- What are the Differences Between NRE vs NRO DEMAT Account for NRIs?

- When NRIs Should Link Their DEMAT to an NRE Account?

- When Should NRIs Link their DEMAT to an NRO Account?

- PIS Requirement for NRIs Investing in Shares

- Tax Implications on NRE and NRO DEMAT Accounts

- How Can NRIs Choose the Right DEMAT-Bank Account Linkage?

- Some Key Regulatory Differences to Note

- Final Thoughts

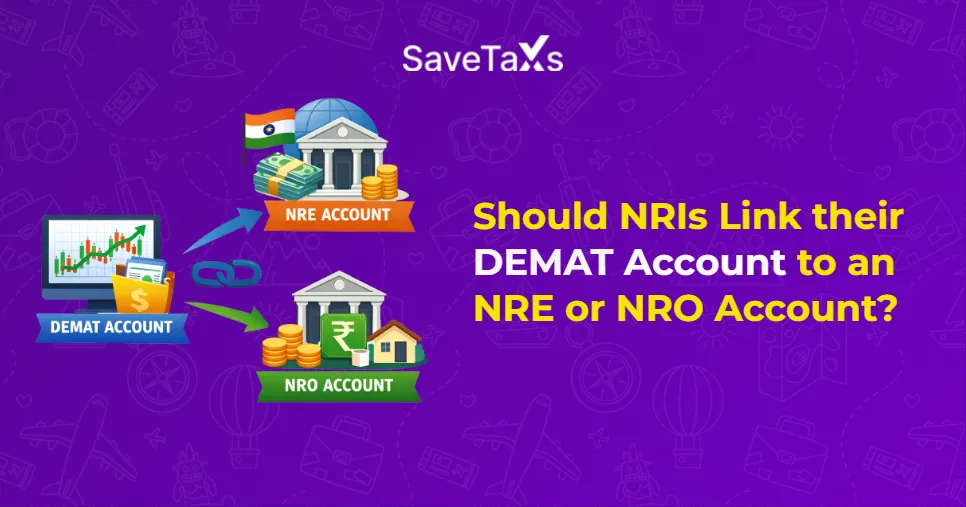

For Non-Resident Indians (NRIs), investing in Indian stocks is more than just choosing good companies. It also includes complying with the rules and regulations set by the Reserve Bank of India (RBI) and FEMA (Foreign Exchange Management Act). One key decision in this process is whether to link the NRI DEMAT account to a Non-Resident External (NRE) account or a NRI DEMAT account with a Non-Resident Ordinary (NRO) account.

This choice impacts the nature of investments, the ability to repatriate funds, and compliance with the Foreign Exchange Management Act (FEMA) and Reserve Bank of India (RBI) guidelines. Keep reading further to learn the implications of each option. This will help NRIs to invest with confidence, prevent procedural complications, and align their portfolios with long-term financial goals.

- Choosing between an NRE or NRO-linked demat account is a regulatory decision that directly affects repatriation rights, FEMA compliance, and how NRI investments are classified and monitored.

- An NRE account linked with a demat account is ideal for overseas-funded investments, as both principal and gains are fully repatriable after taxes, making them suitable for NRIs with global financial planning needs.

- An NRO account linked with a demat account must be used for India-sourced funds, such as rent, inheritance, dividends, or pension income.

- A demat account linked to an NRO account allows Repatriation but is capped at 1 million USD per financial year, subject to documentation and tax clearance.

- Taxation applies equally to both NRE and NRO demat accounts, including capital gains tax and higher TDS for NRIs. The key difference arises after tax.

- PIS compliance is mandatory for direct equity investments. Also the demat account, PIS account, and linked bank account must be aligned properly to avoid regulatory and reporting issues.

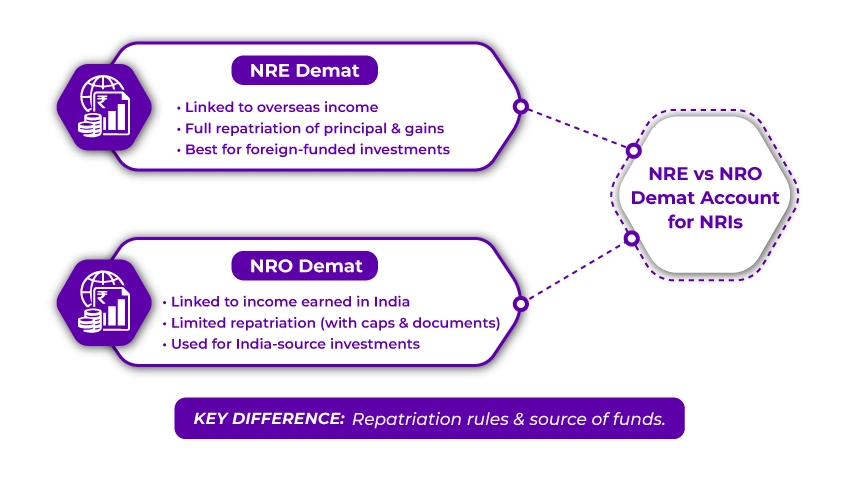

What are the Differences Between NRE vs NRO DEMAT Account for NRIs?

