds

- Everything You Need to Know About Form 15CA and 15CB of Income Tax

- Section 195 of Income Tax Act - TDS Applicability for NRI

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1768808777.webp)