A DEMAT account for NRIs cannot function independently. It must be linked to a bank account, either NRE or NRO. Each account serves a unique regulatory purpose.

- NRE-linked DEMAT account: It facilitates investment funded by overseas income remitted to India. The standard feature is full repatriation. It means both the principal and any gains can be transferred abroad without restrictions after taxes have been paid.

- NRO-linked DEMAT account: It is intended for investments made with income earned or accrued in India. While repatriation is allowed, it comes with certain limitations, including an annual cap and document requirements.

The distinction between these two routes is significant, affecting how investments are classified, monitored, and eventually liquidated.

Reach out to Savetaxs, our experts are ready to simplify all your tax paperwork.

When NRIs Should Link Their DEMAT to an NRE Account?

Linking a DEMAT account to an NRE account allows investments to be repatriable by default. This structure is suitable in situations where the capital is sourced from outside India, and the investor desires flexibility in transferring funds. You should consider linking your DEMAT account to an NRE account if:

- You earn money outside India and send it to India for investment.

- You want your investments to align with your global financial planning.

- You are seeking the flexibility to transfer your money abroad without any restrictions.

*Point to Note: NRE-linked DEMAT account for investments falls under the repatriable Portfolio Investment Scheme (PIS). Your DEMAT account, PIS account, and NRE bank account must be properly aligned for regulatory compliance.

When Should NRIs Link their DEMAT to an NRO Account?

When linking a DEMAT account to an NRO account, investments are deemed non-repatriable, although limited remittance is permissible. This option is mandatory when the source of funds is based in India. Common scenarios include:

- Investing rental income received from property in India.

- Managing inherited or legacy funds already situated within India.

- Using dividends, interest, or pension income directed to an NRO account.

Repatriation from an NRO-linked DEMAT account for NRIs is capped at USD 1 million per financial year, subject to tax clearance and compliance with prescribed forms. For many NRIs with a focus on long-term investments in India, this structure provides compliance certainty without significant operational barriers.

PIS Requirement for NRIs Investing in Shares

For NRI investments in listed equity shares, the portfolio investment scheme (PIS) is a crucial compliance mechanism. According to RBI mandates, PIS ensures that NRI investments stay within specific-sector and ownership limits. Key points to consider include:

- Each NRI can maintain only one PIS account per bank.

- All equity transactions must be reported to the RBI through the designated PIS bank.

- The PIS account must align with the nature of the DEMAT account. NRE-PIS for repatriable investments and NRO-PIS for non-repatriable ones.

While certain instruments, like mutual funds and IPOs, may be exempt from PIS requirements, direct equity investments are not. Proper alignment is essential to prevent reporting discrepancies and regulatory issues.

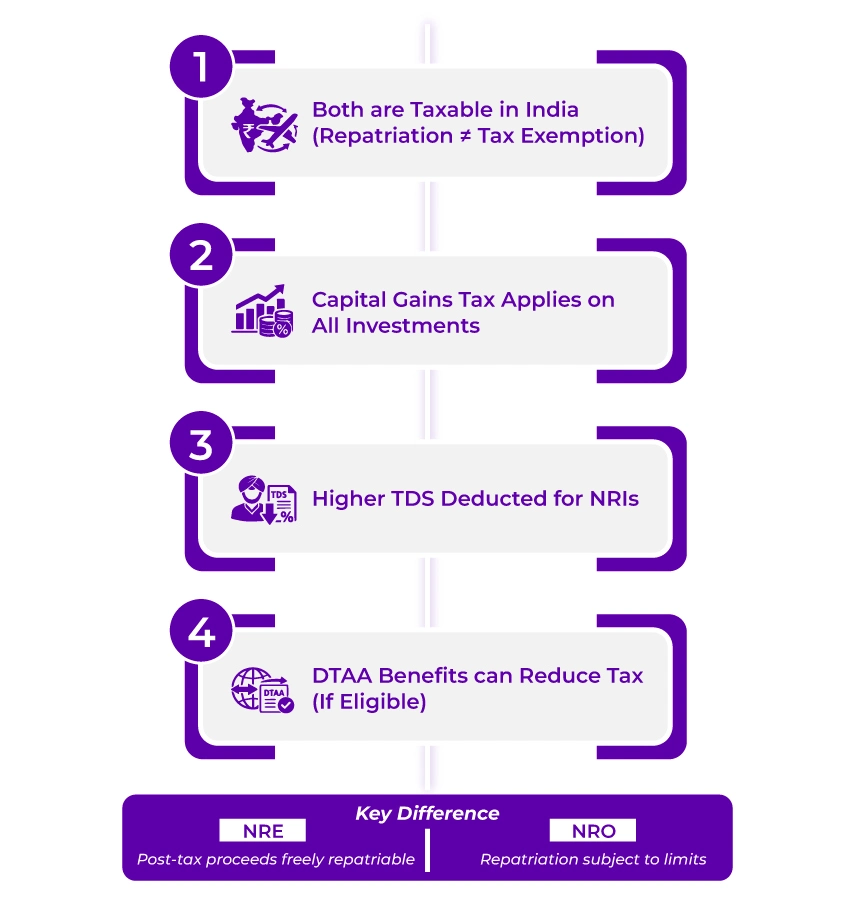

Tax Implications on NRE and NRO DEMAT Accounts

A common misconception is that NRE-linked investments are tax-exempt. However, in reality, taxation in India doesn't consider repatriation status. For both NRE and NRO DEMAT accounts:

- Capital gains are subject to taxation in India.

- Tax deducted at Source (TDS) is applied at higher rates for NRIs.

- Benefits under the Double Taxation Avoidance Agreement (DTAA) can be claimed, based on eligibility and documentation.

- Short-term and long-term capital gains are taxed in accordance with prevailing laws.

The key difference arises post-tax. NRE-linked proceeds can be repatriated freely, while NRO-linked proceeds must navigate regulatory thresholds.

How Can NRIs Choose the Right DEMAT-Bank Account Linkage?

To make the right choice, ask yourself these three questions:

- What is the source of funds? Overseas or India?

- Do you want to repatriate the money?

- What's your long-term financial plan?

An NRE-linked DEMAT account for NRIs is generally advisable if investments are financed by overseas income, and global liquidity is essential. On the other hand, an NRO-linked DEMAT account for NRIs is both compliant and practical if funds are sourced from India and expected to remain invested domestically.

Many NRIs adopt a split approach, meaning they maintain both NRE and NRO DEMAT accounts to distinguish investments based on the origin of funds. This separation simplifies compliance, improves transparency, and minimizes the risk of unintentional violations of FEMA regulations.

Savetaxs offers comprehensive, expert guidance for NRIs regarding investment strategies and related financial matters.

Some Key Regulatory Differences to Note

NRIs must recognize several operational difficulties they might face:

- Joint DEMAT accounts with resident Indians are typically restricted.

- Sectoral caps for NRI investments are closely monitored through PIS reporting.

- If your residency status changes, your DEMAT account may need redesignation.

- Securities purchased through one route cannot be freely transferred to the other without regulatory approval.

Staying aware of these restrictions ensures you take future-proof investment decisions.

Final Thoughts

Linking a DEMAT account to either an NRE or NRO account is a foundational choice for NRIs seeking to invest in India. This decision shapes the regulatory nature of investments, determines repatriation rights, and influences long-term financial flexibility. An NRE-linked DEMAT account prioritizes repatriation and cross-border mobility, while an NRO-linked DEMAT account for NRIs aligns investments with India-sourced funds and structured remittance.

Additionally, as an NRI, if you need expert-backed professional advice on understanding linked demat accounts, Savetaxs is the name to trust. We have been helping NRIs from over 90 countries for several years now. Connect with us anytime as we are actively working 24*7 across all time zones.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Vikram brings in more than ten years of experience in US Taxation. He is also an EA mentor and instructor. The expertise of Mr. Agrawal includes accounting, bookkeeping, Tax preparation, small business tax, personal tax planning, income tax, financial advisory services, and retirement planning.

- Your Detailed Guide for Gift City Funds for NRIs

- Why Is Licence Agreemnt Better Than Rent Agreement For NRIs

- Step-by-Step Guide to NRI Investment in Mutual Funds

- Financial Planning for NRIs in Singapore: What to Consider?

- Monthly Income Investments for NRIs in India

- Why NRIs Must Invest in Child Plans in India for Best Returns?

- Financial Planning For NRIs In The USA - Manage Your Money Wisely

- Mutual Funds vs Real Estate: Best Investment Options for NRIs

- How NRIs Can Retire Early Using the FIRE Strategy?

- What Are the Trading Restrictions for NRIs?

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1768221427.webp)

_1756729655.webp)